3 Middle Eastern Penny Stocks With Market Caps Under US$800M

Reviewed by Simply Wall St

Most Gulf bourses have advanced in early trade, buoyed by rising oil prices and regional economic developments. While the term 'penny stock' might seem outdated, these stocks continue to offer potential opportunities for investors when backed by strong financials. In this article, we'll explore three Middle Eastern penny stocks that stand out for their financial strength and potential for growth.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret (IBSE:KATMR) | TRY1.69 | TRY1.82B | ✅ 2 ⚠️ 2 View Analysis > |

| Thob Al Aseel (SASE:4012) | SAR4.00 | SAR1.6B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪2.953 | ₪206.81M | ✅ 4 ⚠️ 2 View Analysis > |

| Oil Refineries (TASE:ORL) | ₪0.91 | ₪2.83B | ✅ 1 ⚠️ 2 View Analysis > |

| Menara Ventures Xl - Limited Partnership (TASE:MNRA) | ₪2.719 | ₪12.49M | ✅ 1 ⚠️ 4 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.238 | ₪166.38M | ✅ 2 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.715 | AED434.9M | ✅ 2 ⚠️ 2 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.00 | AED346.5M | ✅ 2 ⚠️ 4 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.01 | AED2.02B | ✅ 3 ⚠️ 2 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.41 | AED10.29B | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 95 stocks from our Middle Eastern Penny Stocks screener.

Let's explore several standout options from the results in the screener.

E7 Group PJSC (ADX:E7)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: E7 Group PJSC operates in the commercial printing, packaging, and distribution sectors within the United Arab Emirates and has a market capitalization of AED20.19 billion.

Operations: The company's revenue is derived from its printing segment, which generated AED611.25 million, and its distribution segment, which contributed AED78.65 million.

Market Cap: AED2.02B

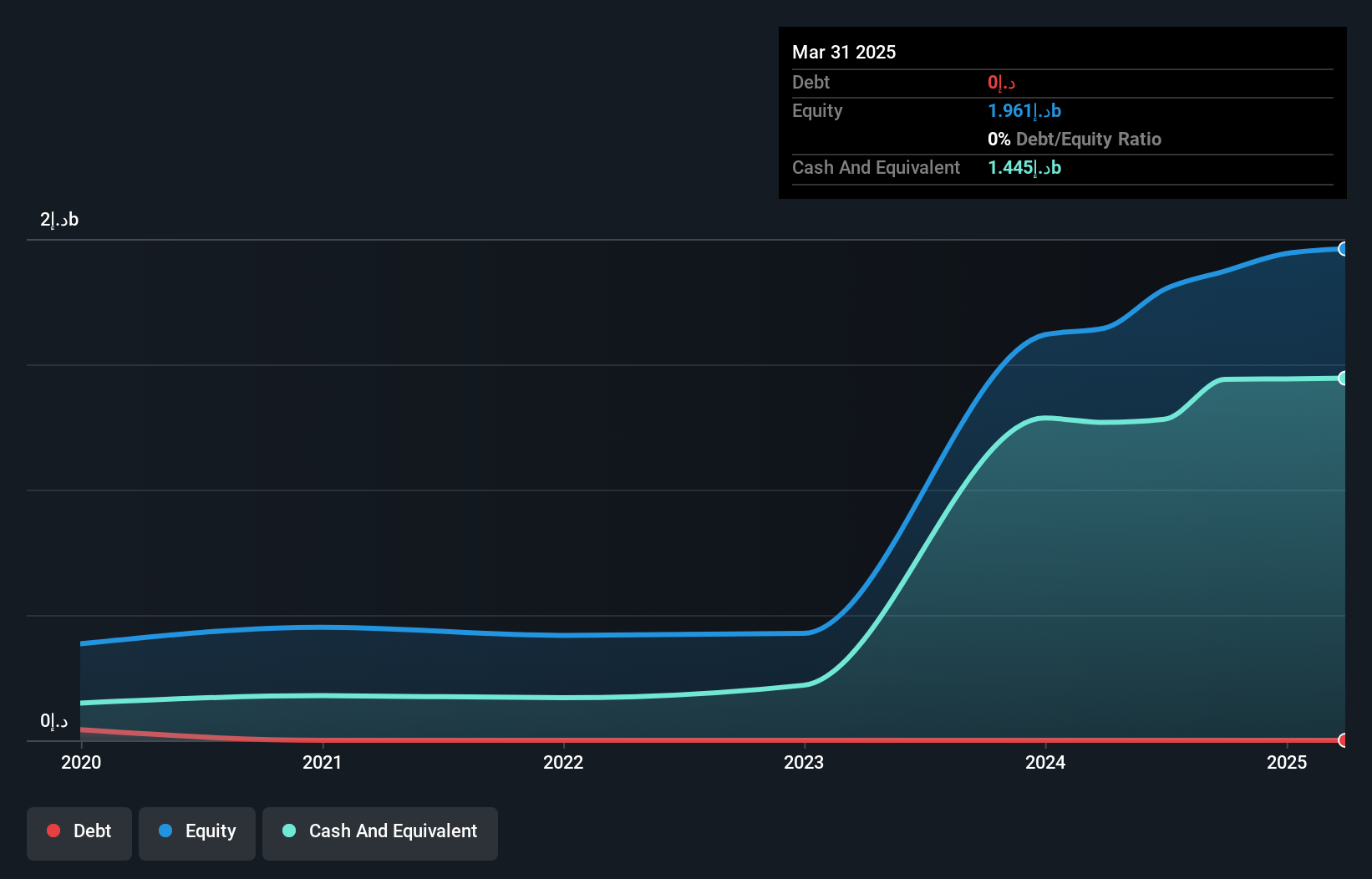

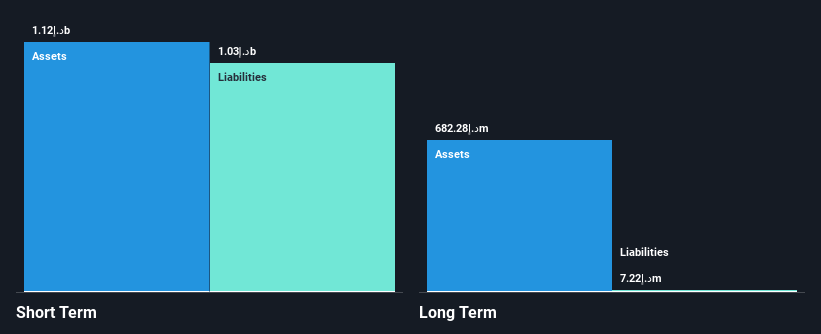

E7 Group PJSC, operating within the UAE's commercial printing and distribution sectors, has recently become profitable. Despite a dip in Q1 2025 sales to AED113.68 million from AED126.05 million the previous year, E7 maintains a solid financial position with no debt and short-term assets of AED2 billion covering both its short- and long-term liabilities. The company’s price-to-earnings ratio of 8.9x suggests it may be undervalued compared to the broader AE market average of 12.5x. However, its dividend sustainability is questionable due to inadequate free cash flow coverage despite recent dividend affirmations.

- Unlock comprehensive insights into our analysis of E7 Group PJSC stock in this financial health report.

- Assess E7 Group PJSC's future earnings estimates with our detailed growth reports.

United Arab Bank P.J.S.C (ADX:UAB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: United Arab Bank P.J.S.C. offers commercial banking products and services to institutional and corporate clients in the United Arab Emirates, with a market capitalization of AED2.58 billion.

Operations: The company's revenue is primarily derived from Wholesale Banking at AED425.35 million, followed by Treasury and Capital Markets contributing AED193.07 million, and Retail Banking generating AED76.82 million.

Market Cap: AED2.58B

United Arab Bank P.J.S.C. demonstrates a compelling profile with its price-to-earnings ratio of 7.7x, suggesting potential undervaluation against the broader AE market average. The bank's earnings have grown by 24.4% over the past year, surpassing industry growth rates, although this is below its five-year average growth of 70.2% per year. Despite a high level of bad loans at 3.4%, UAB maintains an appropriate loans to deposits ratio of 72%. Recent Q1 results show net income increasing to AED101.56 million from AED68.25 million a year ago, reflecting improved profit margins and stable weekly volatility at 4%.

- Take a closer look at United Arab Bank P.J.S.C's potential here in our financial health report.

- Evaluate United Arab Bank P.J.S.C's prospects by accessing our earnings growth report.

Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Dubai National Insurance & Reinsurance (P.S.C.) operates in the insurance and reinsurance sector, providing a range of coverage options, with a market cap of AED346.50 million.

Operations: The company generates its revenue from two main segments: AED37.56 million from investments and AED269.43 million from underwriting activities.

Market Cap: AED346.5M

Dubai National Insurance & Reinsurance (P.S.C.) presents a mixed investment profile with its low return on equity of 6.7% and recent earnings growth of 13.6%, surpassing the industry decline. The company is debt-free, which mitigates interest payment concerns, and its short-term assets comfortably cover both short and long-term liabilities. However, the sustainability of its 5% dividend is questionable due to insufficient free cash flow coverage. While DNIR's price-to-earnings ratio of 6.5x suggests potential undervaluation compared to the AE market average, large one-off gains have impacted financial results recently, affecting earnings quality perceptions.

- Click to explore a detailed breakdown of our findings in Dubai National Insurance & Reinsurance (P.S.C.)'s financial health report.

- Examine Dubai National Insurance & Reinsurance (P.S.C.)'s past performance report to understand how it has performed in prior years.

Summing It All Up

- Dive into all 95 of the Middle Eastern Penny Stocks we have identified here.

- Looking For Alternative Opportunities? We've found 17 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if E7 Group PJSC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:E7

E7 Group PJSC

Engages in commercial printing, packaging, and distribution business in the United Arab Emirates.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives