- United Arab Emirates

- /

- Insurance

- /

- ADX:RAKNIC

Is Ras Al Khaimah National Insurance Company P.S.C.'s (ADX:RAKNIC) Stock's Recent Performance Being Led By Its Attractive Financial Prospects?

Ras Al Khaimah National Insurance Company P.S.C's (ADX:RAKNIC) stock is up by a considerable 11% over the past week. Given the company's impressive performance, we decided to study its financial indicators more closely as a company's financial health over the long-term usually dictates market outcomes. Particularly, we will be paying attention to Ras Al Khaimah National Insurance Company P.S.C's ROE today.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

We check all companies for important risks. See what we found for Ras Al Khaimah National Insurance Company P.S.C in our free report.How Is ROE Calculated?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Ras Al Khaimah National Insurance Company P.S.C is:

12% = د.إ23m ÷ د.إ190m (Based on the trailing twelve months to March 2025).

The 'return' is the yearly profit. That means that for every AED1 worth of shareholders' equity, the company generated AED0.12 in profit.

See our latest analysis for Ras Al Khaimah National Insurance Company P.S.C

What Is The Relationship Between ROE And Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

A Side By Side comparison of Ras Al Khaimah National Insurance Company P.S.C's Earnings Growth And 12% ROE

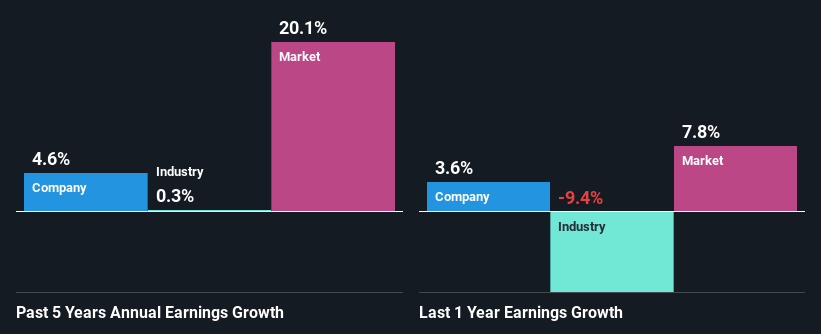

It is quite clear that Ras Al Khaimah National Insurance Company P.S.C's ROE is rather low. However, the fact that it is higher than the industry average of 9.8% makes us a bit more interested. Still, Ras Al Khaimah National Insurance Company P.S.C has seen very little net income growth of 4.6% over the past five years. Bear in mind, the company does have a low ROE. It is just that the industry ROE is lower. Therefore, the low growth in earnings could also be the result of this.

Next, on comparing with the industry net income growth, we found that Ras Al Khaimah National Insurance Company P.S.C's growth is quite high when compared to the industry average growth of 0.3% in the same period, which is great to see.

Earnings growth is a huge factor in stock valuation. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. Doing so will help them establish if the stock's future looks promising or ominous. Is Ras Al Khaimah National Insurance Company P.S.C fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Ras Al Khaimah National Insurance Company P.S.C Using Its Retained Earnings Effectively?

Ras Al Khaimah National Insurance Company P.S.C doesn't pay any regular dividends, which means that it is retaining all of its earnings. This doesn't explain the low earnings growth number that we discussed above. Therefore, there might be some other reasons to explain the lack in that respect. For example, the business could be in decline.

Summary

Overall, we are quite pleased with Ras Al Khaimah National Insurance Company P.S.C's performance. Specifically, we like that it has been reinvesting a high portion of its profits at a moderate rate of return, resulting in earnings expansion.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ADX:RAKNIC

Ras Al Khaimah National Insurance Company P.S.C

Ras Al Khaimah National Insurance Company P.S.C.

Acceptable track record with mediocre balance sheet.

Market Insights

Community Narratives