- United Arab Emirates

- /

- Insurance

- /

- ADX:HAYAH

Middle Eastern Penny Stocks With Market Caps Under US$200M

Reviewed by Simply Wall St

The Middle Eastern stock markets have experienced varied performances recently, with the Saudi Arabia index closing at its lowest since early April, while other indices like Dubai's showed modest gains. In this context of fluctuating market sentiments, penny stocks remain an intriguing area for investors seeking opportunities in smaller or newer companies. Although the term 'penny stock' may seem outdated, these investments can still offer significant value when based on strong financials and potential for growth.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret (IBSE:KATMR) | TRY1.71 | TRY1.84B | ✅ 2 ⚠️ 2 View Analysis > |

| Thob Al Aseel (SASE:4012) | SAR3.94 | SAR1.58B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪3.01 | ₪210.8M | ✅ 4 ⚠️ 2 View Analysis > |

| Oil Refineries (TASE:ORL) | ₪0.893 | ₪2.78B | ✅ 1 ⚠️ 2 View Analysis > |

| Menara Ventures Xl - Limited Partnership (TASE:MNRA) | ₪2.719 | ₪12.49M | ✅ 1 ⚠️ 4 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.289 | ₪170.17M | ✅ 2 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.718 | AED436.73M | ✅ 2 ⚠️ 2 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.13 | AED346.5M | ✅ 2 ⚠️ 5 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.01 | AED2B | ✅ 3 ⚠️ 2 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.40 | AED10.16B | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 95 stocks from our Middle Eastern Penny Stocks screener.

Let's review some notable picks from our screened stocks.

HAYAH Insurance Company P.J.S.C (ADX:HAYAH)

Simply Wall St Financial Health Rating: ★★★★★★

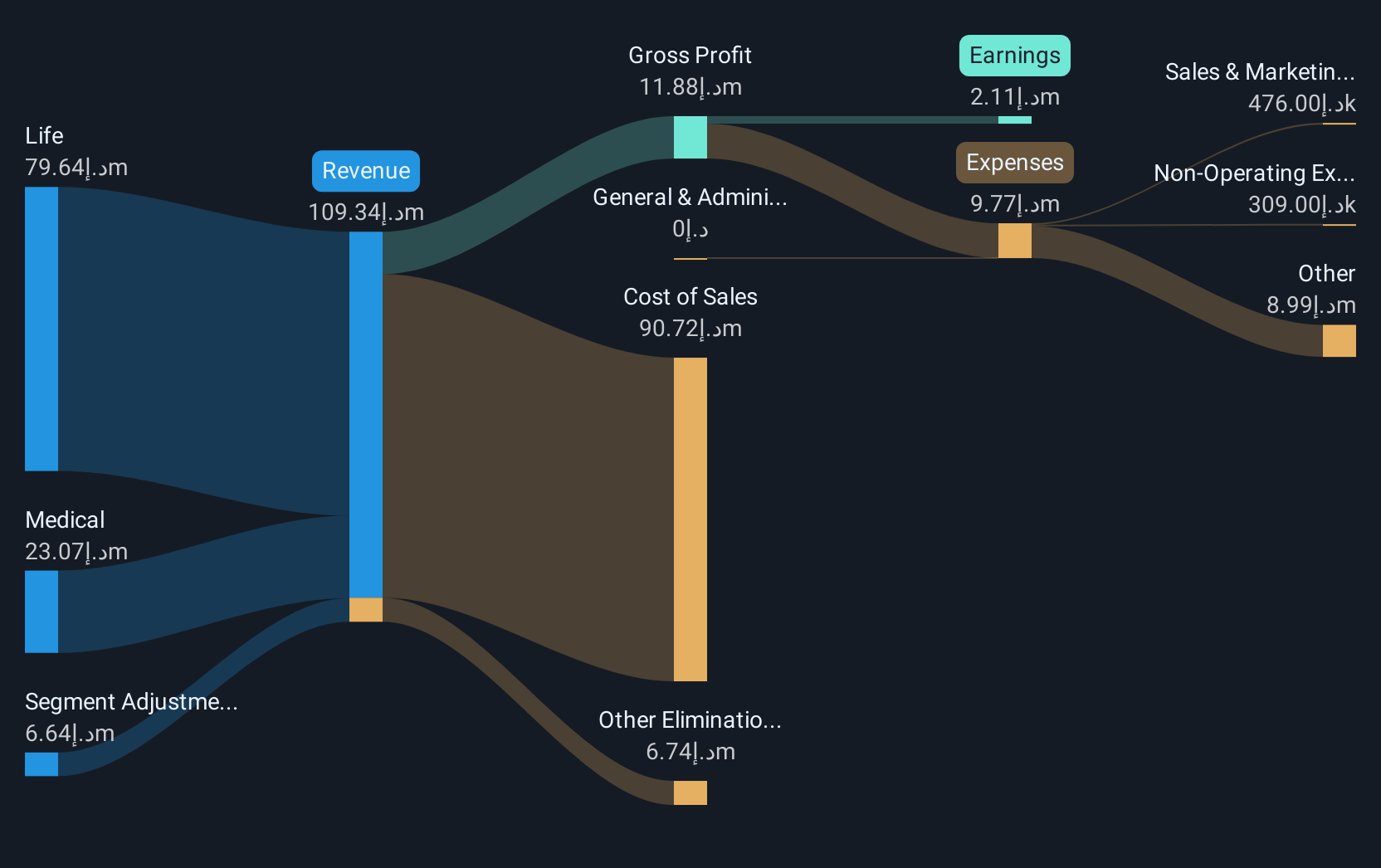

Overview: HAYAH Insurance Company P.J.S.C. offers health and life insurance solutions both in the United Arab Emirates and internationally, with a market cap of AED346 million.

Operations: There are no specific revenue segments reported for this company.

Market Cap: AED346M

HAYAH Insurance Company P.J.S.C., with a market cap of AED346 million, has recently become profitable, reporting a net income of AED 0.535 million for Q1 2025. Despite high volatility in its share price and low return on equity at 1.7%, HAYAH is debt-free and maintains strong liquidity, with short-term assets exceeding both short- and long-term liabilities. The management team is experienced, averaging nearly seven years in tenure. However, earnings have declined compared to the previous year’s first quarter results, reflecting potential challenges ahead despite recent profitability improvements over the past five years.

- Unlock comprehensive insights into our analysis of HAYAH Insurance Company P.J.S.C stock in this financial health report.

- Examine HAYAH Insurance Company P.J.S.C's past performance report to understand how it has performed in prior years.

Odas Elektrik Üretim Sanayi Ticaret (IBSE:ODAS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Odas Elektrik Üretim Sanayi Ticaret A.S. operates in the energy sector, producing and selling electricity through natural gas combined cycles both in Turkey and internationally, with a market capitalization of TRY6.83 billion.

Operations: No specific revenue segments are reported for this company.

Market Cap: TRY6.83B

Odas Elektrik Üretim Sanayi Ticaret A.S., with a market cap of TRY6.83 billion, operates in the energy sector and has faced financial challenges recently. The company reported a net loss of TRY380.42 million for Q1 2025, reversing from a profit the previous year, alongside declining sales figures. Despite these setbacks, Odas's financial position is bolstered by having more cash than total debt and short-term assets exceeding liabilities significantly. However, its removal from the FTSE All-World Index highlights investor concerns amid ongoing unprofitability and increased losses over the past five years at an annual rate of 4.4%.

- Jump into the full analysis health report here for a deeper understanding of Odas Elektrik Üretim Sanayi Ticaret.

- Learn about Odas Elektrik Üretim Sanayi Ticaret's historical performance here.

NRGene Technologies (TASE:NRGN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: NRGene Technologies Ltd is an AI genomics company that offers computational tools and advanced algorithms across various regions including North America, Europe, the Middle East, Africa, Asia Pacific, and internationally with a market cap of ₪32.26 million.

Operations: The company generates revenue primarily through the provision of services, amounting to $1.29 million.

Market Cap: ₪32.26M

NRGene Technologies, with a market cap of ₪32.26 million, faces challenges typical of penny stocks. The company is pre-revenue with sales at US$1.29 million and remains unprofitable, reporting a net loss of US$3.36 million for 2024. Despite having no debt and short-term assets covering liabilities, its cash runway is less than a year due to declining free cash flow. While the board and management are experienced, NRGene's share price has been highly volatile recently. Earnings have decreased over five years by 1.7% annually, indicating ongoing financial hurdles in achieving profitability or meaningful revenue growth soon.

- Click here and access our complete financial health analysis report to understand the dynamics of NRGene Technologies.

- Gain insights into NRGene Technologies' historical outcomes by reviewing our past performance report.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 92 Middle Eastern Penny Stocks now.

- Interested In Other Possibilities? The end of cancer? These 23 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HAYAH Insurance Company P.J.S.C might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:HAYAH

HAYAH Insurance Company P.J.S.C

Provides health and life insurance solutions in the United Arab Emirates and internationally.

Flawless balance sheet low.

Market Insights

Community Narratives