As Gulf markets remain subdued with investors cautiously awaiting key U.S. economic data, the focus on dividend stocks in the Middle East has become increasingly relevant for those seeking stable returns amidst uncertain conditions. In this environment, selecting stocks with strong dividend yields can offer a measure of financial stability and income potential, making them an attractive option for investors navigating current market uncertainties.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO) | 5.48% | ★★★★★★ |

| Saudi Awwal Bank (SASE:1060) | 6.18% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.73% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) (DFM:NGI) | 7.63% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 6.38% | ★★★★★☆ |

| Göltas Göller Bölgesi Cimento Sanayi ve Ticaret (IBSE:GOLTS) | 3.42% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 7.04% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 5.30% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 6.02% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 5.72% | ★★★★★☆ |

Click here to see the full list of 60 stocks from our Top Middle Eastern Dividend Stocks screener.

We'll examine a selection from our screener results.

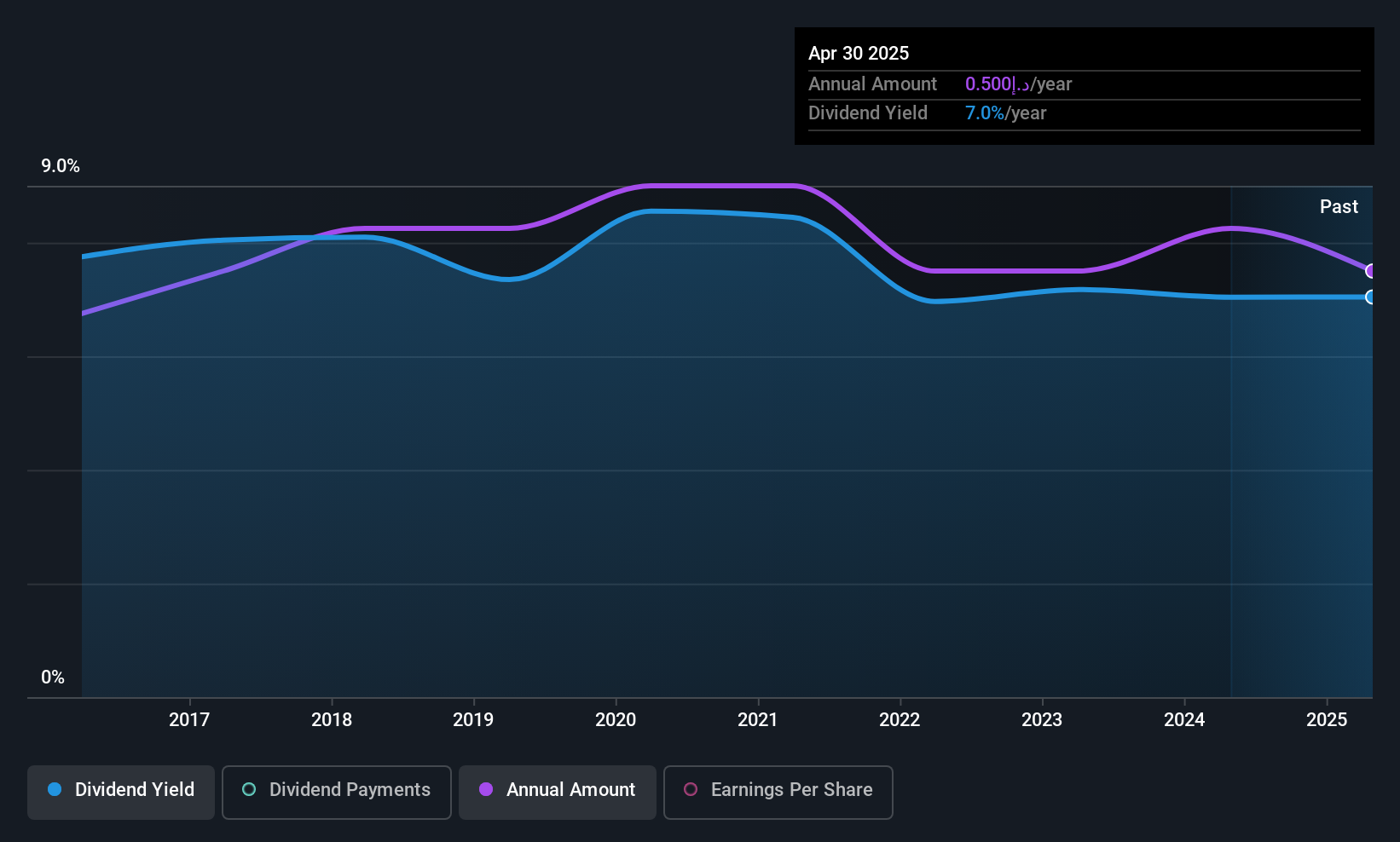

Emirates Insurance Company P.J.S.C (ADX:EIC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Emirates Insurance Company P.J.S.C. operates in the general insurance and reinsurance sectors across the United Arab Emirates, the United States, and Europe, with a market cap of AED1.10 billion.

Operations: Emirates Insurance Company P.J.S.C. generates revenue through its investments, amounting to AED86.04 million, and underwriting activities totaling AED2.41 billion.

Dividend Yield: 6.8%

Emirates Insurance Company P.J.S.C. offers a compelling dividend yield of 6.85%, placing it in the top quartile among UAE dividend payers, with dividends well-covered by earnings (54.4% payout ratio) and cash flows (45.6% cash payout ratio). Despite stable per-share dividends over the past decade, their reliability has been inconsistent, with payments previously declining. Recent Q3 results show improved profitability, as net income rose to AED 39.3 million from AED 29.24 million year-on-year, indicating potential for sustained payouts.

- Click to explore a detailed breakdown of our findings in Emirates Insurance Company P.J.S.C's dividend report.

- Upon reviewing our latest valuation report, Emirates Insurance Company P.J.S.C's share price might be too optimistic.

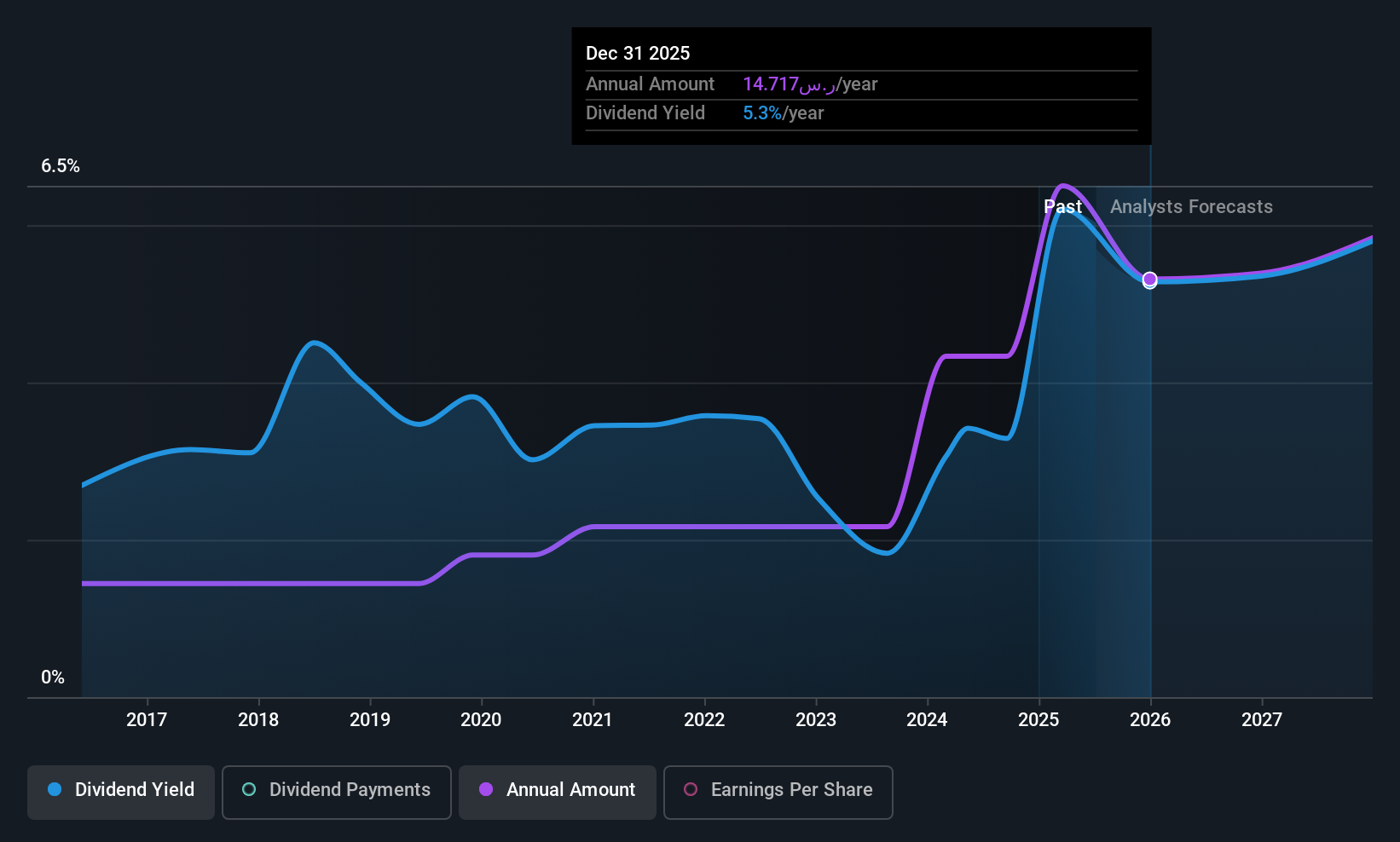

Saudia Dairy & Foodstuff (SASE:2270)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Saudia Dairy & Foodstuff Company produces and distributes dairy products, beverages, and various foodstuffs in the Kingdom of Saudi Arabia, Poland, and other Gulf and Arab countries with a market cap of SAR7.46 billion.

Operations: Saudia Dairy & Foodstuff Company's revenue is comprised of SAR1.66 billion from beverages and SAR1.47 billion from non-beverages.

Dividend Yield: 7.7%

Saudia Dairy & Foodstuff offers a substantial dividend yield of 7.72%, ranking it in the top quartile of Saudi payers, though its high payout ratios (104.5% earnings, 213% cash) indicate unsustainability. Despite stable and growing dividends over the past decade, coverage by earnings and cash flows is inadequate. Recent Q3 results show net income rising to SAR 184.53 million from SAR 137.5 million year-on-year, supporting interim dividends but highlighting potential financial strain on future payouts.

- Click here and access our complete dividend analysis report to understand the dynamics of Saudia Dairy & Foodstuff.

- Our expertly prepared valuation report Saudia Dairy & Foodstuff implies its share price may be too high.

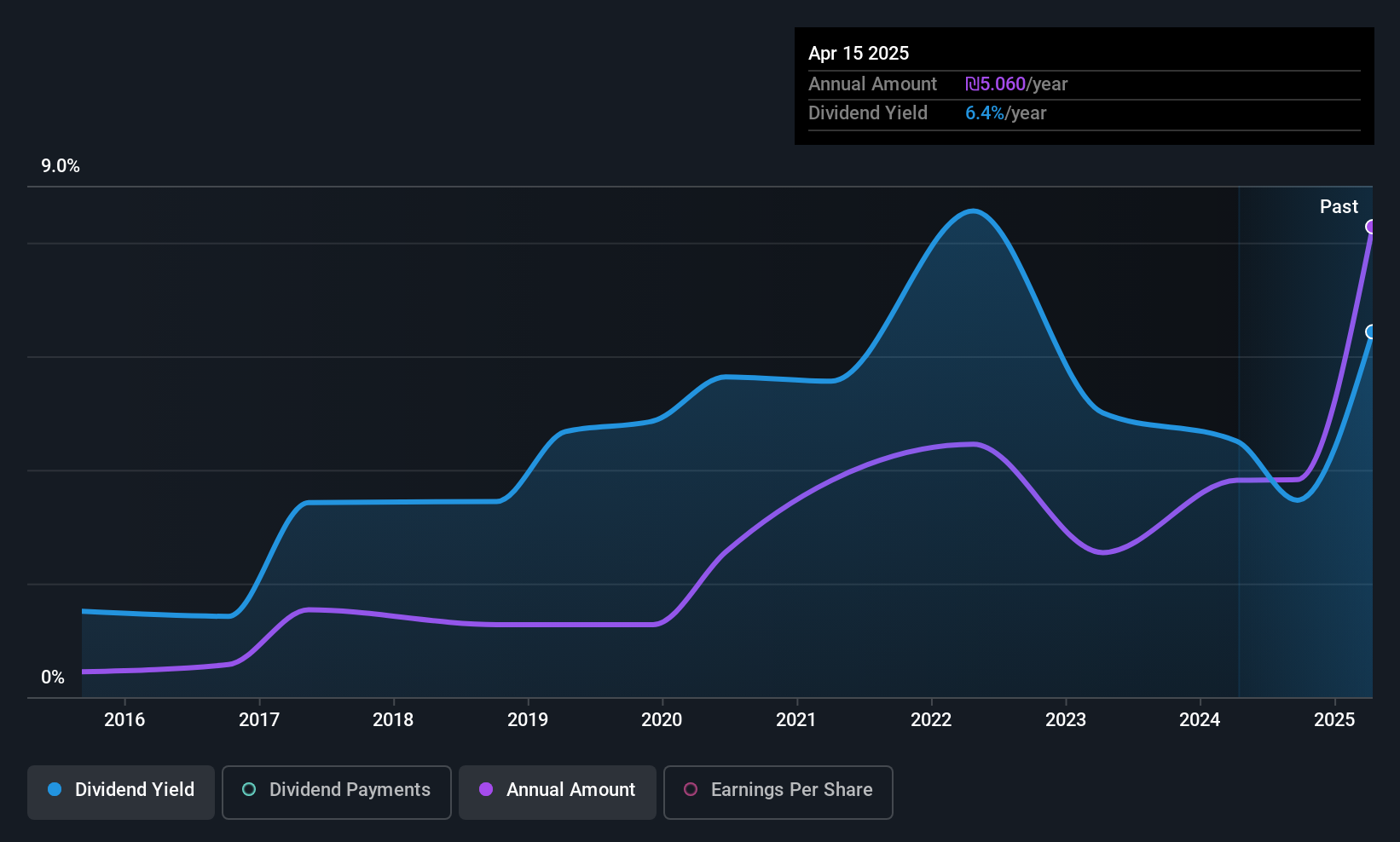

Palram Industries (1990) (TASE:PLRM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Palram Industries (1990) Ltd is a manufacturer of extruded thermoplastic sheets and panel systems, serving both domestic and international markets, with a market cap of ₪1.43 billion.

Operations: Palram Industries generates revenue through several segments, including the PVC Sector (₪431.39 million), Polycarbonate Sector (₪911.14 million), Home Finished Products Sector (₪229.65 million), and Sales and Display Stands Sector (₪243.61 million).

Dividend Yield: 9.1%

Palram Industries' dividend yield of 9.08% places it among the top quarter of Israeli payers, supported by a sustainable payout ratio of 51.6% and cash coverage at 46.3%. Despite this, dividends have been volatile over the past decade, with significant annual drops in some years. Recent Q3 earnings show a decline in net income to ILS 41.85 million from ILS 62.37 million year-on-year, which may impact future dividend stability despite current coverage levels.

- Take a closer look at Palram Industries (1990)'s potential here in our dividend report.

- Our valuation report unveils the possibility Palram Industries (1990)'s shares may be trading at a discount.

Key Takeaways

- Dive into all 60 of the Top Middle Eastern Dividend Stocks we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:PLRM

Palram Industries (1990)

Operates as a manufacturer of extruded thermoplastic sheets and panel systems in Israel and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)