- United Arab Emirates

- /

- Oil and Gas

- /

- ADX:DANA

Undiscovered Gems These 3 Small Caps with Strong Fundamentals

Reviewed by Simply Wall St

In a week marked by busy earnings reports and fluctuating macroeconomic indicators, small-cap stocks have shown resilience compared to their larger counterparts, as evidenced by the Russell 2000's modest gains amidst broader market declines. As investors navigate these dynamic conditions, identifying stocks with strong fundamentals becomes crucial for uncovering potential opportunities in the small-cap space.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Petrol d.d | 42.18% | 17.56% | -0.49% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| Etihad Atheeb Telecommunication | NA | 26.82% | 62.18% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Britam Holdings | 8.55% | -2.40% | 35.94% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Dana Gas PJSC (ADX:DANA)

Simply Wall St Value Rating: ★★★★★★

Overview: Dana Gas PJSC operates in the exploration, production, and sale of natural gas and petroleum products across the UAE, Iraq, and Egypt with a market cap of AED4.69 billion.

Operations: Dana Gas PJSC generates revenue primarily from its integrated oil and gas operations, amounting to $306 million. The company's net profit margin reflects its financial efficiency in managing costs relative to revenue.

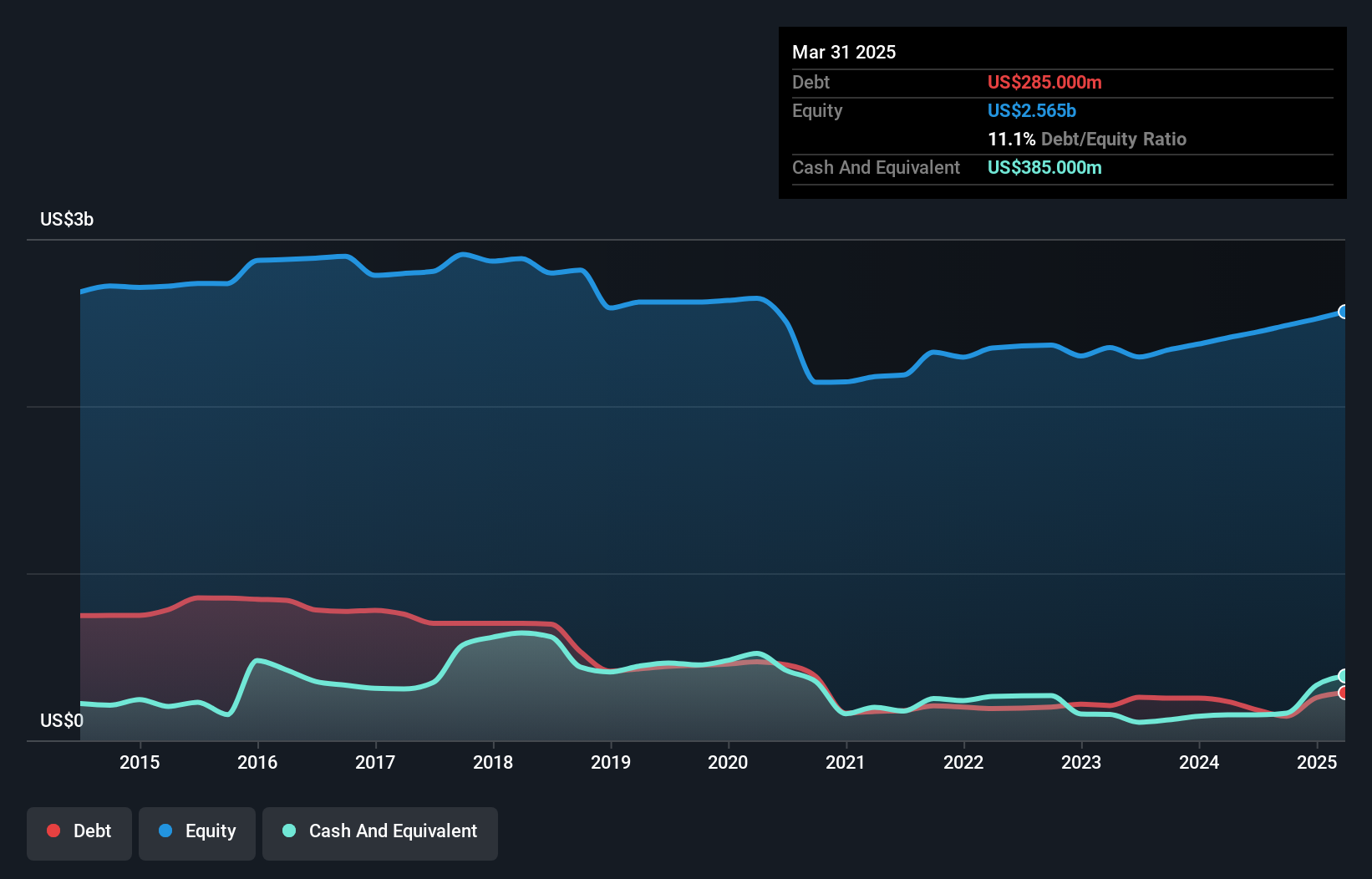

Dana Gas PJSC, a player in the oil and gas sector, showcases a satisfactory net debt to equity ratio of 1.2%, reflecting prudent financial management. Despite recent earnings growth challenges at -3.2% compared to the industry's -7.1%, it trades at 37.9% below its estimated fair value, suggesting potential upside for investors seeking undervalued opportunities. The company's interest payments are comfortably covered by EBIT with a coverage ratio of 41.8x, indicating strong operational efficiency. Recent removal from the FTSE All-World Index might impact visibility but doesn't overshadow its robust fundamentals and forecasted annual earnings growth of 17%.

- Click here and access our complete health analysis report to understand the dynamics of Dana Gas PJSC.

Review our historical performance report to gain insights into Dana Gas PJSC's's past performance.

Polaris Media (OB:POL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Polaris Media ASA is a media house and printing company operating in Norway and Sweden, with a market capitalization of NOK 4.29 billion.

Operations: Polaris Media generates revenue primarily from its Media House operations in Norway and Sweden, with significant contributions of NOK 1.91 billion and NOK 1.08 billion, respectively. Additional income streams include Print and Distribution services in both countries.

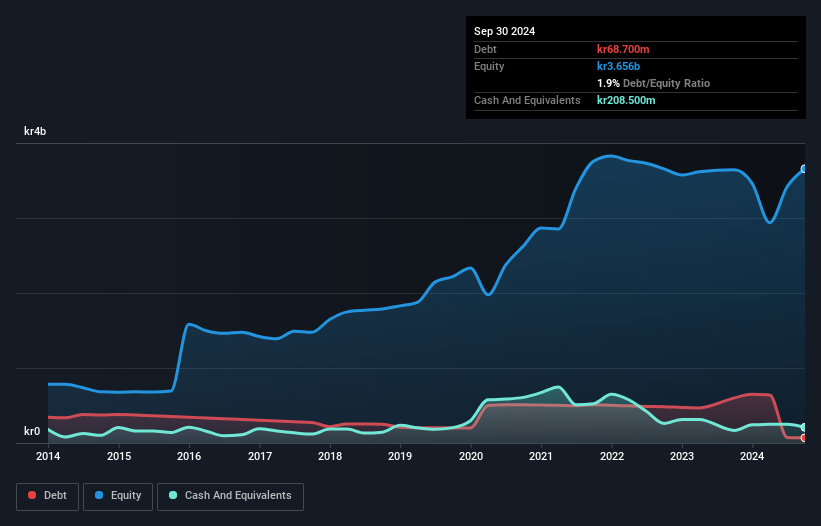

Polaris Media, a nimble player in the media landscape, has shown impressive earnings growth of 471.3% over the past year, outpacing the industry average of 21.3%. Despite a dip in revenue to NOK 901.9 million from NOK 946 million in Q2, net income soared to NOK 624.3 million from NOK 86.7 million previously, reflecting robust operational efficiency and high-quality earnings. With a price-to-earnings ratio of just 8.3x compared to the Norwegian market's average of 11x and reduced debt-to-equity ratio from 9.4% to 2.2% over five years, Polaris offers compelling value potential amidst its financial prudence and strategic positioning.

- Dive into the specifics of Polaris Media here with our thorough health report.

Gain insights into Polaris Media's past trends and performance with our Past report.

Dai-Dan (TSE:1980)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Dai-Dan Co., Ltd. specializes in the design, supervision, and construction of electrical, air conditioning, plumbing and sanitary, and firefighting facilities works in Japan with a market cap of ¥129.46 billion.

Operations: The primary revenue stream for Dai-Dan comes from its Equipment Construction Business, which generated ¥201.03 billion.

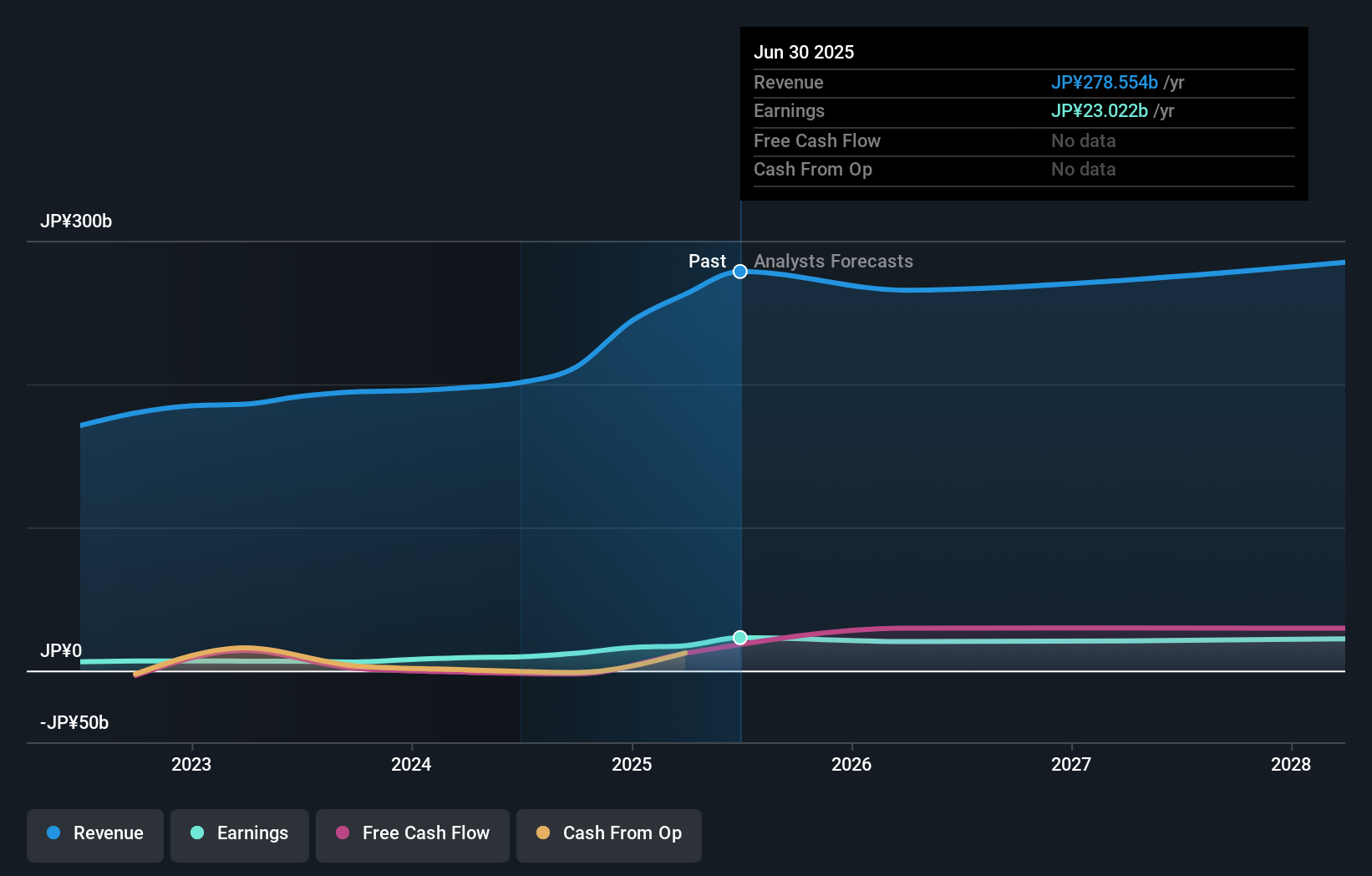

Dai-Dan, a compact player in the construction sector, has shown impressive earnings growth of 47.8% over the past year, outpacing the industry average of 26.5%. Despite its highly volatile share price recently, it trades at 51.8% below its estimated fair value, suggesting potential upside for investors. The company holds more cash than total debt and earns more interest than it pays, indicating financial stability. Although not currently free cash flow positive, Dai-Dan remains profitable with high-quality earnings and forecasts suggest an annual earnings growth rate of 10.95%, alongside a planned dividend increase to JPY 52 per share for fiscal year ending March 2025 from JPY 48 previously.

- Click here to discover the nuances of Dai-Dan with our detailed analytical health report.

Gain insights into Dai-Dan's historical performance by reviewing our past performance report.

Make It Happen

- Get an in-depth perspective on all 4738 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:DANA

Dana Gas PJSC

Engages in the exploration, production, ownership, transportation, processing, distribution, marketing, and sale of natural gas and petroleum related products in the United Arab Emirates, Iraq, and Egypt.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives