- Taiwan

- /

- Food and Staples Retail

- /

- TPEX:6469

Undiscovered Gems Promising Stocks To Watch In January 2025

Reviewed by Simply Wall St

As global markets navigate a mixed start to 2025, with the S&P 500 marking another strong year despite recent economic uncertainties such as declining manufacturing activity and GDP forecast adjustments, investors are increasingly turning their attention to small-cap stocks. In this environment, identifying promising stocks often involves looking for companies with strong fundamentals that can thrive amidst broader market volatility and economic shifts.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Master Trust | 33.35% | 28.01% | 41.50% | ★★★★★☆ |

| Network People Services Technologies | 0.11% | 84.31% | 84.48% | ★★★★★☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

| BOSQAR d.d | 94.35% | 39.99% | 23.94% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Dana Gas PJSC (ADX:DANA)

Simply Wall St Value Rating: ★★★★★★

Overview: Dana Gas PJSC operates in the exploration, production, transportation, processing, distribution, marketing, and sale of natural gas and petroleum-related products across the United Arab Emirates, Iraq, and Egypt with a market cap of AED4.94 billion.

Operations: Dana Gas generates revenue primarily from its integrated oil and gas operations, amounting to $300 million. The company's financial performance is characterized by a focus on efficient cost management to optimize profitability.

Dana Gas, a notable player in the energy sector, is trading at a significant 56.8% below its estimated fair value, suggesting potential undervaluation compared to peers. Despite an 8% drop in production to 55,300 boepd for nine months of 2024 and a slight earnings contraction of -0.7%, it still outpaces the broader industry decline of -6.6%. The company has reduced its debt-to-equity ratio from 17.1% to 5.8% over five years and maintains positive free cash flow with net income at US$112 million for this period, highlighting robust financial health amidst challenging market conditions.

Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative (ENXTPA:CRBP2)

Simply Wall St Value Rating: ★★★★★★

Overview: Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative offers a variety of banking and financial services to diverse customer segments in France, with a market cap of €1.06 billion.

Operations: Brie Picardie generates revenue primarily from retail banking, amounting to €626 million. The company has a market capitalization of approximately €1.06 billion.

With total assets of €42.2 billion and equity of €5 billion, Caisse Régionale de Crédit Agricole Mutuel Brie Picardie stands as a robust financial entity. Its earnings grew by 6.2% over the past year, outpacing the industry average of 5.3%, despite a revenue dip of 2.2%. The bank's liabilities are primarily low-risk, with customer deposits making up 91%. A prudent approach to risk is evident in its bad loans ratio at just 1.2% and a sufficient allowance for these at 115%. Trading significantly below estimated fair value suggests potential undervaluation opportunities for investors seeking hidden gems in finance.

Great Tree Pharmacy (TPEX:6469)

Simply Wall St Value Rating: ★★★★★☆

Overview: Great Tree Pharmacy Co., Ltd. operates in Taiwan, focusing on the management and trading of drugs, health supplements, maternity and infant products, and cosmetics, with a market cap of NT$19.45 billion.

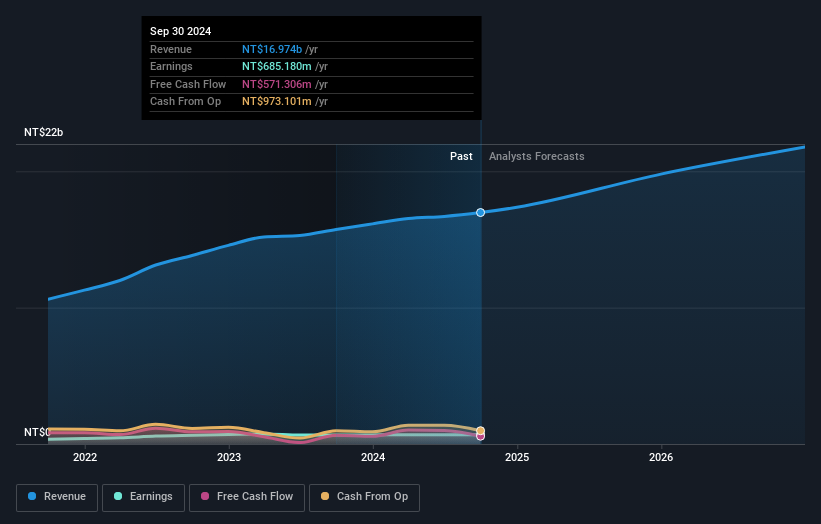

Operations: The company generates revenue primarily from biotechnology, contributing NT$16.97 billion.

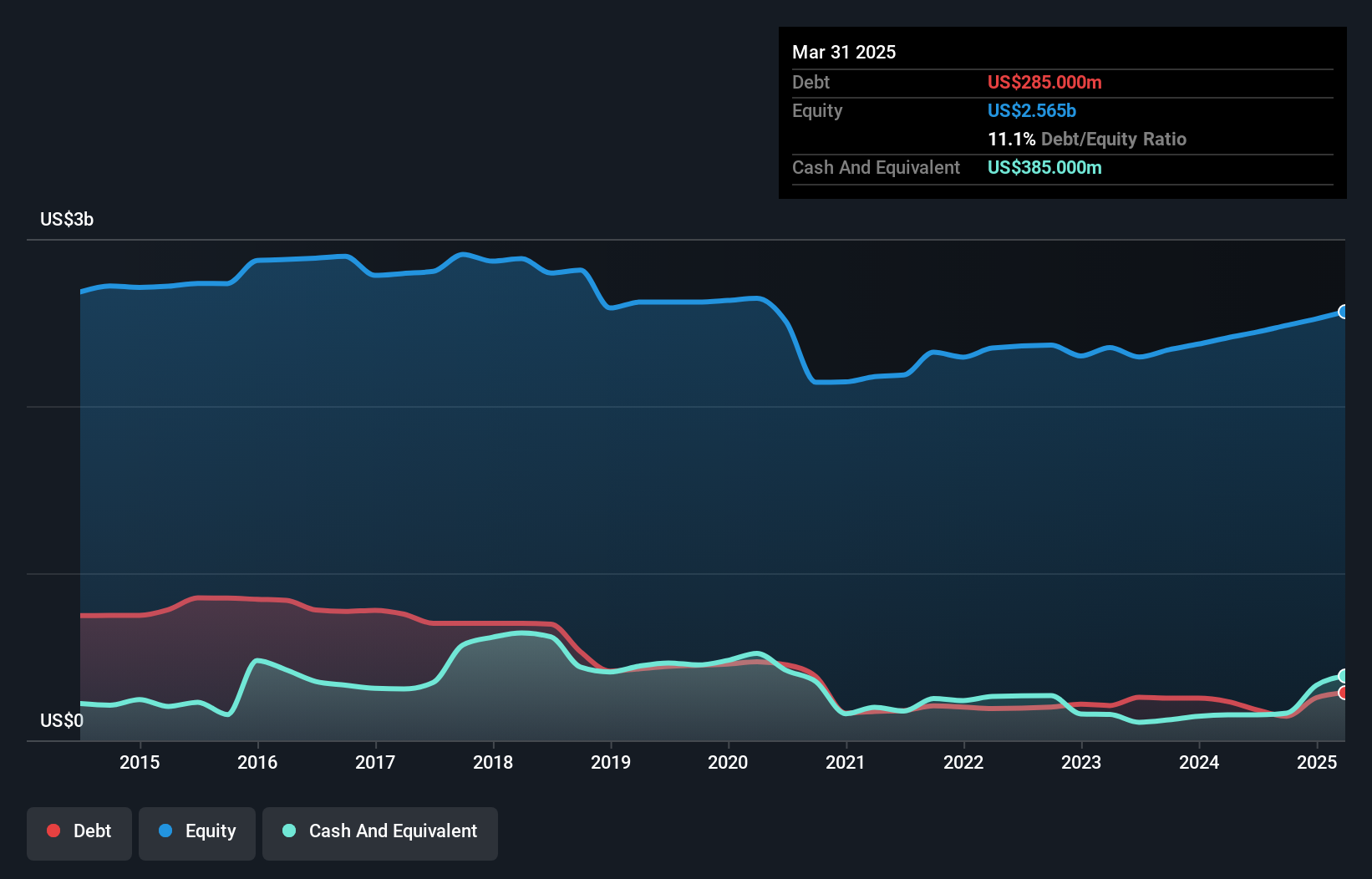

Great Tree Pharmacy has shown consistent growth, with earnings increasing by 31.9% annually over the past five years, although recent annual growth of 4.5% lagged behind the industry average of 11.2%. The company reported third-quarter sales of TWD 4.34 billion and net income of TWD 167 million, slightly up from last year’s figures. Its debt to equity ratio rose from 19.8% to 29.4%, yet interest payments are well covered at an impressive EBIT coverage of 18.8 times, indicating solid financial health despite increased leverage in recent years.

- Click here and access our complete health analysis report to understand the dynamics of Great Tree Pharmacy.

Understand Great Tree Pharmacy's track record by examining our Past report.

Turning Ideas Into Actions

- Explore the 4669 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6469

Great Tree Pharmacy

Engages in management and trading of drugs, health supplements, maternity and infant products, and cosmetics products in Taiwan.

Excellent balance sheet average dividend payer.