As global markets navigate a mixed start to the new year, with notable fluctuations in major indices and economic indicators like the Chicago PMI reflecting ongoing challenges, investors are keenly observing opportunities for stable returns. In this environment, dividend stocks can offer a reliable income stream and potential resilience against market volatility, making them an attractive consideration for those seeking steady performance amidst economic uncertainty.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.09% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.55% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.68% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.41% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.37% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.93% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.97% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.15% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.99% | ★★★★★★ |

Click here to see the full list of 1985 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

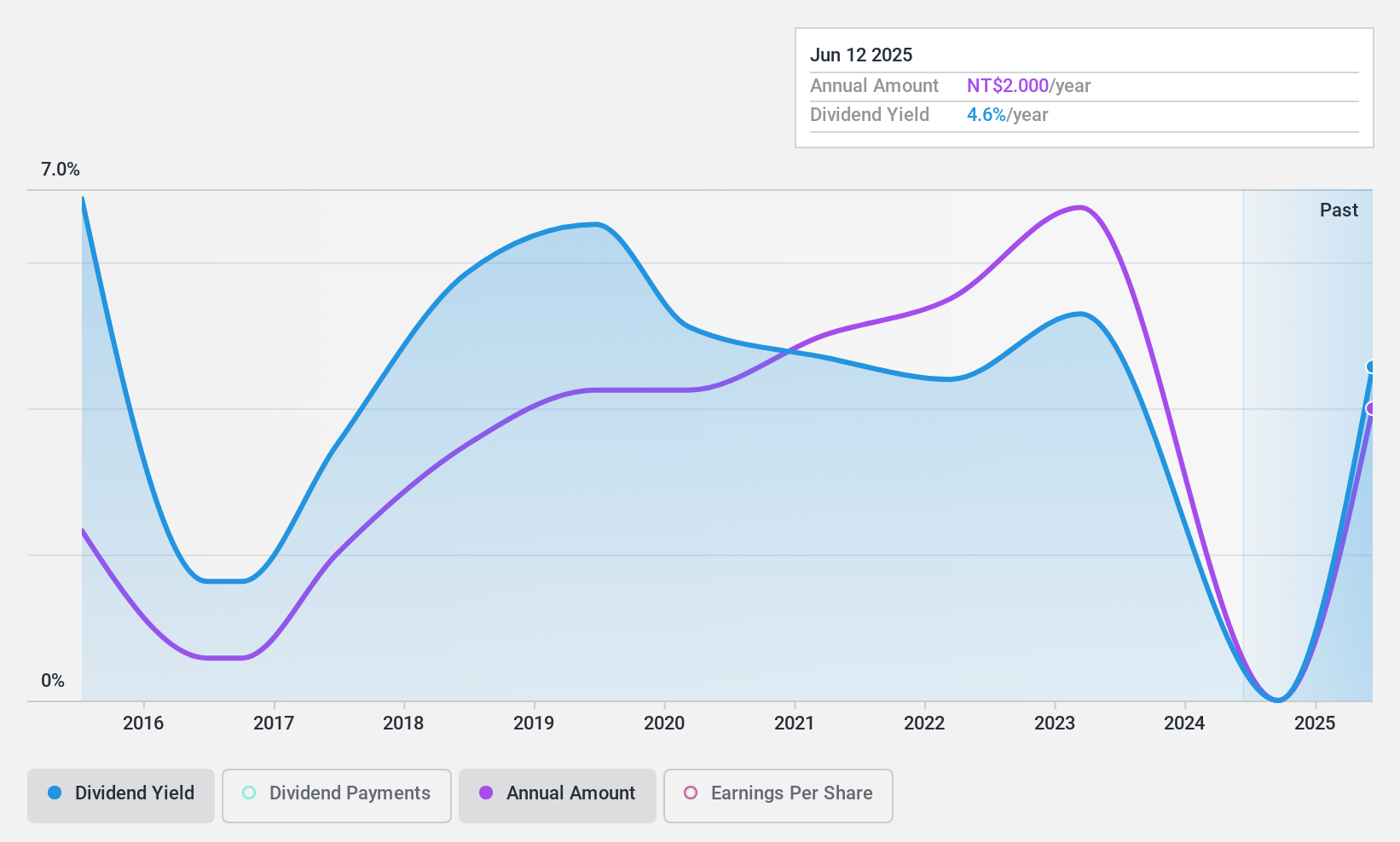

Highlight Tech (TPEX:6208)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Highlight Tech Corp. operates in Taiwan and China, focusing on designing, manufacturing, selling, retailing, wholesaling, repairing, and maintaining electronic components with a market cap of NT$4.69 billion.

Operations: Highlight Tech Corp.'s revenue segments include NT$2.28 billion from Yang Technology Co., LTD, NT$841.10 million from Riyang Electronic Technology (Shanghai) Co., Ltd., and NT$634.81 million from Mingyuan Precision Technology Co., Ltd. and its subsidiaries.

Dividend Yield: 9.8%

Highlight Tech offers a high dividend yield of 9.78%, placing it in the top 25% of dividend payers in the TW market. However, its dividends are not well-covered by free cash flow, with a cash payout ratio at 175.1%. The dividends have been volatile and unreliable over the past decade, reflecting financial instability partly due to high debt levels. Recent earnings show declining sales and net income, which may impact future dividend sustainability.

- Delve into the full analysis dividend report here for a deeper understanding of Highlight Tech.

- In light of our recent valuation report, it seems possible that Highlight Tech is trading beyond its estimated value.

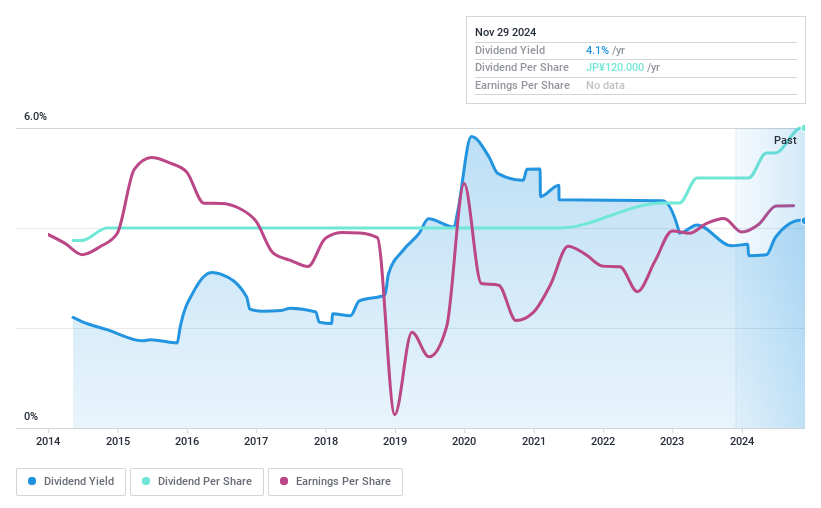

Musashino Bank (TSE:8336)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: The Musashino Bank, Ltd., along with its subsidiaries, offers banking products and financial services in Japan, with a market cap of ¥99.24 billion.

Operations: The Musashino Bank, Ltd. generates revenue from its primary segments including Banking at ¥63.27 billion, Leasing Business at ¥11.28 billion, and Credit Guarantee Business at ¥1.62 billion.

Dividend Yield: 3.9%

Musashino Bank offers a high and reliable dividend yield of 3.92%, ranking in the top 25% of dividend payers in the JP market. Its dividends are well-covered by earnings, with a payout ratio of 31%. Over the past decade, dividends have been stable and growing, supported by consistent earnings growth averaging 9.1% annually over five years. However, there is insufficient data to determine long-term sustainability based on cash flows or future projections.

- Click to explore a detailed breakdown of our findings in Musashino Bank's dividend report.

- Our expertly prepared valuation report Musashino Bank implies its share price may be lower than expected.

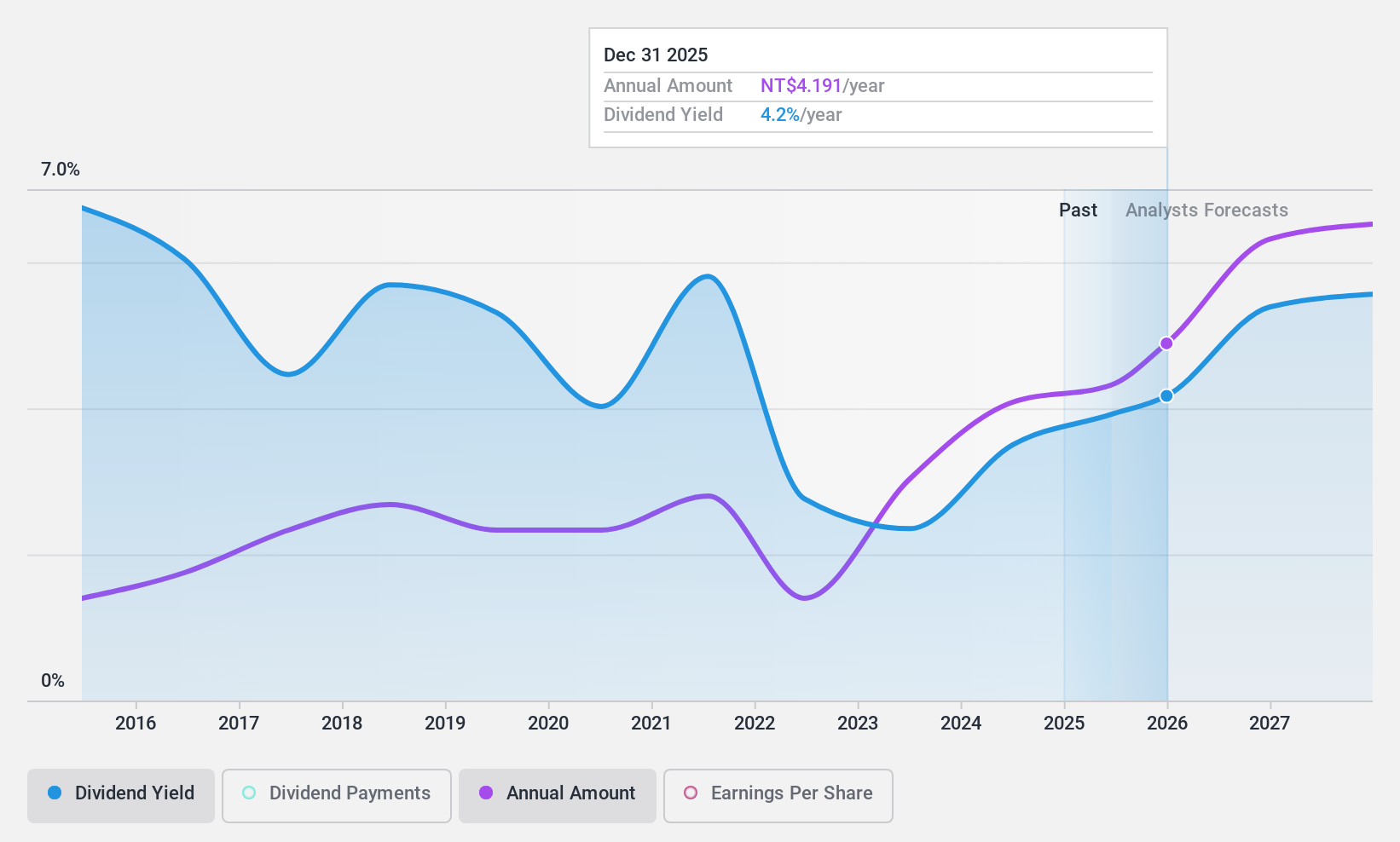

Sunonwealth Electric Machine Industry (TWSE:2421)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sunonwealth Electric Machine Industry Co., Ltd., with a market cap of NT$26.69 billion, manufactures and sells precision motors and thermal solutions globally through its subsidiaries.

Operations: Sunonwealth Electric Machine Industry Co., Ltd.'s revenue segments include NT$22.93 billion from Greater China and NT$790.64 million from Europe and North America.

Dividend Yield: 3.5%

Sunonwealth Electric Machine Industry's dividend yield of 3.53% is below the top tier in Taiwan, and its payout ratio of 74% indicates dividends are covered by earnings. Despite a volatile dividend history over the past decade, recent increases suggest some growth potential. The stock trades at a discount to its estimated fair value, but share price volatility remains high. Earnings and cash flows currently support dividend payments, though sustainability concerns persist due to historical unreliability.

- Navigate through the intricacies of Sunonwealth Electric Machine Industry with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Sunonwealth Electric Machine Industry is priced lower than what may be justified by its financials.

Turning Ideas Into Actions

- Navigate through the entire inventory of 1985 Top Dividend Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2421

Sunonwealth Electric Machine Industry

Manufactures and sells precision motors and thermal solutions worldwide.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives