- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:8183

Jiangsu Chunlan Refrigerating Equipment Stockltd And 2 Other Reliable Dividend Stocks

Reviewed by Simply Wall St

As global markets navigate mixed signals, with the S&P 500 and Nasdaq Composite capping off a strong year despite recent volatility, investors continue to seek stability amid economic uncertainties such as fluctuating PMI readings and GDP forecasts. In this environment, dividend stocks like Jiangsu Chunlan Refrigerating Equipment Stock Ltd offer a potential haven for those looking to balance growth with income, as these investments often provide consistent returns through regular payouts.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.31% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.60% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.73% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.01% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.53% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.37% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.88% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.51% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.40% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.83% | ★★★★★★ |

Click here to see the full list of 1980 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

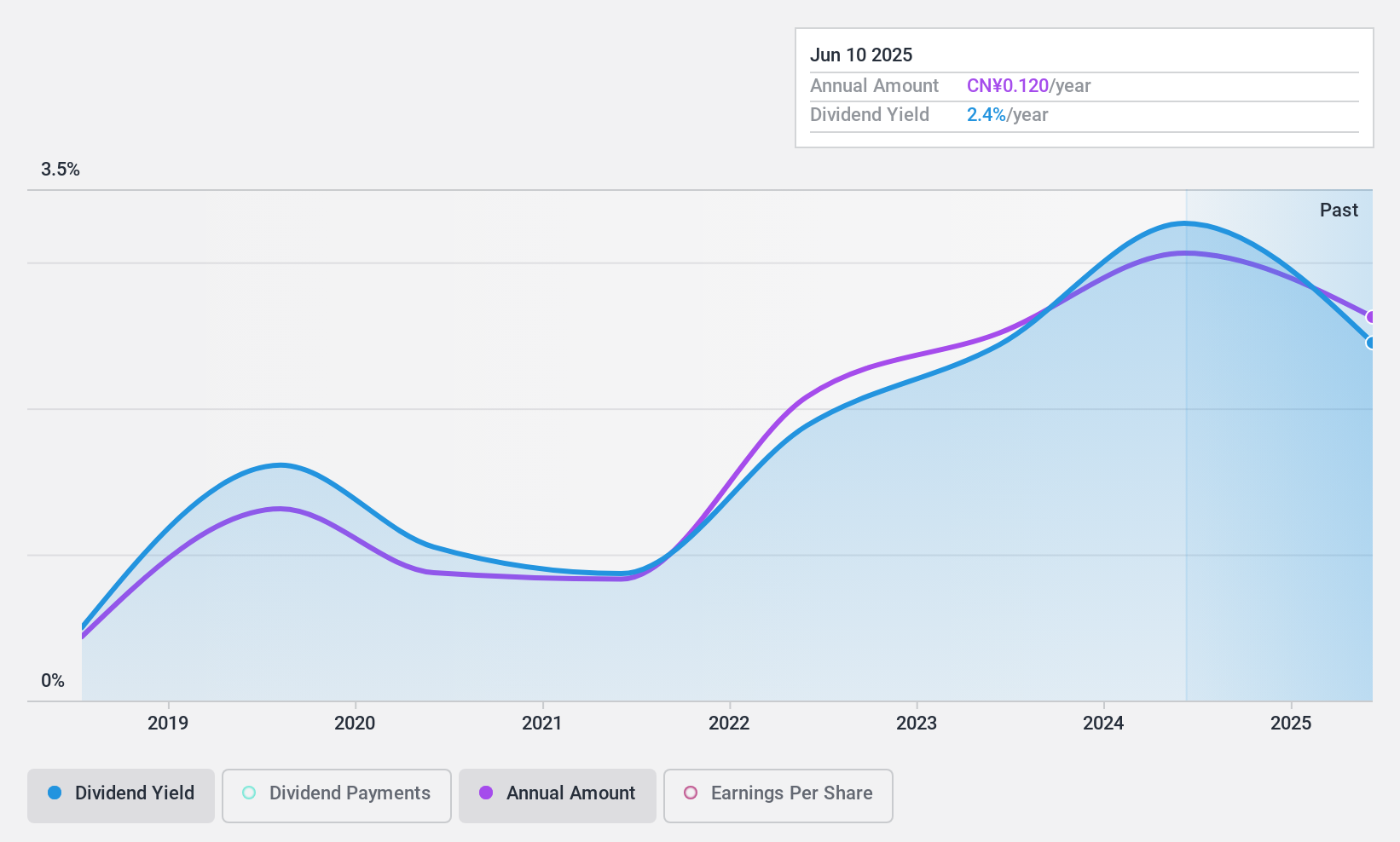

Jiangsu chunlan refrigerating equipment stockltd (SHSE:600854)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jiangsu Chunlan Refrigerating Equipment Stock Co., Ltd. (SHSE:600854) is engaged in the manufacturing and distribution of refrigerating equipment, with a market cap of CN¥2.30 billion.

Operations: Unfortunately, the provided Business operations text does not contain specific revenue segment information for Jiangsu Chunlan Refrigerating Equipment Stock Co., Ltd. (SHSE:600854). Therefore, I am unable to summarize the company's revenue segments into one sentence.

Dividend Yield: 2.9%

Jiangsu Chunlan Refrigerating Equipment's dividend yield of 2.88% ranks in the top 25% of CN market payers, though its dividends have been volatile over the past decade. Despite a low payout ratio of 49.1%, indicating earnings coverage, cash flow issues persist with a high cash payout ratio of 134.7%. Recent earnings show stable net income at CNY 134.1 million despite halved sales, highlighting potential challenges in sustaining dividends from free cash flows.

- Take a closer look at Jiangsu chunlan refrigerating equipment stockltd's potential here in our dividend report.

- Our expertly prepared valuation report Jiangsu chunlan refrigerating equipment stockltd implies its share price may be too high.

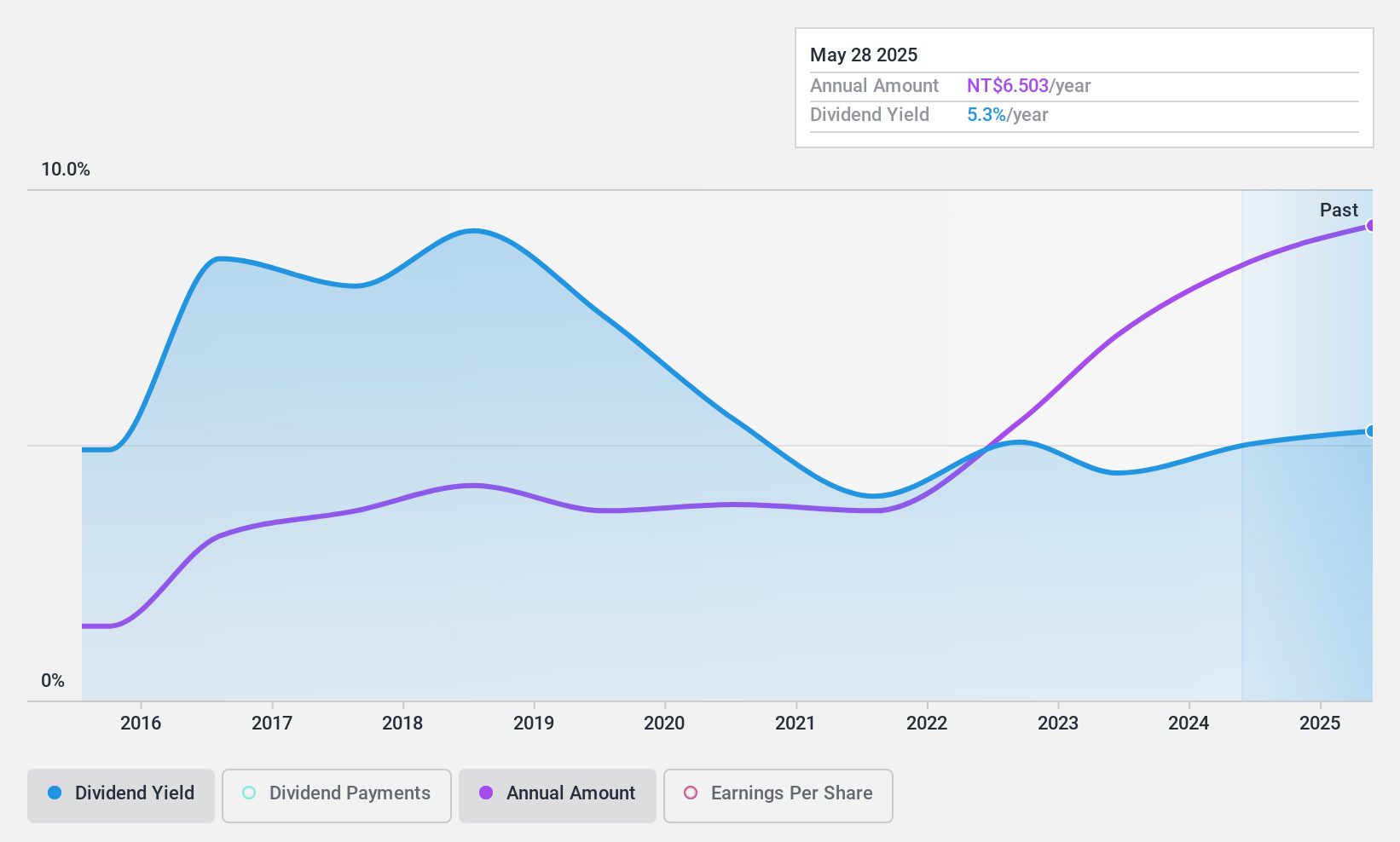

Dimerco Data System (TPEX:5403)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dimerco Data System Corporation, along with its subsidiaries, focuses on designing, developing, and selling various software products in Taiwan and has a market capitalization of NT$9.08 billion.

Operations: Dimerco Data System Corporation generates its revenue primarily from the Hardware Department, contributing NT$2.07 billion, followed by the Software Sector with NT$809.87 million.

Dividend Yield: 4.9%

Dimerco Data System's dividend yield of 4.88% is among the top 25% in Taiwan, but its sustainability is questionable due to a high cash payout ratio of 137.1%, indicating inadequate free cash flow coverage. Despite a growth in earnings over five years, recent results show declining net income and EPS compared to last year. The dividend history is marked by volatility and unreliability, with past shareholder dilution further complicating its attractiveness as a stable dividend stock.

- Unlock comprehensive insights into our analysis of Dimerco Data System stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Dimerco Data System is priced higher than what may be justified by its financials.

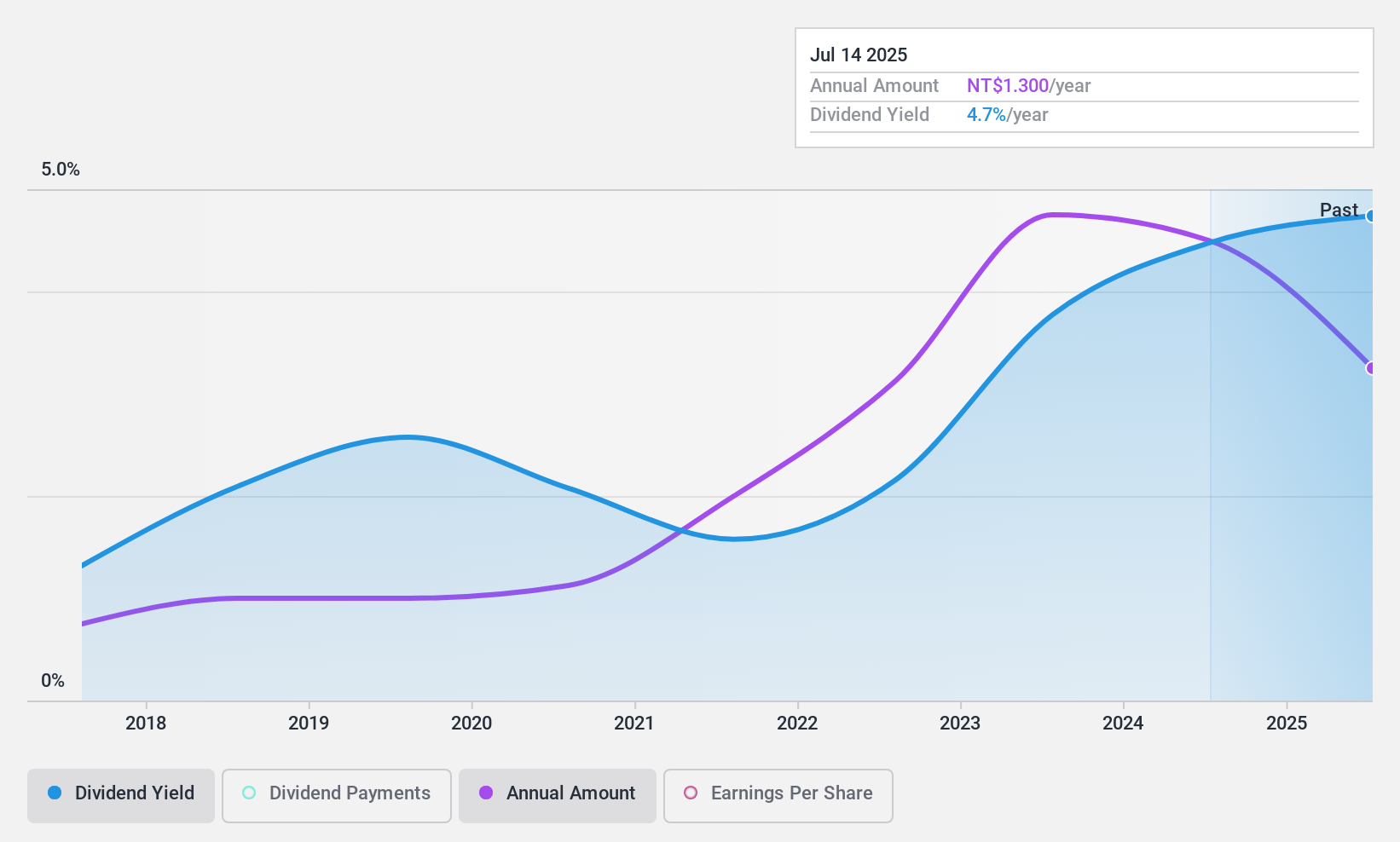

Info-Tek (TPEX:8183)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Info-Tek Corporation is involved in the manufacture, assembly, processing, sale, and distribution of information electronic products across Taiwan, China, the rest of Asia, the United States, and Europe with a market capitalization of NT$4.85 billion.

Operations: Info-Tek Corporation's revenue segments include NT$327.23 million from PCBA - EMS1 and NT$6.33 billion from PCBA - EMS3.

Dividend Yield: 4.3%

Info-Tek's dividend payments have grown over the past decade, but they remain volatile and unreliable. Despite this, dividends are well-covered by earnings (56% payout ratio) and cash flows (40.5% cash payout ratio), though the yield of 4.34% is below Taiwan's top quartile. Recent financials show a decline in net income and EPS for Q3 2024 compared to last year, with sales slightly increasing to TWD 1.95 billion from TWD 1.8 billion.

- Get an in-depth perspective on Info-Tek's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Info-Tek is priced lower than what may be justified by its financials.

Turning Ideas Into Actions

- Reveal the 1980 hidden gems among our Top Dividend Stocks screener with a single click here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:8183

Info-Tek

Engages in the manufacture, assembly, processing, sale, and distribution of information electronic products in Taiwan, China, rest of Asia, Europe, and the United States.

Excellent balance sheet second-rate dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion