- Israel

- /

- Hospitality

- /

- TASE:TRA

Finance House P.J.S.C Leads These 3 Middle Eastern Penny Stocks

Reviewed by Simply Wall St

The Middle Eastern stock markets have recently experienced some fluctuations, with ex-dividend stocks impacting indices in the UAE. Despite these challenges, the region continues to offer intriguing investment opportunities, particularly in niche areas like penny stocks. Once considered a buzzword and now more of a niche, penny stocks—typically representing smaller or newer companies—can still provide growth potential when backed by strong financial health and fundamentals.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR4.10 | SAR1.65B | ✅ 2 ⚠️ 1 View Analysis > |

| Keir International (SASE:9542) | SAR4.40 | SAR528M | ✅ 2 ⚠️ 3 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪2.357 | ₪163.44M | ✅ 4 ⚠️ 2 View Analysis > |

| Oil Refineries (TASE:ORL) | ₪0.898 | ₪2.79B | ✅ 1 ⚠️ 2 View Analysis > |

| Big Tech 50 R&D-Limited Partnership (TASE:BIGT) | ₪1.686 | ₪17.89M | ✅ 0 ⚠️ 6 View Analysis > |

| Tarya Israel (TASE:TRA) | ₪0.631 | ₪187.32M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.299 | ₪170.91M | ✅ 1 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.755 | AED473.22M | ✅ 2 ⚠️ 2 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.83 | AED442.37M | ✅ 2 ⚠️ 3 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.38 | AED10.08B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 92 stocks from our Middle Eastern Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Finance House P.J.S.C (ADX:FH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Finance House P.J.S.C. operates in the United Arab Emirates, offering investment, consumer and commercial financing services, with a market cap of AED620.14 million.

Operations: The company's revenue segments include Commercial and Retail Financing generating AED108.57 million and Investment contributing AED9.67 million.

Market Cap: AED620.14M

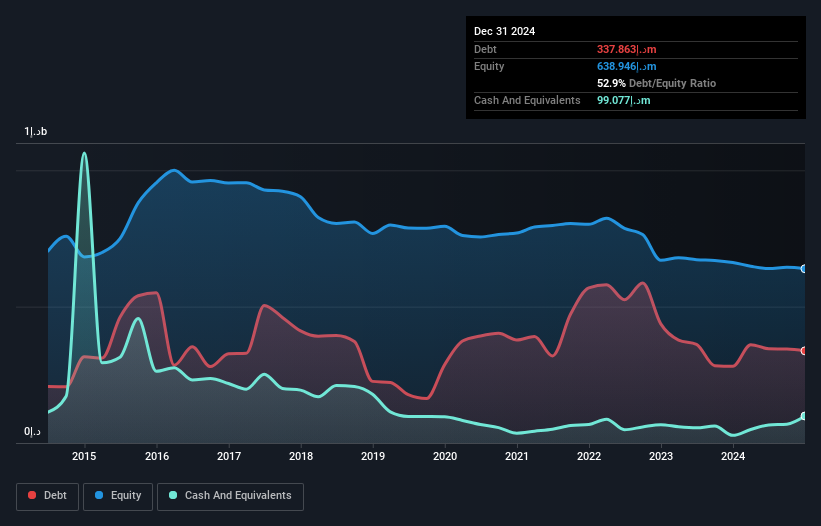

Finance House P.J.S.C. recently reported a significant drop in net income to AED15.68 million for 2024 from AED35.98 million the previous year, resulting in a basic loss per share of AED0.01 compared to earnings of AED0.05 last year. Despite being unprofitable, the company has managed to reduce losses at an annual rate of 33.4% over five years and maintains satisfactory debt levels with a net debt to equity ratio of 37.4%. Its short-term assets exceed both long-term and short-term liabilities, providing some financial stability amid high share price volatility over recent months.

- Get an in-depth perspective on Finance House P.J.S.C's performance by reading our balance sheet health report here.

- Assess Finance House P.J.S.C's previous results with our detailed historical performance reports.

National Investor Pr. J.S.C (ADX:TNI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: The National Investor Pr. J.S.C., operating in the United Arab Emirates, engages in private equity, real estate investment and consultancy, economic feasibility studies, commercial agencies, and hospitality services with a market cap of AED110.22 million.

Operations: The company has not reported any specific revenue segments.

Market Cap: AED110.22M

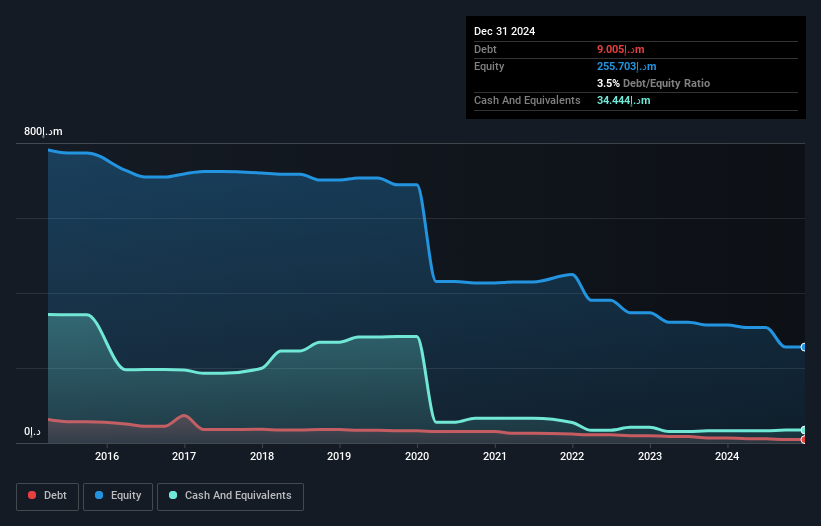

National Investor Pr. J.S.C. remains unprofitable, with a net loss of AED 10.9 million for 2024, up from AED 9.11 million the previous year, despite revenue increasing to AED 27.02 million from AED 22.78 million. The company benefits from a strong financial position with more cash than total debt and short-term assets covering both short- and long-term liabilities, suggesting liquidity strength amid its operational challenges. While earnings have declined over the past five years by an annual rate of 14.6%, TNI's experienced board (5.9 years average tenure) and stable weekly volatility offer some stability in this volatile penny stock sector.

- Click here and access our complete financial health analysis report to understand the dynamics of National Investor Pr. J.S.C.

- Gain insights into National Investor Pr. J.S.C's past trends and performance with our report on the company's historical track record.

Tarya Israel (TASE:TRA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Tarya Israel Ltd, with a market cap of ₪187.32 million, operates an internet platform in Israel through its subsidiaries.

Operations: Tarya Israel Ltd has not reported any specific revenue segments.

Market Cap: ₪187.32M

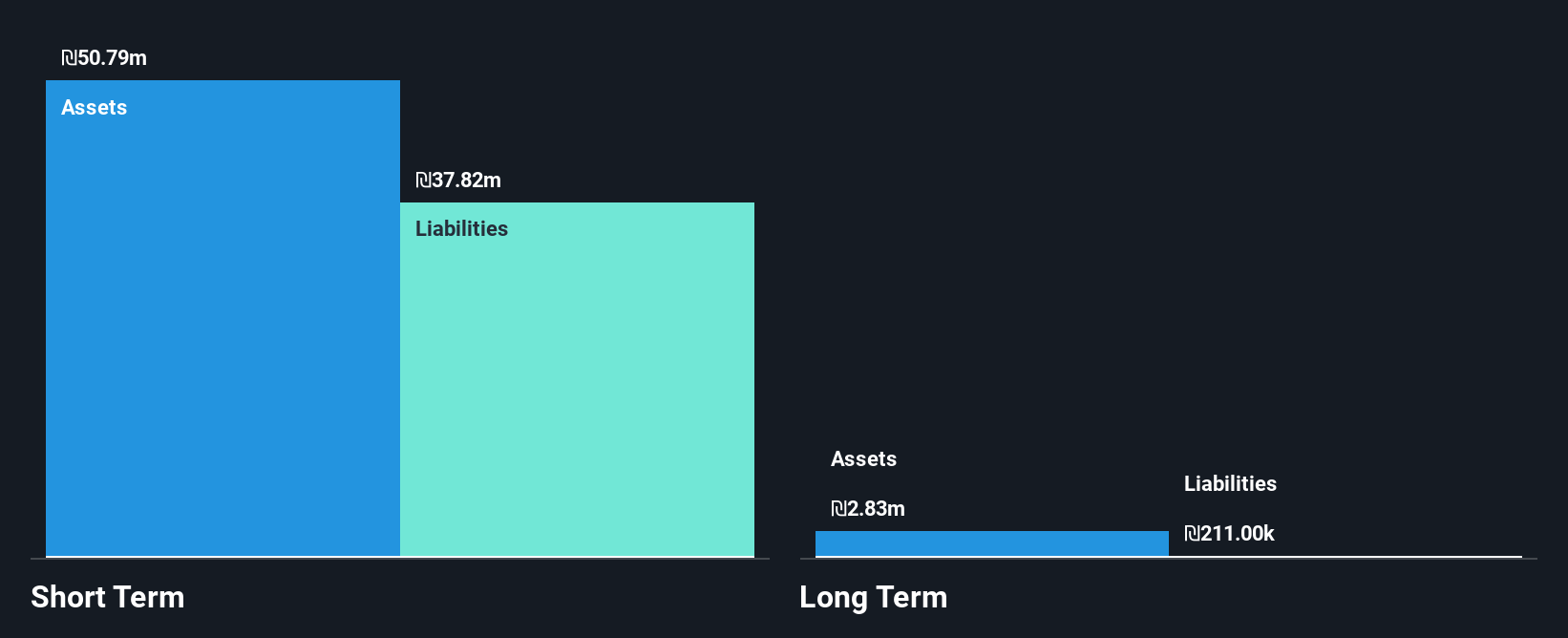

Tarya Israel Ltd has transitioned to profitability, reporting a net income of ₪10.12 million for 2024, reversing a previous net loss. Despite a decline in sales to ₪52.88 million from the prior year, the company's financial health is robust with short-term assets of ₪50.9 million exceeding both short- and long-term liabilities and cash surpassing total debt. Its return on equity stands out at an impressive 42.1%, though its share price remains highly volatile compared to most Israeli stocks. The board's lack of experience may pose governance challenges despite strong earnings quality and well-covered interest payments by EBIT (5.5x).

- Jump into the full analysis health report here for a deeper understanding of Tarya Israel.

- Gain insights into Tarya Israel's historical outcomes by reviewing our past performance report.

Where To Now?

- Discover the full array of 92 Middle Eastern Penny Stocks right here.

- Searching for a Fresh Perspective? Explore 21 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tarya Israel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:TRA

Excellent balance sheet and good value.

Market Insights

Community Narratives