- United Arab Emirates

- /

- Capital Markets

- /

- ADX:RAPCO

RAPCO Investment PJSC (ADX:RAPCO) pops 11% this week, taking five-year gains to 54%

RAPCO Investment PJSC (ADX:RAPCO) shareholders might be concerned after seeing the share price drop 11% in the last quarter. But at least the stock is up over the last five years. Unfortunately its return of 54% is below the market return of 215%.

Since it's been a strong week for RAPCO Investment PJSC shareholders, let's have a look at trend of the longer term fundamentals.

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

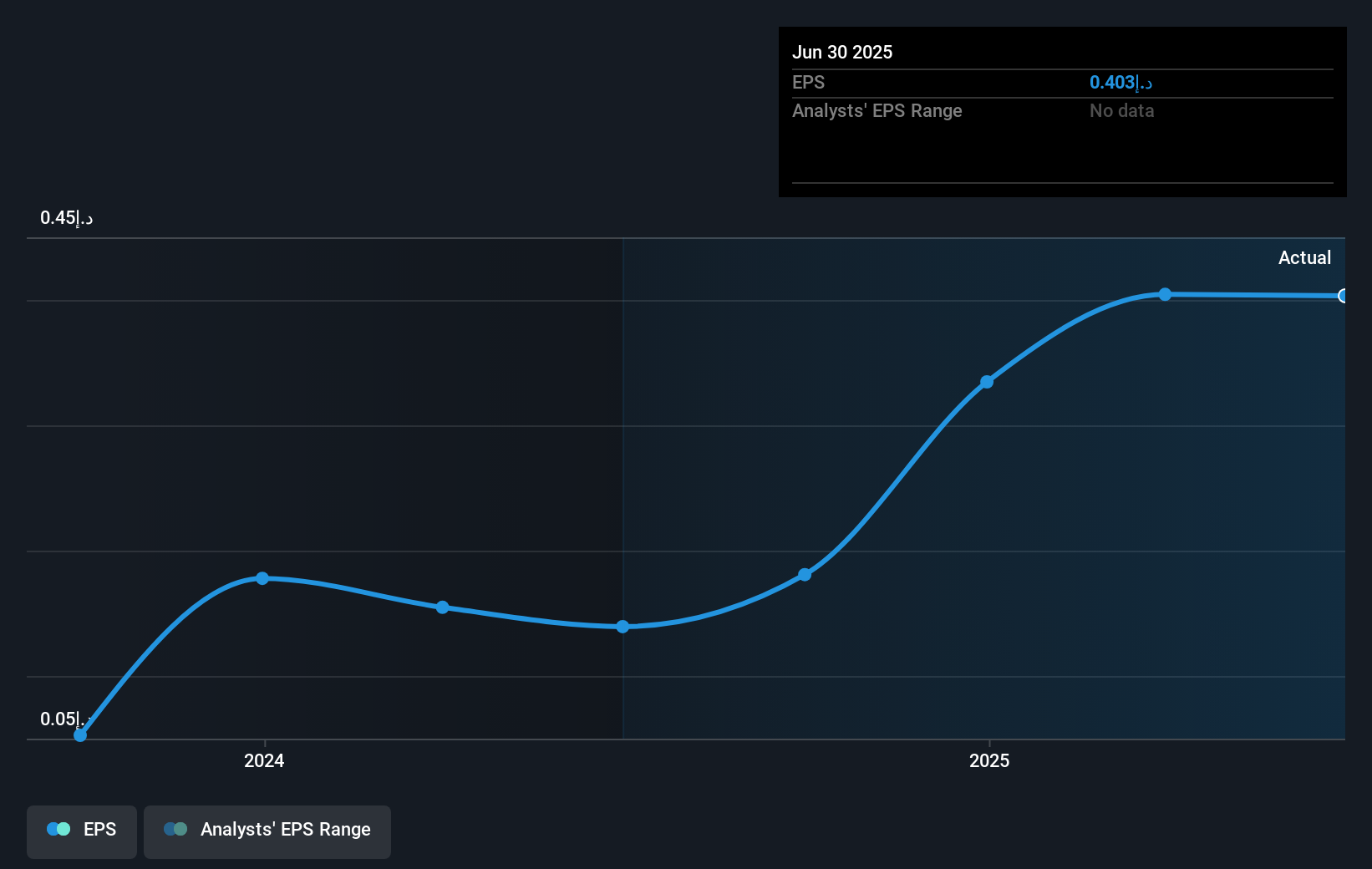

During the last half decade, RAPCO Investment PJSC became profitable. That would generally be considered a positive, so we'd hope to see the share price to rise. Given that the company made a profit three years ago, but not five years ago, it is worth looking at the share price returns over the last three years, too. Indeed, the RAPCO Investment PJSC share price has gained 31% in three years. In the same period, EPS is up 107% per year. This EPS growth is higher than the 9% average annual increase in the share price over the same three years. So you might conclude the market is a little more cautious about the stock, these days. This unenthusiastic sentiment is reflected in the stock's reasonably modest P/E ratio of 5.50.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Dive deeper into RAPCO Investment PJSC's key metrics by checking this interactive graph of RAPCO Investment PJSC's earnings, revenue and cash flow.

A Different Perspective

We're pleased to report that RAPCO Investment PJSC shareholders have received a total shareholder return of 24% over one year. That's better than the annualised return of 9% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 4 warning signs for RAPCO Investment PJSC (1 is a bit concerning) that you should be aware of.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Emirian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ADX:RAPCO

RAPCO Investment PJSC

Engages in the commercial enterprise investment, institution, and management activities.

Adequate balance sheet with slight risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026