Lulu Retail Holdings PLC's (ADX:LULU) 26% Cheaper Price Remains In Tune With Earnings

Lulu Retail Holdings PLC (ADX:LULU) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. Longer-term shareholders will rue the drop in the share price, since it's now virtually flat for the year after a promising few quarters.

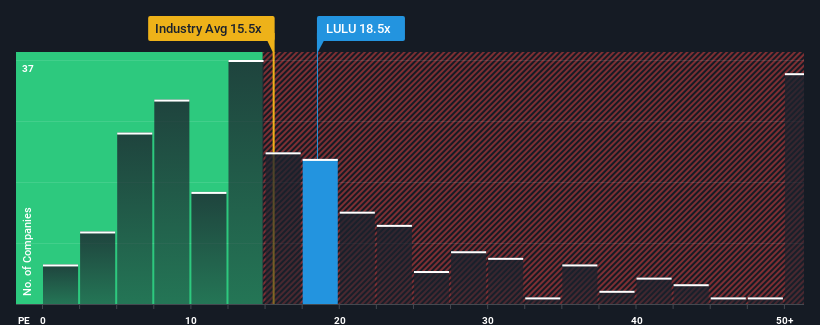

In spite of the heavy fall in price, Lulu Retail Holdings' price-to-earnings (or "P/E") ratio of 18.5x might still make it look like a sell right now compared to the market in the United Arab Emirates, where around half of the companies have P/E ratios below 13x and even P/E's below 9x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

With earnings growth that's superior to most other companies of late, Lulu Retail Holdings has been doing relatively well. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Lulu Retail Holdings

What Are Growth Metrics Telling Us About The High P/E?

Lulu Retail Holdings' P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

If we review the last year of earnings growth, the company posted a worthy increase of 13%. Pleasingly, EPS has also lifted 809% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 31% each year as estimated by the six analysts watching the company. That's shaping up to be materially higher than the 7.1% per annum growth forecast for the broader market.

In light of this, it's understandable that Lulu Retail Holdings' P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Lulu Retail Holdings' P/E?

Despite the recent share price weakness, Lulu Retail Holdings' P/E remains higher than most other companies. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Lulu Retail Holdings' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Before you take the next step, you should know about the 1 warning sign for Lulu Retail Holdings that we have uncovered.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ADX:LULU

Lulu Retail Holdings

Operates food and non-food products retail stores under the LuLu brand in the United Arab Emirates, the Kingdom of Saudi Arabia, Oman, Qatar, Kuwait, Egypt, Bahrain, and internationally.

High growth potential and good value.

Market Insights

Community Narratives