- United Arab Emirates

- /

- Food and Staples Retail

- /

- ADX:GHITHA

Statutory Earnings May Not Be The Best Way To Understand Ghitha Holding P.J.S.C's (ADX:GHITHA) True Position

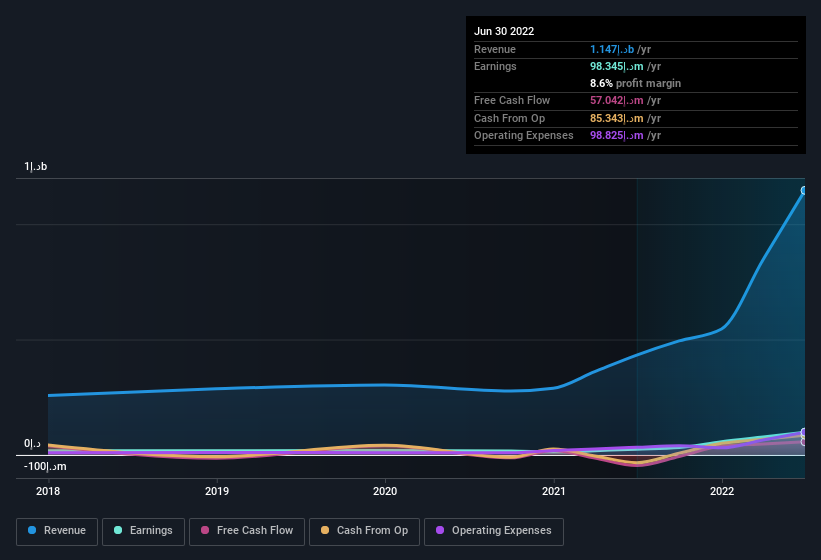

Despite posting strong earnings, Ghitha Holding P.J.S.C's (ADX:GHITHA) stock didn't move much over the last week. We think that investors might be worried about the foundations the earnings are built on.

Check out our latest analysis for Ghitha Holding P.J.S.C

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. Ghitha Holding P.J.S.C expanded the number of shares on issue by 142% over the last year. That means its earnings are split among a greater number of shares. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. You can see a chart of Ghitha Holding P.J.S.C's EPS by clicking here.

How Is Dilution Impacting Ghitha Holding P.J.S.C's Earnings Per Share (EPS)?

Ghitha Holding P.J.S.C has improved its profit over the last three years, with an annualized gain of 429% in that time. In comparison, earnings per share only gained 20% over the same period. And the 295% profit boost in the last year certainly seems impressive at first glance. On the other hand, earnings per share are only up 218% in that time. Therefore, one can observe that the dilution is having a fairly profound effect on shareholder returns.

In the long term, earnings per share growth should beget share price growth. So it will certainly be a positive for shareholders if Ghitha Holding P.J.S.C can grow EPS persistently. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Ghitha Holding P.J.S.C.

The Impact Of Unusual Items On Profit

Alongside that dilution, it's also important to note that Ghitha Holding P.J.S.C's profit was boosted by unusual items worth د.إ44m in the last twelve months. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. And, after all, that's exactly what the accounting terminology implies. We can see that Ghitha Holding P.J.S.C's positive unusual items were quite significant relative to its profit in the year to June 2022. All else being equal, this would likely have the effect of making the statutory profit a poor guide to underlying earnings power.

Our Take On Ghitha Holding P.J.S.C's Profit Performance

In its last report Ghitha Holding P.J.S.C benefitted from unusual items which boosted its profit, which could make the profit seem better than it really is on a sustainable basis. On top of that, the dilution means that its earnings per share performance is worse than its profit performance. On reflection, the above-mentioned factors give us the strong impression that Ghitha Holding P.J.S.C'sunderlying earnings power is not as good as it might seem, based on the statutory profit numbers. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. To help with this, we've discovered 3 warning signs (1 makes us a bit uncomfortable!) that you ought to be aware of before buying any shares in Ghitha Holding P.J.S.C.

Our examination of Ghitha Holding P.J.S.C has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ADX:GHITHA

Ghitha Holding P.J.S.C

An investment holding company, provides management and investment services in diversified projects and businesses in the United Arab Emirates.

Excellent balance sheet with questionable track record.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026