- United Arab Emirates

- /

- Building

- /

- ADX:RAKCEC

Does R.A.K. Ceramics P.J.S.C. (ADX:RAKCEC) Have A Place In Your Dividend Stock Portfolio?

Could R.A.K. Ceramics P.J.S.C. (ADX:RAKCEC) be an attractive dividend share to own for the long haul? Investors are often drawn to strong companies with the idea of reinvesting the dividends. If you are hoping to live on your dividends, it's important to be more stringent with your investments than the average punter. Regular readers know we like to apply the same approach to each dividend stock, and we hope you'll find our analysis useful.

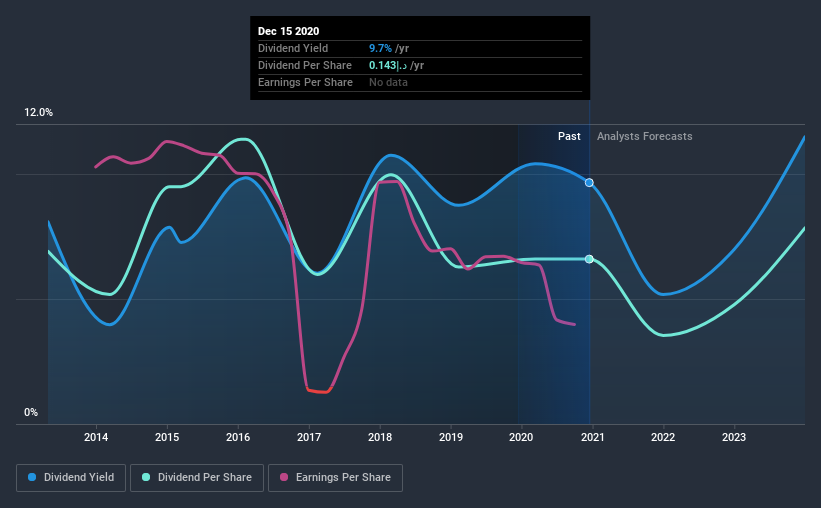

In this case, R.A.K. Ceramics P.J.S.C likely looks attractive to dividend investors, given its 9.7% dividend yield and eight-year payment history. It sure looks interesting on these metrics - but there's always more to the story. There are a few simple ways to reduce the risks of buying R.A.K. Ceramics P.J.S.C for its dividend, and we'll go through these below.

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. Looking at the data, we can see that 173% of R.A.K. Ceramics P.J.S.C's profits were paid out as dividends in the last 12 months. A payout ratio above 100% is definitely an item of concern, unless there are some other circumstances that would justify it.

We also measure dividends paid against a company's levered free cash flow, to see if enough cash was generated to cover the dividend. R.A.K. Ceramics P.J.S.C paid out a conservative 44% of its free cash flow as dividends last year. It's disappointing to see that the dividend was not covered by profits, but cash is more important from a dividend sustainability perspective, and R.A.K. Ceramics P.J.S.C fortunately did generate enough cash to fund its dividend. If executives were to continue paying more in dividends than the company reported in profits, we'd view this as a warning sign. Extraordinarily few companies are capable of persistently paying a dividend that is greater than their profits.

We update our data on R.A.K. Ceramics P.J.S.C every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. Looking at the last decade of data, we can see that R.A.K. Ceramics P.J.S.C paid its first dividend at least eight years ago. Although it has been paying a dividend for several years now, the dividend has been cut at least once, and we're cautious about the consistency of its dividend across a full economic cycle. During the past eight-year period, the first annual payment was د.إ0.1 in 2012, compared to د.إ0.1 last year. Dividend payments have shrunk at a rate of less than 1% per annum over this time frame.

We struggle to make a case for buying R.A.K. Ceramics P.J.S.C for its dividend, given that payments have shrunk over the past eight years.

Dividend Growth Potential

With a relatively unstable dividend, it's even more important to see if earnings per share (EPS) are growing. Why take the risk of a dividend getting cut, unless there's a good chance of bigger dividends in future? R.A.K. Ceramics P.J.S.C's earnings per share have shrunk at 24% a year over the past five years. A sharp decline in earnings per share is not great from from a dividend perspective, as even conservative payout ratios can come under pressure if earnings fall far enough.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. We're a bit uncomfortable with its high payout ratio, although at least the dividend was covered by free cash flow. Earnings per share have been falling, and the company has cut its dividend at least once in the past. From a dividend perspective, this is a cause for concern. Overall, R.A.K. Ceramics P.J.S.C falls short in several key areas here. Unless the investor has strong grounds for an alternative conclusion, we find it hard to get interested in a dividend stock with these characteristics.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. However, there are other things to consider for investors when analysing stock performance. Just as an example, we've come accross 3 warning signs for R.A.K. Ceramics P.J.S.C you should be aware of, and 1 of them is a bit unpleasant.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

When trading R.A.K. Ceramics P.J.S.C or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ADX:RAKCEC

R.A.K. Ceramics P.J.S.C

Engages in manufacture and sale of various ceramic products in the Middle East, Europe, Asian countries, and internationally.

Excellent balance sheet, good value and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.