- United Arab Emirates

- /

- Banks

- /

- DFM:EMIRATESNBD

3 Leading Dividend Stocks Offering Up To 4.6% Yield

Reviewed by Simply Wall St

In a week marked by tariff uncertainties and mixed economic signals, global markets have shown resilience despite some downward pressure on major indices. With U.S. job growth falling short of expectations and manufacturing activity seeing a cautious recovery, investors are increasingly turning their attention to stable income sources like dividend stocks. In such an environment, selecting stocks that offer reliable dividends can be an attractive strategy for those seeking steady returns amidst market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 4.08% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.55% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.79% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.99% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.39% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.11% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.25% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.87% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.85% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.45% | ★★★★★☆ |

Click here to see the full list of 1959 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Emirates NBD Bank PJSC (DFM:EMIRATESNBD)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Emirates NBD Bank PJSC, along with its subsidiaries, offers a range of corporate, institutional, retail, treasury, and Islamic banking services and has a market cap of AED137.07 billion.

Operations: Emirates NBD Bank PJSC's revenue is primarily derived from Retail Banking and Wealth Management (AED15.33 billion), Corporate and Institutional Banking (AED10.83 billion), Deniz Bank (AED10.55 billion), and Global Markets and Treasury (AED2.69 billion).

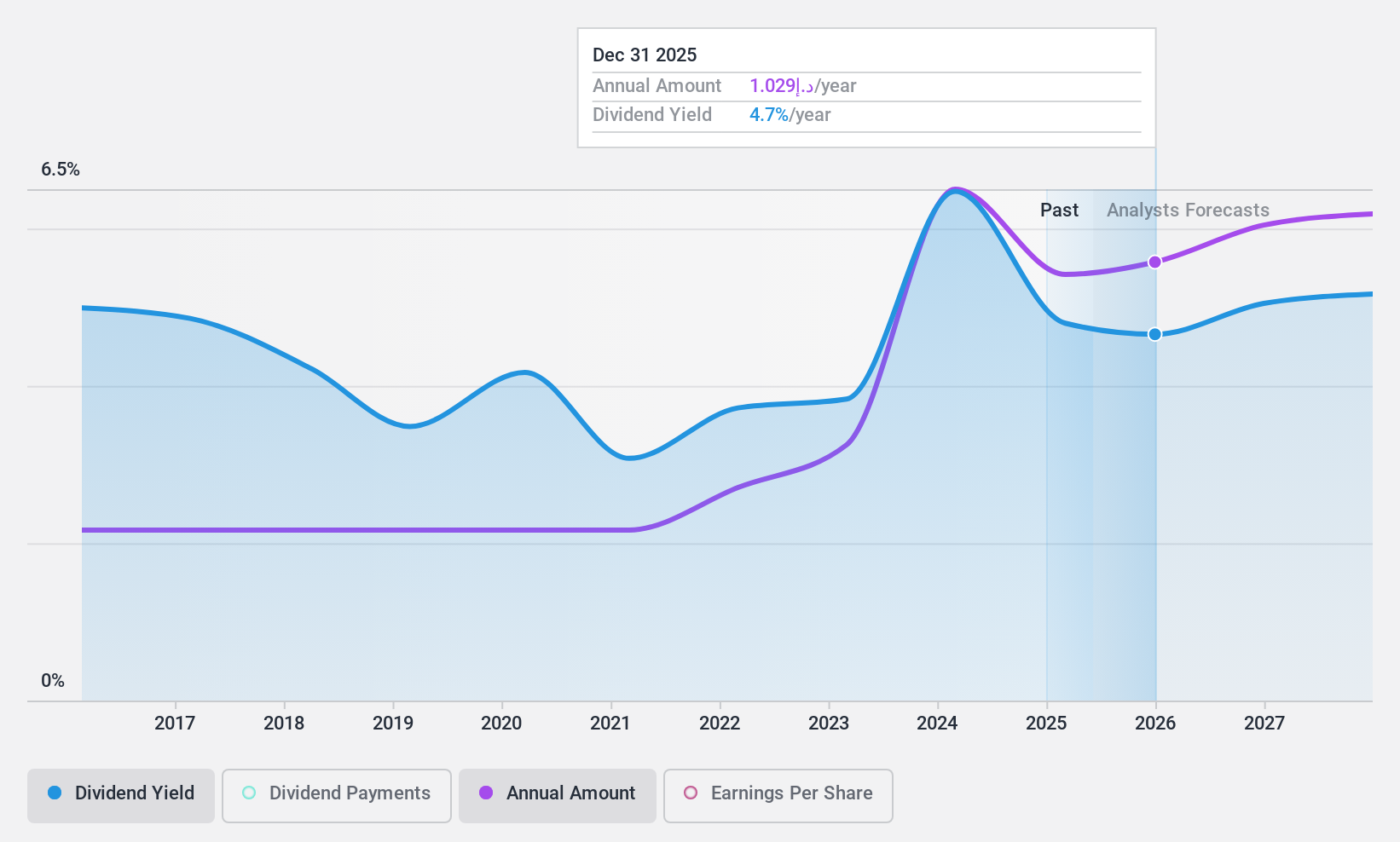

Dividend Yield: 4.6%

Emirates NBD Bank PJSC offers a reliable dividend yield of 4.61%, with payments well covered by earnings, reflected in a low payout ratio of 28.1%. Dividends have been stable and growing over the past decade. The bank's recent earnings report shows net income increased to AED 23 billion, supporting its capacity to maintain dividends. However, its dividend yield is lower than the top tier in the AE market, and it faces challenges with high bad loans at 3.3%.

- Dive into the specifics of Emirates NBD Bank PJSC here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Emirates NBD Bank PJSC is trading behind its estimated value.

Nacity Property Service GroupLtd (SHSE:603506)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nacity Property Service Group Co., Ltd. provides real estate property management services in China and has a market cap of approximately CN¥1.69 billion.

Operations: Nacity Property Service Group Co., Ltd. generates revenue through its real estate property management services in China.

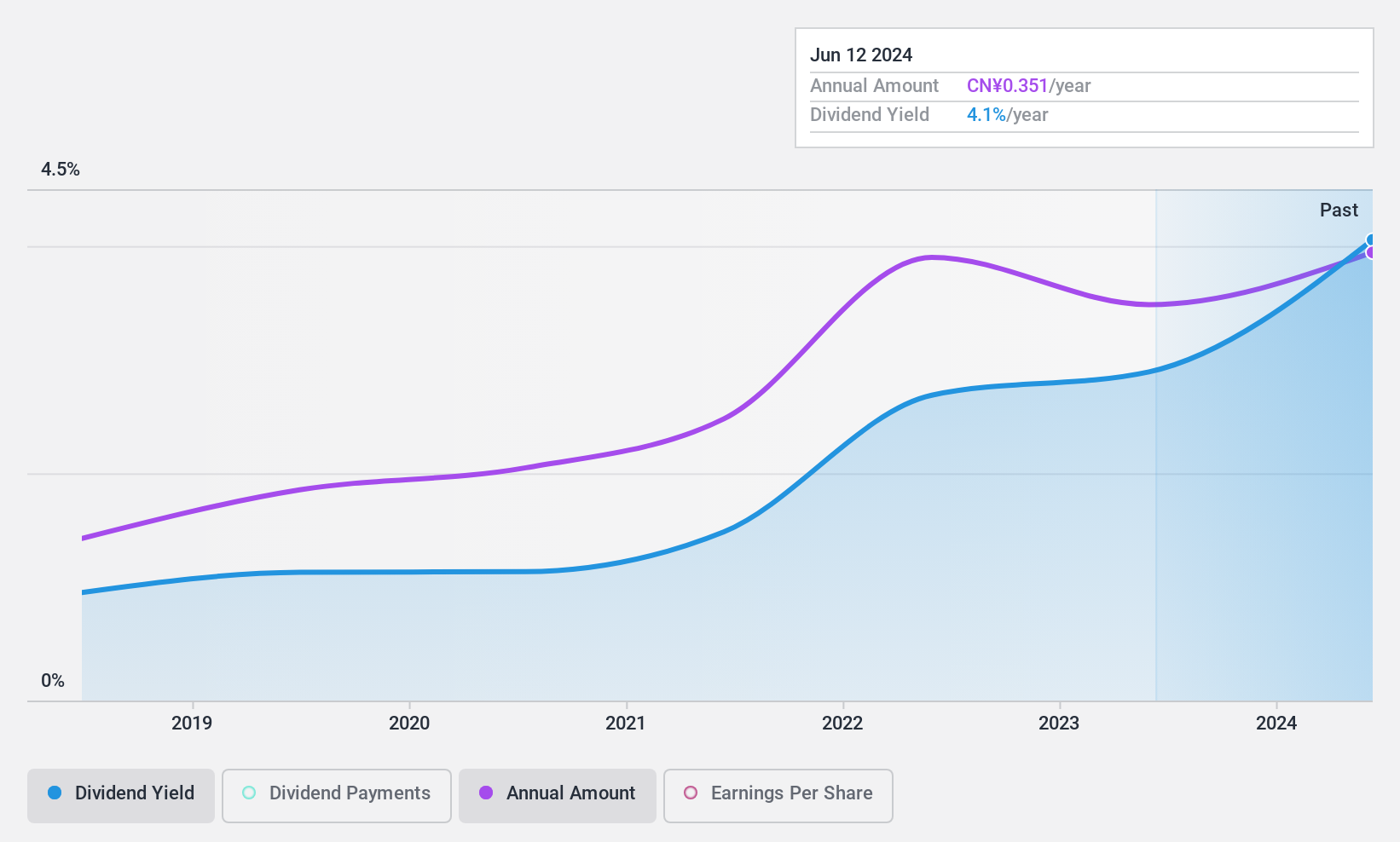

Dividend Yield: 3.8%

Nacity Property Service Group Ltd. offers a dividend yield of 3.84%, ranking in the top 25% within the CN market. Its dividends are well-covered by earnings and cash flows, with payout ratios of 50.2% and 51.6%, respectively, though it has only a seven-year history of payments. The company's price-to-earnings ratio is favorable at 12.9x compared to the market average, despite large one-off items affecting financial results recently.

- Unlock comprehensive insights into our analysis of Nacity Property Service GroupLtd stock in this dividend report.

- According our valuation report, there's an indication that Nacity Property Service GroupLtd's share price might be on the expensive side.

Yantai Zhenghai Biotechnology (SZSE:300653)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yantai Zhenghai Biotechnology Co., Ltd. focuses on the research, development, production, and marketing of regenerative medical materials in China with a market cap of CN¥3.70 billion.

Operations: Yantai Zhenghai Biotechnology Co., Ltd. generates revenue from the research, development, production, and sales of bio-renewable materials amounting to CN¥383.22 million.

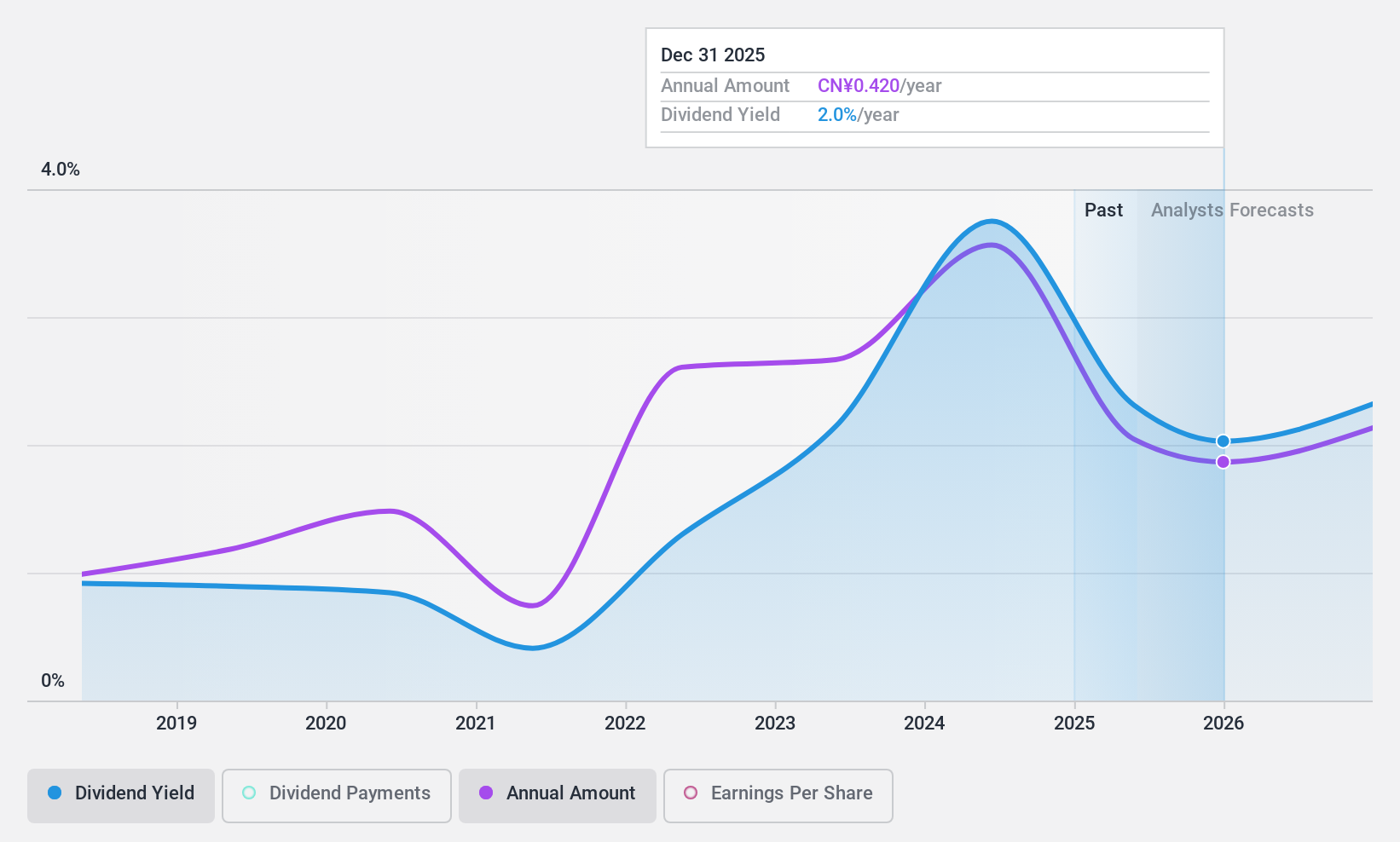

Dividend Yield: 3.9%

Yantai Zhenghai Biotechnology's dividend yield of 3.87% places it among the top 25% in the CN market, supported by earnings and cash flow coverage with payout ratios at 86.3% and 89%. Despite a favorable price-to-earnings ratio of 22x below the market average, its dividend history is unstable over seven years with volatility exceeding annual drops of 20%. Recent buybacks totaling CNY 49.92 million may indicate management's confidence despite being dropped from the S&P Global BMI Index.

- Get an in-depth perspective on Yantai Zhenghai Biotechnology's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Yantai Zhenghai Biotechnology is trading beyond its estimated value.

Turning Ideas Into Actions

- Explore the 1959 names from our Top Dividend Stocks screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Emirates NBD Bank PJSC, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Emirates NBD Bank PJSC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DFM:EMIRATESNBD

Emirates NBD Bank PJSC

Provides corporate, institutional, retail, treasury, and Islamic banking services.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives