- United Arab Emirates

- /

- Banks

- /

- DFM:AJMANBANK

Middle Eastern Opportunities: 3 Penny Stocks With Market Caps Over US$200M

Reviewed by Simply Wall St

Gulf markets have recently been subdued due to weak oil prices, which continue to weigh on the fiscal balances of oil-dependent nations in the region. Despite these challenges, there remain promising opportunities within the market for investors who are willing to explore beyond traditional large-cap stocks. Penny stocks, often perceived as relics of past trading days, still hold relevance today by offering potential growth at lower price points when backed by strong financials and fundamentals.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.34 | SAR1.33B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪2.913 | ₪208.85M | ✅ 2 ⚠️ 3 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.00 | AED2.06B | ✅ 3 ⚠️ 2 View Analysis > |

| Sharjah Insurance Company P.S.C (ADX:SICO) | AED1.49 | AED225M | ✅ 2 ⚠️ 2 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.50 | AED724.5M | ✅ 2 ⚠️ 3 View Analysis > |

| Arabian Pipes (SASE:2200) | SAR4.96 | SAR998M | ✅ 3 ⚠️ 0 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED2.95 | AED340.73M | ✅ 2 ⚠️ 5 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.45 | AED14.58B | ✅ 2 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.829 | AED504.85M | ✅ 2 ⚠️ 1 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.733 | ₪214.54M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 77 stocks from our Middle Eastern Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Ajman Bank PJSC (DFM:AJMANBANK)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ajman Bank PJSC offers a range of banking products and services to individuals, businesses, and government institutions in the United Arab Emirates, with a market cap of AED3.69 billion.

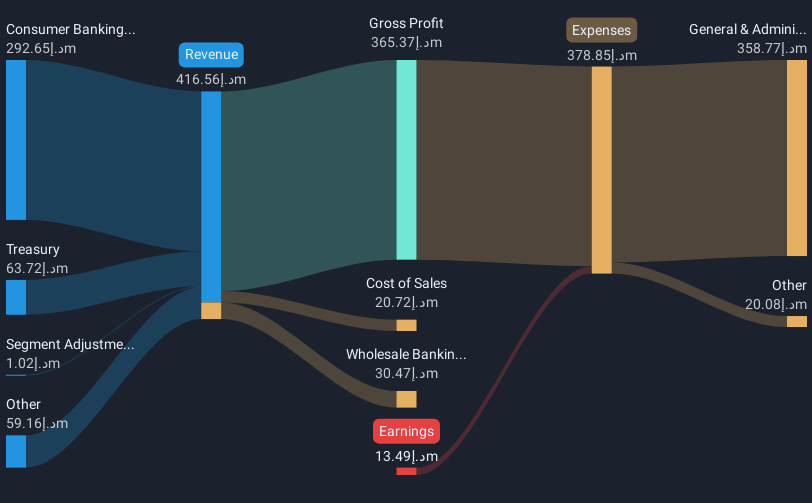

Operations: The company's revenue is primarily derived from its Treasury segment at AED184.52 million, Consumer Banking at AED279.19 million, and Wholesale Banking at AED447.74 million.

Market Cap: AED3.69B

Ajman Bank PJSC, with a market cap of AED3.69 billion, has shown profitability in the past year and reported improved net income for Q3 2025 at AED134.88 million, up from AED74 million the previous year. Despite a low Return on Equity of 14.6%, its Price-To-Earnings ratio of 7.5x suggests it is valued below the AE market average, potentially offering good value for investors interested in penny stocks. The bank's funding is primarily from customer deposits, considered low risk; however, it faces challenges with a high bad loans ratio of 8.9%.

- Get an in-depth perspective on Ajman Bank PJSC's performance by reading our balance sheet health report here.

- Understand Ajman Bank PJSC's track record by examining our performance history report.

Sanica Isi Sanayi (IBSE:SNICA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sanica Isi Sanayi A.S. is a Turkish company that manufactures and sells radiators, towel warmers, boilers, built-in reservoirs, control panels, and various pipes with a market capitalization of TRY2.50 billion.

Operations: The company generates revenue of TRY2.51 billion from its Building Products segment.

Market Cap: TRY2.5B

Sanica Isi Sanayi A.S., with a market cap of TRY2.50 billion, faces challenges as it remains unprofitable, reporting a net loss of TRY83.34 million in Q3 2025 despite increased sales to TRY942 million from the previous year. The company's earnings have declined by 44% annually over the past five years, and its negative Return on Equity reflects ongoing profitability issues. However, Sanica has reduced its debt significantly over five years and maintains a satisfactory net debt to equity ratio of 24.9%. Additionally, it boasts sufficient short-term assets to cover both short- and long-term liabilities while maintaining positive free cash flow growth.

- Click here and access our complete financial health analysis report to understand the dynamics of Sanica Isi Sanayi.

- Gain insights into Sanica Isi Sanayi's historical outcomes by reviewing our past performance report.

Novolog (Pharm-Up 1966) (TASE:NVLG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Novolog (Pharm-Up 1966) Ltd is a healthcare services provider operating in Israel with a market cap of ₪664.14 million.

Operations: No specific revenue segments are reported for this healthcare services provider operating in Israel.

Market Cap: ₪664.14M

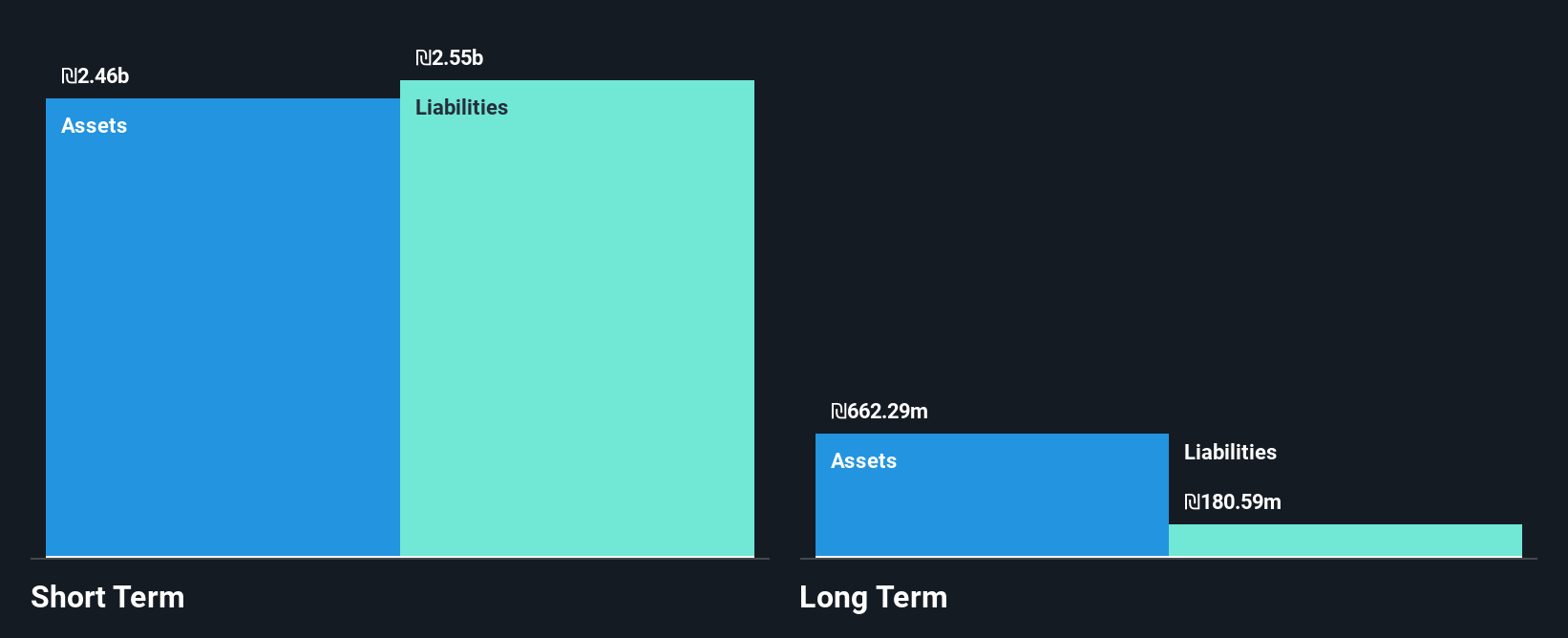

Novolog (Pharm-Up 1966) Ltd, with a market cap of ₪664.14 million, has recently turned profitable, although its earnings have declined by 27.6% annually over the past five years. The company's short-term assets of ₪2.4 billion do not fully cover its short-term liabilities of ₪2.5 billion but exceed long-term liabilities significantly at ₪170 million. Despite a low Return on Equity at 3.3%, Novolog's interest payments are well-covered by EBIT and cash flow covers debt effectively at 337%. Recent earnings reports show decreased sales and net income compared to last year, impacting profitability sustainability and dividend coverage.

- Click to explore a detailed breakdown of our findings in Novolog (Pharm-Up 1966)'s financial health report.

- Explore historical data to track Novolog (Pharm-Up 1966)'s performance over time in our past results report.

Where To Now?

- Click here to access our complete index of 77 Middle Eastern Penny Stocks.

- Curious About Other Options? AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DFM:AJMANBANK

Ajman Bank PJSC

Provides various banking products and services for individuals, businesses, and government institutions in the United Arab Emirates.

Adequate balance sheet with acceptable track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026