- United Arab Emirates

- /

- Banks

- /

- DFM:AJMANBANK

January 2025's Top Picks: Promising Penny Stocks

Reviewed by Simply Wall St

Global markets have been experiencing volatility, with U.S. equities facing pressure from inflation fears and political uncertainties, leading to a notable decline in small-cap stocks. In such a choppy market landscape, investors often seek opportunities that can offer growth potential despite broader economic challenges. Penny stocks, though an older term, remain relevant as they represent smaller or newer companies that may provide significant value when backed by strong financials. This article will explore several promising penny stocks that exhibit financial robustness and potential for long-term success amidst current market conditions.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Polar Capital Holdings (AIM:POLR) | £4.965 | £478.61M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| MGB Berhad (KLSE:MGB) | MYR0.75 | MYR443.74M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £1.976 | £744.58M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.83 | HK$526.87M | ★★★★★★ |

| T.A.C. Consumer (SET:TACC) | THB4.30 | THB2.58B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.565 | A$66.23M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR292.11M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.405 | £178.93M | ★★★★★☆ |

Click here to see the full list of 5,716 stocks from our Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Greenland Resources (DB:M0LY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Greenland Resources Inc. is a mining company focused on acquiring, exploring, and developing mineral projects in Greenland with a market cap of €75.37 million.

Operations: Currently, there are no reported revenue segments for this mining-focused entity.

Market Cap: €75.37M

Greenland Resources Inc. is a pre-revenue mining company with a market cap of €75.37 million, operating in Greenland. The company is debt-free and has no long-term liabilities, but it faces financial challenges with less than one year of cash runway and increasing losses over the past five years at an annual rate of 21.5%. Despite this, recent earnings reports show some improvement in net losses compared to the previous year. The board of directors has an average tenure of six years, indicating experienced governance; however, the management team's experience level remains unclear due to insufficient data.

- Jump into the full analysis health report here for a deeper understanding of Greenland Resources.

- Gain insights into Greenland Resources' past trends and performance with our report on the company's historical track record.

Ajman Bank PJSC (DFM:AJMANBANK)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ajman Bank PJSC offers a range of banking products and services in the United Arab Emirates, with a market capitalization of AED4.68 billion.

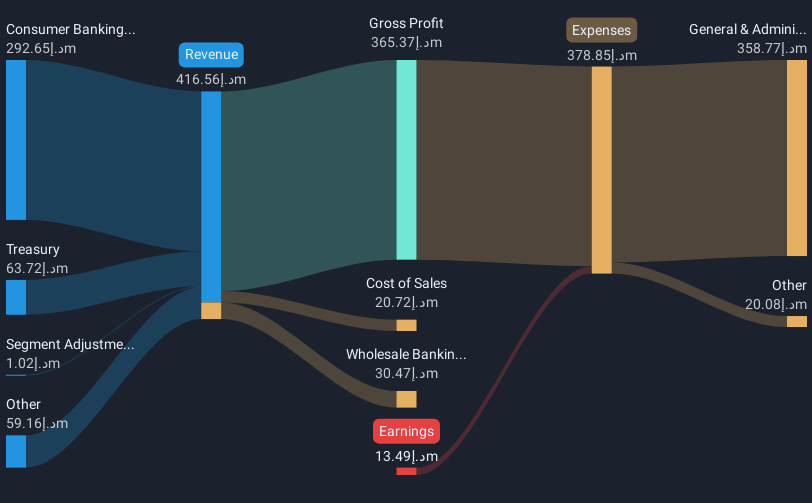

Operations: The company's revenue segments include Treasury with AED63.72 million, Consumer Banking contributing AED292.65 million, and Wholesale Banking at a loss of AED30.47 million.

Market Cap: AED4.68B

Ajman Bank PJSC, with a market cap of AED4.68 billion, is currently unprofitable, experiencing increased losses over the past five years at a rate of 39.6% annually. Despite this, recent earnings show improvement with net income of AED74 million in Q3 2024 compared to a net loss the previous year. The bank maintains an appropriate Loans to Assets ratio (55%) and primarily low-risk funding through customer deposits (95%). However, it faces challenges with high bad loans (11.2%) and a low allowance for these loans (39%). Management and board members are considered experienced with average tenures of two and 3.6 years respectively.

- Click to explore a detailed breakdown of our findings in Ajman Bank PJSC's financial health report.

- Review our historical performance report to gain insights into Ajman Bank PJSC's track record.

Yeebo (International Holdings) (SEHK:259)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Yeebo (International Holdings) Limited is an investment holding company involved in the manufacture and sale of liquid crystal display (LCD) and liquid crystal display module (LCM) products, with a market cap of HK$3.23 billion.

Operations: The company's revenue is primarily derived from its Displays and Other Services segment, totaling HK$949.16 million.

Market Cap: HK$3.23B

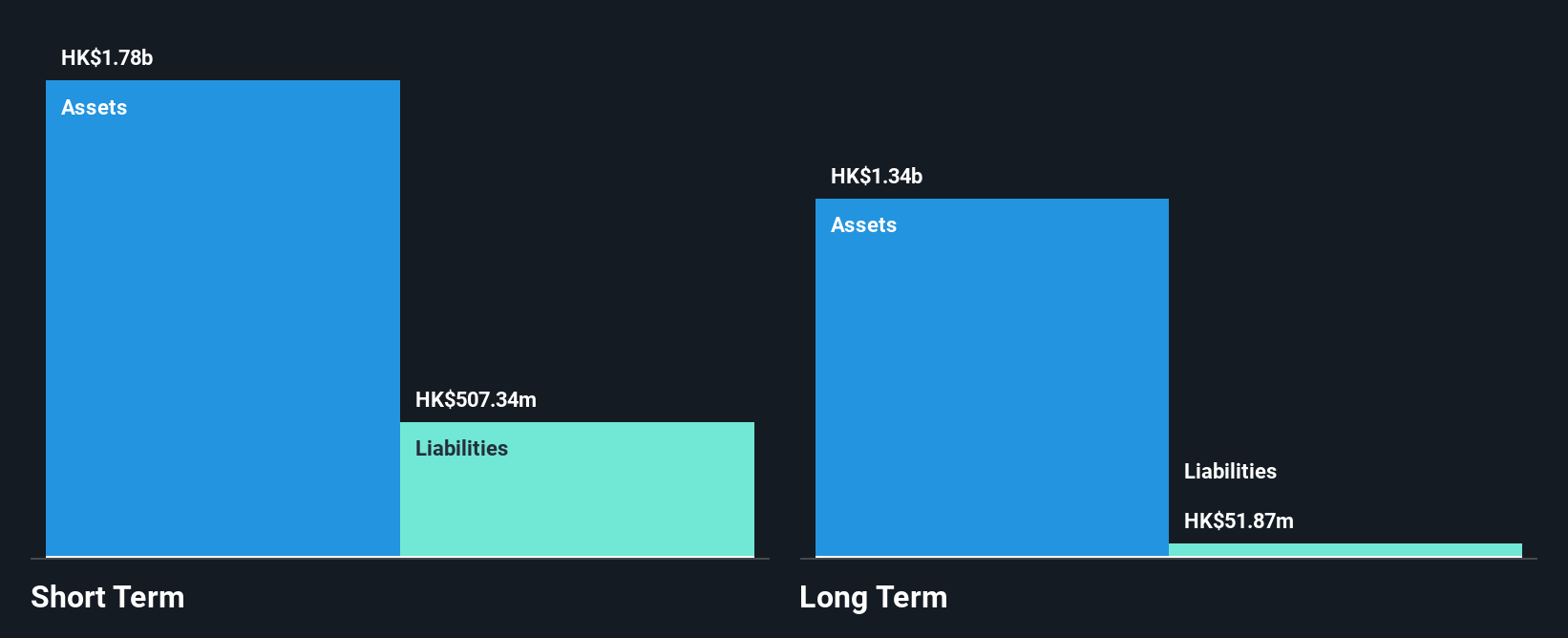

Yeebo (International Holdings) Limited, with a market cap of HK$3.23 billion, has seen mixed financial performance. The company's recent half-year sales increased to HK$527.31 million from HK$514.76 million the previous year, but net income declined to HK$88.91 million from HK$113.36 million. Despite having more cash than debt and strong coverage of interest payments, Yeebo's return on equity remains low at 6%. Short-term assets comfortably cover both short and long-term liabilities, indicating solid liquidity management. However, profit margins have decreased significantly from last year’s figures while earnings growth has been negative recently.

- Dive into the specifics of Yeebo (International Holdings) here with our thorough balance sheet health report.

- Assess Yeebo (International Holdings)'s previous results with our detailed historical performance reports.

Make It Happen

- Access the full spectrum of 5,716 Penny Stocks by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DFM:AJMANBANK

Ajman Bank PJSC

Provides various banking products and services in the United Arab Emirates.

Adequate balance sheet minimal.