- Turkey

- /

- Aerospace & Defense

- /

- IBSE:ALTNY

Ajman Bank PJSC And 2 Other Hidden Gems In The Middle East Market

Reviewed by Simply Wall St

The Middle East market is experiencing a mixed landscape, with Saudi Arabia's stock index slipping due to weaker corporate earnings, while Egypt's benchmark index hits new record highs amid economic optimism and declining inflation. In this dynamic environment, identifying stocks with strong fundamentals and growth potential can be crucial for navigating the shifting tides of regional markets.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Formula Systems (1985) | 33.74% | 8.44% | 11.96% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 1.94% | 16.33% | 21.26% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Besler Gida Ve Kimya Sanayi ve Ticaret Anonim Sirketi | 40.12% | 43.54% | 38.87% | ★★★★★★ |

| Etihad Atheeb Telecommunication | 1.05% | 36.24% | 62.23% | ★★★★★★ |

| Najran Cement | 14.20% | -2.87% | -22.60% | ★★★★★★ |

| C. Mer Industries | 109.27% | 13.77% | 72.47% | ★★★★★☆ |

| Alfa Solar Enerji Sanayi ve Ticaret | 38.29% | -32.50% | -4.61% | ★★★★★☆ |

| Rotshtein Realestate | 167.30% | 23.48% | 15.60% | ★★★★☆☆ |

| National Environmental Recycling | 69.43% | 43.47% | 32.77% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Ajman Bank PJSC (DFM:AJMANBANK)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Ajman Bank PJSC is a financial institution offering a range of banking products and services to individuals, businesses, and government entities in the United Arab Emirates with a market capitalization of AED4.01 billion.

Operations: Ajman Bank's revenue streams primarily include Treasury (AED139.57 million), Consumer Banking (AED302.69 million), and Wholesale Banking (AED395.46 million).

Ajman Bank PJSC, a smaller player in the Middle East financial scene, has shown resilience with total assets of AED26.6 billion and equity at AED3.2 billion. The bank’s deposits stand at AED20.8 billion against loans of AED14.8 billion, indicating a solid deposit base with 89% low-risk funding primarily from customer deposits. Despite becoming profitable recently, Ajman Bank faces challenges with a high non-performing loan ratio of 9.8%, coupled with a low bad loan allowance at 46%. Its P/E ratio is an attractive 9.3x compared to the broader AE market's 13.2x, suggesting potential undervaluation amidst its ongoing digital transformation efforts led by new fintech leadership.

- Unlock comprehensive insights into our analysis of Ajman Bank PJSC stock in this health report.

Evaluate Ajman Bank PJSC's historical performance by accessing our past performance report.

Altinay Savunma Teknolojileri Anonim Sirketi (IBSE:ALTNY)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Altinay Savunma Teknolojileri Anonim Sirketi specializes in motion control, unmanned systems, stealth technology, weaponry, and ammunition destruction and production systems with a market capitalization of TRY18.25 billion.

Operations: Altinay Savunma Teknolojileri Anonim Sirketi generates revenue primarily from its Defense Industry Systems segment, amounting to TRY1.96 billion. The company's financial performance is characterized by a focus on this core revenue stream, which plays a significant role in its overall market presence.

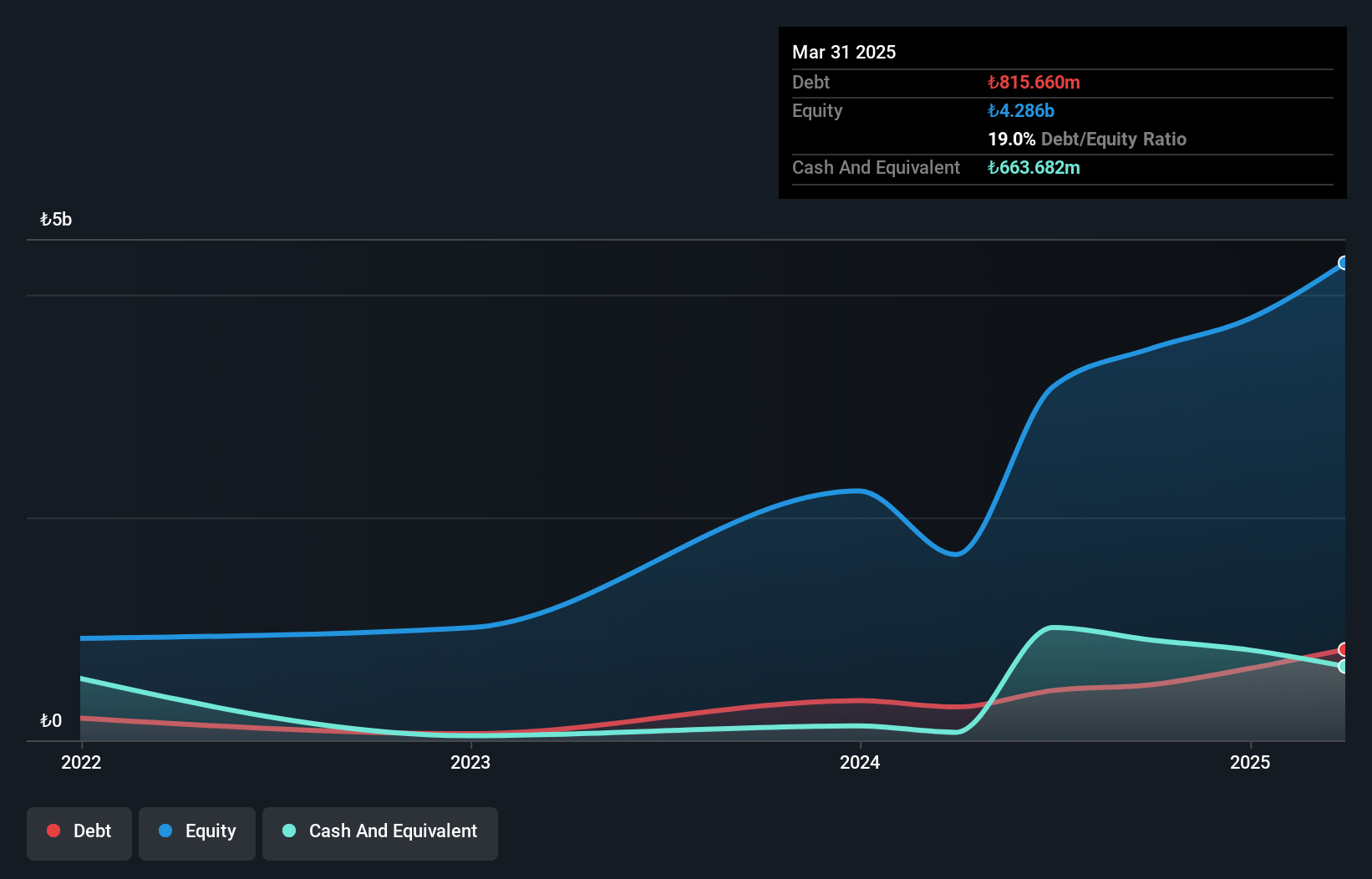

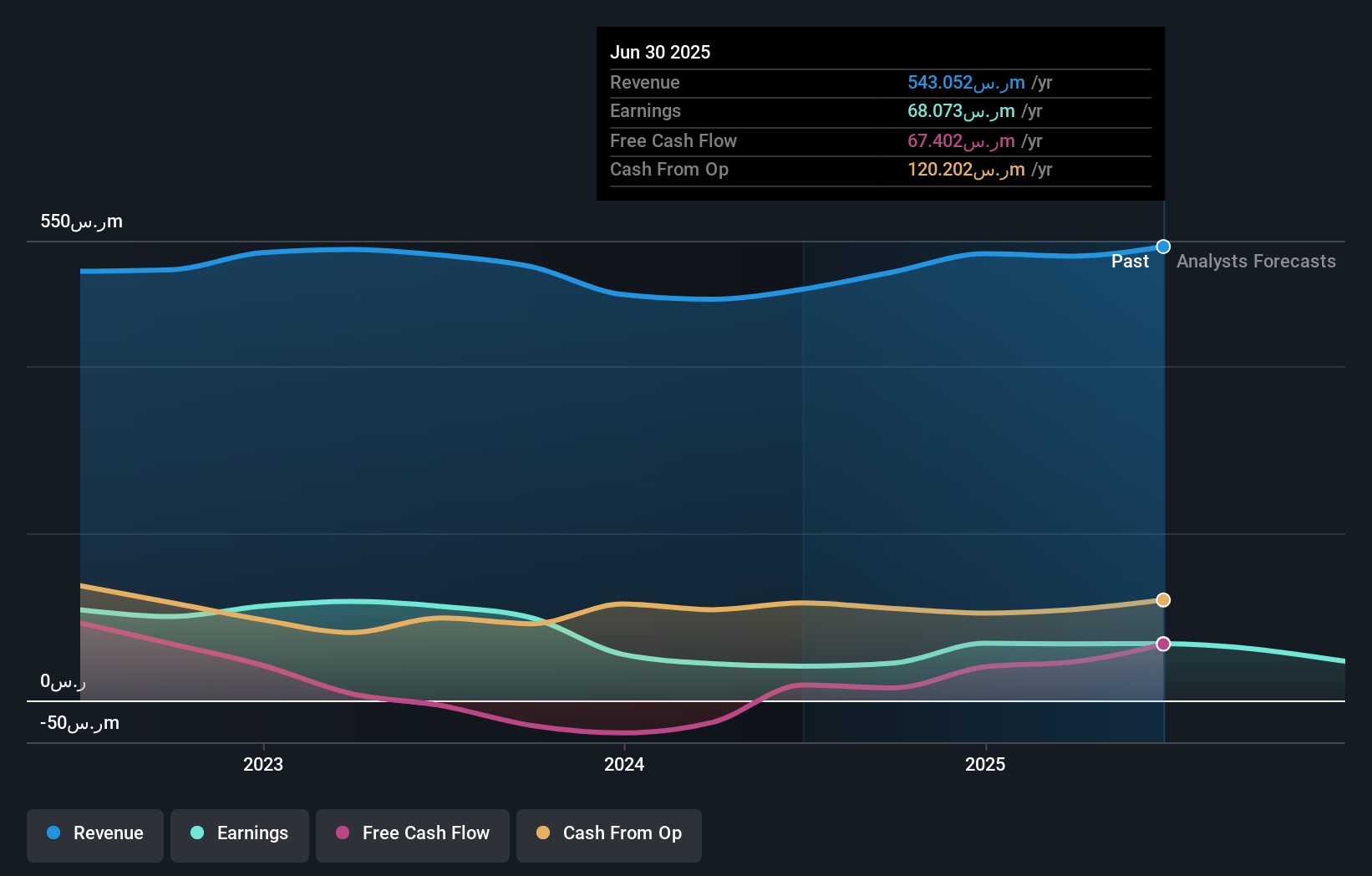

Altinay Savunma Teknolojileri Anonim Sirketi, a nimble player in the Aerospace & Defense sector, shows promising growth with earnings surging 86.7% over the past year, outpacing industry growth of 6.3%. Despite its volatile share price recently, its Price-To-Earnings ratio of 25.6x remains attractive compared to the industry average of 54.8x. The company reported TRY 637.41 million in sales for Q1 2025, significantly up from TRY 440.15 million a year ago, and turned around from a net loss to a net income of TRY 62.57 million this quarter while maintaining satisfactory debt levels at a net debt to equity ratio of just 3.5%.

Najran Cement (SASE:3002)

Simply Wall St Value Rating: ★★★★★★

Overview: Najran Cement Company is involved in the manufacture and sale of cement products within Saudi Arabia, with a market capitalization of SAR1.37 billion.

Operations: The company generates revenue primarily through its cement manufacturing operations, with sales amounting to SAR531.62 million.

Najran Cement, a notable player in the Middle East's cement industry, has been making strides with its financial management. The company recently secured an extension on a SAR 193 million long-term loan with Al Rajhi Bank, stretching the term to November 2031. This move reflects improved financial solvency, marked by a debt-to-asset ratio at a historic low of 9.3%. Despite earnings declining by an average of 22.6% annually over five years, recent performance shows promise with earnings growing by 53.6% last year and surpassing industry averages. Its net debt to equity stands at a satisfactory 13.2%, indicating prudent leverage management.

Summing It All Up

- Navigate through the entire inventory of 221 Middle Eastern Undiscovered Gems With Strong Fundamentals here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:ALTNY

Altinay Savunma Teknolojileri Anonim Sirketi

Provides products and solutions in the fields of motion control, unmanned, stealth, weapon, ammunition destruction, and production systems.

Adequate balance sheet and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)