- Saudi Arabia

- /

- Banks

- /

- SASE:1010

Middle Eastern Dividend Stocks Featuring National Bank of Ras Al-Khaimah (P.S.C.)

Reviewed by Simply Wall St

As Gulf markets experience mixed results amid fluctuating oil prices and potential U.S. interest rate cuts, investor sentiment in the Middle East remains cautiously optimistic despite challenges. In such an environment, dividend stocks like those from National Bank of Ras Al-Khaimah (P.S.C.) offer a compelling option for investors seeking stability and income, as they tend to provide consistent returns even during periods of market volatility.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Saudi Telecom (SASE:7010) | 9.41% | ★★★★★☆ |

| Saudi National Bank (SASE:1180) | 5.18% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 6.15% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.29% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) (DFM:NGI) | 7.09% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 6.31% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 7.33% | ★★★★★☆ |

| Delek Group (TASE:DLEKG) | 6.43% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 5.18% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 6.53% | ★★★★★☆ |

Click here to see the full list of 69 stocks from our Top Middle Eastern Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

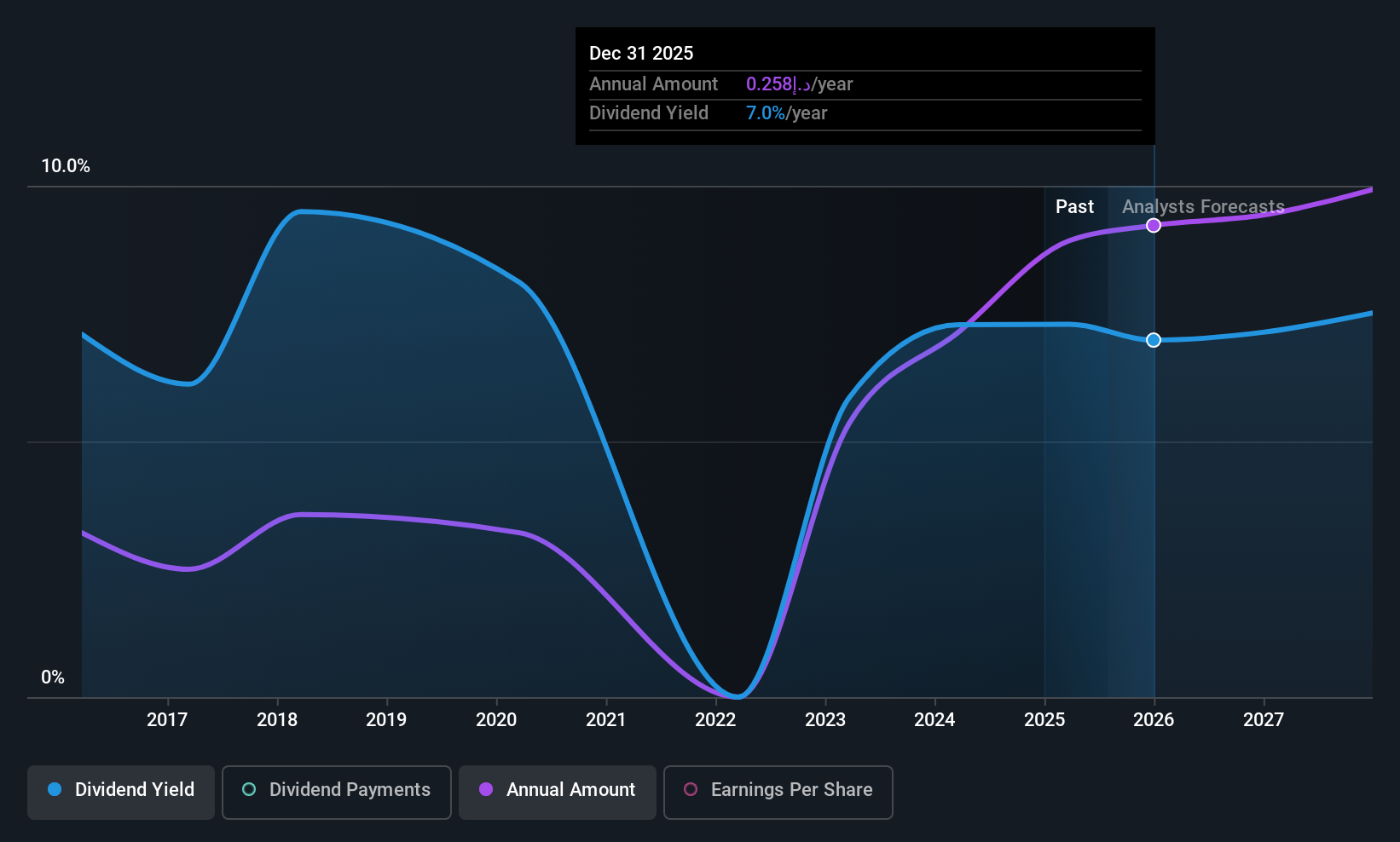

National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: The National Bank of Ras Al-Khaimah (P.S.C.) offers retail, Islamic, and commercial banking products and services in the UAE, with a market cap of AED15.93 billion.

Operations: The National Bank of Ras Al-Khaimah (P.S.C.) generates revenue from several segments, including Retail Banking (AED1.28 billion), Business Banking (AED1.88 billion), and Wholesale Banking (AED1.31 billion).

Dividend Yield: 6.3%

National Bank of Ras Al-Khaimah (P.S.C.) offers a dividend yield of 6.31%, placing it in the top 25% of AE market payers, with dividends currently covered by earnings at a 42.8% payout ratio. Despite earnings growth of 19.3% over the past year, future earnings are forecast to decline by an average of 4.9% annually over three years, potentially impacting dividend sustainability given its historically volatile payouts over the last decade. The stock trades at a favorable P/E ratio of 6.8x compared to the AE market's average of 12.4x, suggesting good relative value despite uncertainties regarding dividend reliability and growth prospects amidst fluctuating revenues and profits forecasts.

- Click here to discover the nuances of National Bank of Ras Al-Khaimah (P.S.C.) with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, National Bank of Ras Al-Khaimah (P.S.C.)'s share price might be too pessimistic.

Air Arabia PJSC (DFM:AIRARABIA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Air Arabia PJSC, along with its subsidiaries, offers air travel services and has a market cap of AED18.01 billion.

Operations: Air Arabia PJSC generates revenue primarily from its airline operations, amounting to AED6.49 billion.

Dividend Yield: 6.5%

Air Arabia PJSC's dividend yield of 6.48% ranks in the top 25% of AE market payers, with dividends covered by earnings and cash flows at payout ratios of 78.3% and 71.9%, respectively. Despite a decade-long increase in dividend payments, they have been volatile, raising concerns about reliability. The company's P/E ratio of 12.1x is slightly below the AE market average, indicating potential value amidst recent earnings growth challenges and revenue forecasts predicting continued growth.

- Take a closer look at Air Arabia PJSC's potential here in our dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Air Arabia PJSC shares in the market.

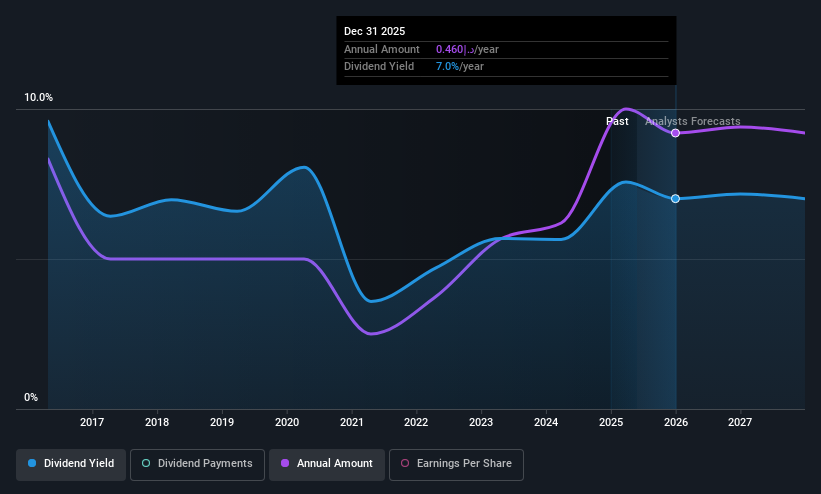

Riyad Bank (SASE:1010)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Riyad Bank offers banking and investment services in the Kingdom of Saudi Arabia, with a market capitalization of SAR83.40 billion.

Operations: Riyad Bank's revenue is primarily derived from its Corporate Banking segment at SAR8.56 billion, followed by Retail Banking at SAR4.24 billion, Treasury and Investments at SAR2.69 billion, and Investment Banking and Brokerage at SAR1.04 billion.

Dividend Yield: 6.3%

Riyad Bank's dividend yield of 6.29% places it in the top 25% of SA market payers, with a sustainable payout ratio of 54.8%. Despite past volatility in dividend payments, recent increases suggest potential stability. Trading at a P/E ratio of 8.7x, below the SA market average, it offers good relative value. Recent earnings growth and revenue forecasts indicate positive financial health, supporting future dividend coverage amidst an unstable historical track record.

- Navigate through the intricacies of Riyad Bank with our comprehensive dividend report here.

- The valuation report we've compiled suggests that Riyad Bank's current price could be quite moderate.

Summing It All Up

- Click this link to deep-dive into the 69 companies within our Top Middle Eastern Dividend Stocks screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:1010

Riyad Bank

Provides banking and investment services in the Kingdom of Saudi Arabia.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives