- United States

- /

- Auto

- /

- NYSE:XPEV

XPeng (NYSE:XPEV) Achieves Record Deliveries in 2025 Amid Global Expansion

Reviewed by Simply Wall St

XPeng (NYSE:XPEV) recently announced significant achievements, including the delivery of 34,611 Smart EVs in June 2025—a 224% year-over-year increase—and the launch of its flagship model, XPENG X9, in Indonesia, marking its expansion into over 40 countries. Despite these milestones, the company's stock faced a 5% decline over the last month. This is particularly interesting as broader markets, exemplified by the Nasdaq and S&P 500, saw gains. Factors such as positive market trends might have partly countered XPeng's decline, but the company's robust delivery performance and international expansion seem misaligned with its stock movement.

Buy, Hold or Sell XPeng? View our complete analysis and fair value estimate and you decide.

The recent milestones achieved by XPeng, including a significant year-over-year increase in Smart EV deliveries and the expansion into Indonesia, could positively influence the company’s long-term growth narrative. However, despite these developments, the company’s stock recorded a 5% decline in the past month, contrasting with broader market gains on the Nasdaq and S&P 500. This divergence may suggest that while operational achievements are evident, investors remain cautious due to potential short-term margin pressures from ongoing R&D and expansion investments.

Over the past year, XPeng's total return, including share price and dividends, was an impressive 139.32%. This remarkable performance highlights its strong recovery, although the company's stock price remains sensitive to market sentiment and economic conditions. The EV sector generally outperformed the market, with XPeng outperforming both the US Auto industry, which saw a 41.6% return, and the broader US Market, which returned 13.9% over the past year. Despite this outperformance, XPeng's current trading value above its consensus price target of US$19.91 suggests that market expectations might be optimistic.

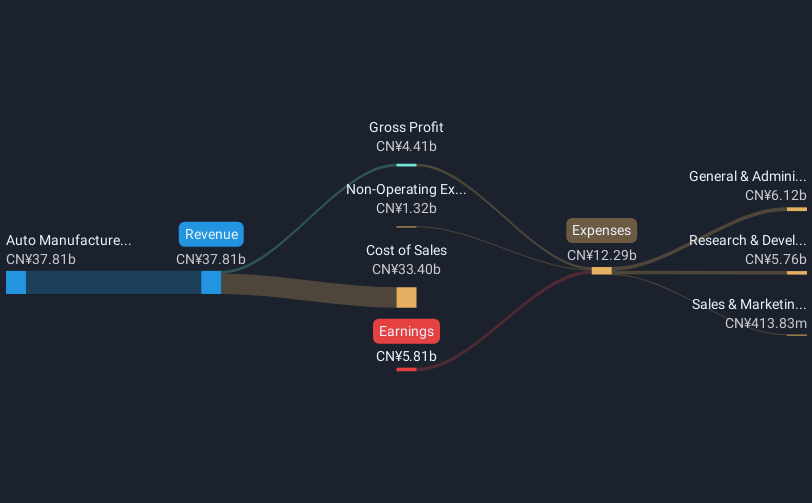

Subsequent revenue and earnings forecasts could see adjustments influenced by XPeng's international ventures and AI commitments. Analysts have assumed annual revenue growth of 24%, with earnings projected to improve as new technologies gain traction. However, these forecasts depend on XPeng managing costs and delivering on growth prospects amidst heightened competition and market expansion challenges. The current share price of US$22.64 supports an optimistic outlook, yet it exceeds the analyst price target by 13.7%, indicating disagreements among analysts and highlighting uncertainty in achieving projected milestones.

Our valuation report unveils the possibility XPeng's shares may be trading at a premium.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XPEV

XPeng

Designs, develops, manufactures, and markets smart electric vehicles (EVs) in the People’s Republic of China.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives