Would Shareholders Who Purchased Raiffeisen Bank International's(VIE:RBI) Stock Three Years Be Happy With The Share price Today?

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. We regret to report that long term Raiffeisen Bank International AG (VIE:RBI) shareholders have had that experience, with the share price dropping 42% in three years, versus a market decline of about 16%. The more recent news is of little comfort, with the share price down 27% in a year. More recently, the share price has dropped a further 8.5% in a month. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

See our latest analysis for Raiffeisen Bank International

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Although the share price is down over three years, Raiffeisen Bank International actually managed to grow EPS by 3.0% per year in that time. Given the share price reaction, one might suspect that EPS is not a good guide to the business performance during the period (perhaps due to a one-off loss or gain). Alternatively, growth expectations may have been unreasonable in the past.

After considering the numbers, we'd posit that the the market had higher expectations of EPS growth, three years back. Looking to other metrics might better explain the share price change.

Given the healthiness of the dividend payments, we doubt that they've concerned the market. It's good to see that Raiffeisen Bank International has increased its revenue over the last three years. If the company can keep growing revenue, there may be an opportunity for investors. You might have to dig deeper to understand the recent share price weakness.

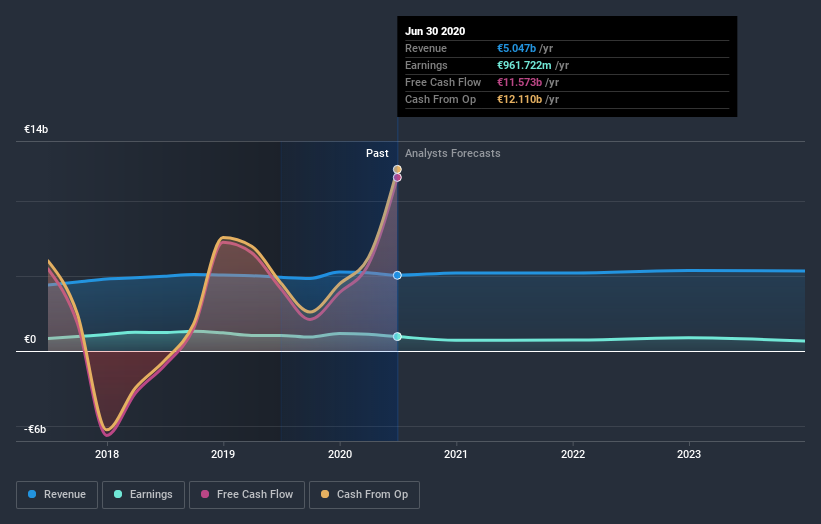

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Raiffeisen Bank International is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. If you are thinking of buying or selling Raiffeisen Bank International stock, you should check out this free report showing analyst consensus estimates for future profits.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Raiffeisen Bank International's TSR for the last 3 years was -38%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

While the broader market lost about 20% in the twelve months, Raiffeisen Bank International shareholders did even worse, losing 27% (even including dividends). Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. On the bright side, long term shareholders have made money, with a gain of 7.0% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It's always interesting to track share price performance over the longer term. But to understand Raiffeisen Bank International better, we need to consider many other factors. Case in point: We've spotted 1 warning sign for Raiffeisen Bank International you should be aware of.

Of course Raiffeisen Bank International may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AT exchanges.

If you decide to trade Raiffeisen Bank International, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About WBAG:RBI

Raiffeisen Bank International

Offers banking services to corporate, private, and institutional customers.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives