- Hong Kong

- /

- Real Estate

- /

- SEHK:1528

Why Red Star Macalline Group Corporation Ltd.'s (HKG:1528) CEO Pay Matters To You

Jianxing Che became the CEO of Red Star Macalline Group Corporation Ltd. (HKG:1528) in 2007. This analysis aims first to contrast CEO compensation with other companies that have similar market capitalization. After that, we will consider the growth in the business. And finally - as a second measure of performance - we will look at the returns shareholders have received over the last few years. This method should give us information to assess how appropriately the company pays the CEO.

See our latest analysis for Red Star Macalline Group

How Does Jianxing Che's Compensation Compare With Similar Sized Companies?

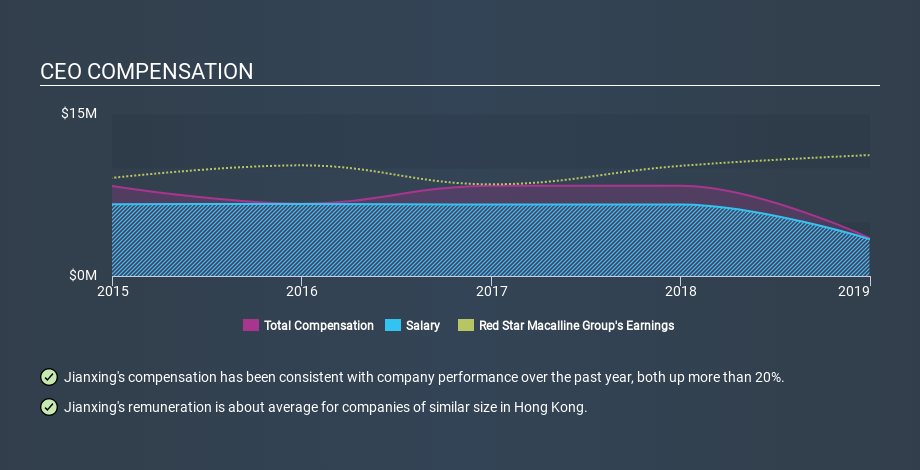

According to our data, Red Star Macalline Group Corporation Ltd. has a market capitalization of HK$42b, and paid its CEO total annual compensation worth CN¥3.5m over the year to December 2018. It is worth noting that the CEO compensation consists almost entirely of the salary, worth CN¥3.4m. When we examined a selection of companies with market caps ranging from CN¥28b to CN¥83b, we found the median CEO total compensation was CN¥4.3m.

So Jianxing Che is paid around the average of the companies we looked at. While this data point isn't particularly informative alone, it gains more meaning when considered with business performance.

You can see, below, how CEO compensation at Red Star Macalline Group has changed over time.

Is Red Star Macalline Group Corporation Ltd. Growing?

Over the last three years Red Star Macalline Group Corporation Ltd. has grown its earnings per share (EPS) by an average of 11% per year (using a line of best fit). It achieved revenue growth of 21% over the last year.

This shows that the company has improved itself over the last few years. Good news for shareholders. This sort of respectable year-on-year revenue growth is often seen at a healthy, growing business. It could be important to check this free visual depiction of what analysts expect for the future.

Has Red Star Macalline Group Corporation Ltd. Been A Good Investment?

Given the total loss of 14% over three years, many shareholders in Red Star Macalline Group Corporation Ltd. are probably rather dissatisfied, to say the least. So shareholders would probably think the company shouldn't be too generous with CEO compensation.

In Summary...

Jianxing Che is paid around the same as most CEOs of similar size companies.

We'd say the company can boast of its EPS growth, but we find the returns over the last three years to be lacking. We'd be surprised if shareholders want to see a pay rise for the CEO, but we'd stop short of calling their pay too generous. If you think CEO compensation levels are interesting you will probably really like this free visualization of insider trading at Red Star Macalline Group.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SEHK:1528

Fair value with moderate growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)