- India

- /

- Electronic Equipment and Components

- /

- NSEI:HONAUT

Why Honeywell Automation India's (NSE:HONAUT) CEO Pay Matters

This article will reflect on the compensation paid to Ashish Gaikwad who has served as CEO of Honeywell Automation India Limited (NSE:HONAUT) since 2016. This analysis will also assess whether Honeywell Automation India pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

Check out our latest analysis for Honeywell Automation India

How Does Total Compensation For Ashish Gaikwad Compare With Other Companies In The Industry?

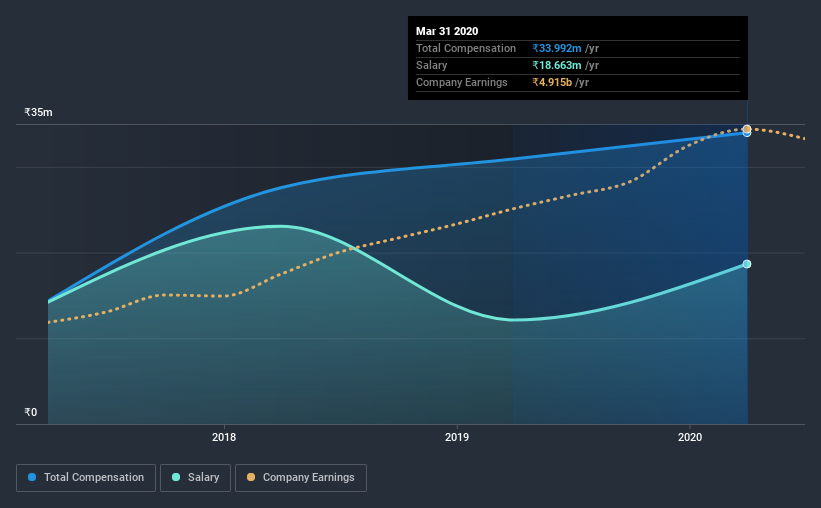

At the time of writing, our data shows that Honeywell Automation India Limited has a market capitalization of ₹288b, and reported total annual CEO compensation of ₹34m for the year to March 2020. Notably, that's an increase of 9.9% over the year before. In particular, the salary of ₹18.7m, makes up a huge portion of the total compensation being paid to the CEO.

On comparing similar companies from the same industry with market caps ranging from ₹147b to ₹471b, we found that the median CEO total compensation was ₹58m. In other words, Honeywell Automation India pays its CEO lower than the industry median. What's more, Ashish Gaikwad holds ₹6.5m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | ₹19m | ₹12m | 55% |

| Other | ₹15m | ₹19m | 45% |

| Total Compensation | ₹34m | ₹31m | 100% |

Speaking on an industry level, nearly 100% of total compensation represents salary, while the remainder of 0.4% is other remuneration. In Honeywell Automation India's case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Honeywell Automation India Limited's Growth

Honeywell Automation India Limited has seen its earnings per share (EPS) increase by 37% a year over the past three years. Its revenue is down 2.8% over the previous year.

This demonstrates that the company has been improving recently and is good news for the shareholders. While it would be good to see revenue growth, profits matter more in the end. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Honeywell Automation India Limited Been A Good Investment?

Most shareholders would probably be pleased with Honeywell Automation India Limited for providing a total return of 104% over three years. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

As we touched on above, Honeywell Automation India Limited is currently paying its CEO below the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. Considering robust EPS growth, we believe Ashish to be modestly paid. Given the strong history of shareholder returns, the shareholders are probably very happy with Ashish's performance.

So you may want to check if insiders are buying Honeywell Automation India shares with their own money (free access).

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you’re looking to trade Honeywell Automation India, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Honeywell Automation India, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Honeywell Automation India might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:HONAUT

Honeywell Automation India

Manufactures and sells industrial process control and automation system in India and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives