- United States

- /

- Renewable Energy

- /

- OTCPK:AZRE.F

What We Make Of Azure Power Global's (NYSE:AZRE) Returns On Capital

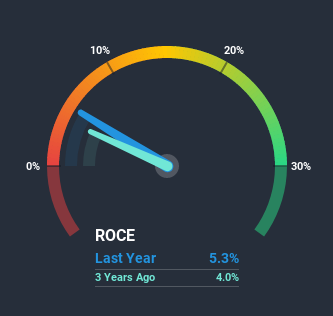

What trends should we look for it we want to identify stocks that can multiply in value over the long term? One common approach is to try and find a company with returns on capital employed (ROCE) that are increasing, in conjunction with a growing amount of capital employed. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. So on that note, Azure Power Global (NYSE:AZRE) looks quite promising in regards to its trends of return on capital.

Understanding Return On Capital Employed (ROCE)

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. Analysts use this formula to calculate it for Azure Power Global:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.053 = ₹6.5b ÷ (₹132b - ₹9.2b) (Based on the trailing twelve months to March 2020).

Thus, Azure Power Global has an ROCE of 5.3%. In absolute terms, that's a low return and it also under-performs the Renewable Energy industry average of 7.1%.

Check out our latest analysis for Azure Power Global

In the above chart we have a measured Azure Power Global's prior ROCE against its prior performance, but the future is arguably more important. If you're interested, you can view the analysts predictions in our free report on analyst forecasts for the company.

What Does the ROCE Trend For Azure Power Global Tell Us?

We're glad to see that ROCE is heading in the right direction, even if it is still low at the moment. Over the last five years, returns on capital employed have risen substantially to 5.3%. The company is effectively making more money per dollar of capital used, and it's worth noting that the amount of capital has increased too, by 657%. The increasing returns on a growing amount of capital is common amongst multi-baggers and that's why we're impressed.

On a related note, the company's ratio of current liabilities to total assets has decreased to 7.0%, which basically reduces it's funding from the likes of short-term creditors or suppliers. So shareholders would be pleased that the growth in returns has mostly come from underlying business performance.Our Take On Azure Power Global's ROCE

To sum it up, Azure Power Global has proven it can reinvest in the business and generate higher returns on that capital employed, which is terrific. Given the stock has declined 1.5% in the last three years, there could be a chance of a good investment here if the valuation makes sense. That being the case, research into the company's current valuation metrics and future prospects seems fitting.

Azure Power Global does have some risks, we noticed 2 warning signs (and 1 which shouldn't be ignored) we think you should know about.

While Azure Power Global may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

When trading Azure Power Global or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account.Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About OTCPK:AZRE.F

Azure Power Global

Operates as a renewable energy developer and independent renewable power producer in India.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)