- Malaysia

- /

- Oil and Gas

- /

- KLSE:FAST

What We Learned About Techfast Holdings Berhad's (KLSE:TECFAST) CEO Compensation

Yoon Yap became the CEO of Techfast Holdings Berhad (KLSE:TECFAST) in 2009, and we think it's a good time to look at the executive's compensation against the backdrop of overall company performance. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Techfast Holdings Berhad.

View our latest analysis for Techfast Holdings Berhad

Comparing Techfast Holdings Berhad's CEO Compensation With the industry

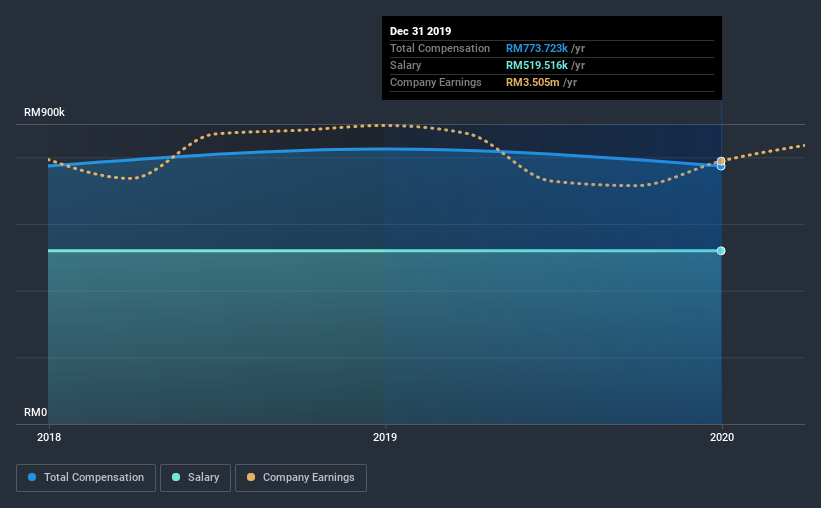

At the time of writing, our data shows that Techfast Holdings Berhad has a market capitalization of RM84m, and reported total annual CEO compensation of RM774k for the year to December 2019. That's a slight decrease of 6.2% on the prior year. We note that the salary portion, which stands at RM519.5k constitutes the majority of total compensation received by the CEO.

In comparison with other companies in the industry with market capitalizations under RM836m, the reported median total CEO compensation was RM412k. This suggests that Yoon Yap is paid more than the median for the industry. What's more, Yoon Yap holds RM15m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | RM520k | RM520k | 67% |

| Other | RM254k | RM306k | 33% |

| Total Compensation | RM774k | RM825k | 100% |

Speaking on an industry level, nearly 70% of total compensation represents salary, while the remainder of 30% is other remuneration. Although there is a difference in how total compensation is set, Techfast Holdings Berhad more or less reflects the market in terms of setting the salary. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Techfast Holdings Berhad's Growth Numbers

Earnings per share at Techfast Holdings Berhad are much the same as they were three years ago, albeit with slightly higher. Revenue was pretty flat on last year.

We're not particularly impressed by the revenue growth, but it is good to see modest EPS growth. So there are some positives here, but not enough to earn high praise. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Techfast Holdings Berhad Been A Good Investment?

With a three year total loss of 45% for the shareholders, Techfast Holdings Berhad would certainly have some dissatisfied shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

As we noted earlier, Techfast Holdings Berhad pays its CEO higher than the norm for similar-sized companies belonging to the same industry. The growth in the business has been uninspiring, but the shareholder returns for Techfast Holdings Berhad have arguably been worse, over the last three years. And the situation doesn't look all that good when you see Yoon is remunerated higher than the industry average. With such poor returns, we would understand if shareholders had concerns related to the CEO's pay.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 1 warning sign for Techfast Holdings Berhad that investors should think about before committing capital to this stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

When trading Techfast Holdings Berhad or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KLSE:FAST

Fast Energy Holdings Berhad

An investment holding company, engages in oil trading and bunkering services business in Malaysia.

Excellent balance sheet and good value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)