- Russia

- /

- Electric Utilities

- /

- MISX:MRKP

What Is Interregional Distribution Grid Company of Center and Volga Region's (MCX:MRKP) P/E Ratio After Its Share Price Tanked?

To the annoyance of some shareholders, Interregional Distribution Grid Company of Center and Volga Region (MCX:MRKP) shares are down a considerable 42% in the last month. That drop has capped off a tough year for shareholders, with the share price down 51% in that time.

Assuming nothing else has changed, a lower share price makes a stock more attractive to potential buyers. In the long term, share prices tend to follow earnings per share, but in the short term prices bounce around in response to short term factors (which are not always obvious). The implication here is that long term investors have an opportunity when expectations of a company are too low. Perhaps the simplest way to get a read on investors' expectations of a business is to look at its Price to Earnings Ratio (PE Ratio). Investors have optimistic expectations of companies with higher P/E ratios, compared to companies with lower P/E ratios.

See our latest analysis for Interregional Distribution Grid Company of Center and Volga Region

How Does Interregional Distribution Grid Company of Center and Volga Region's P/E Ratio Compare To Its Peers?

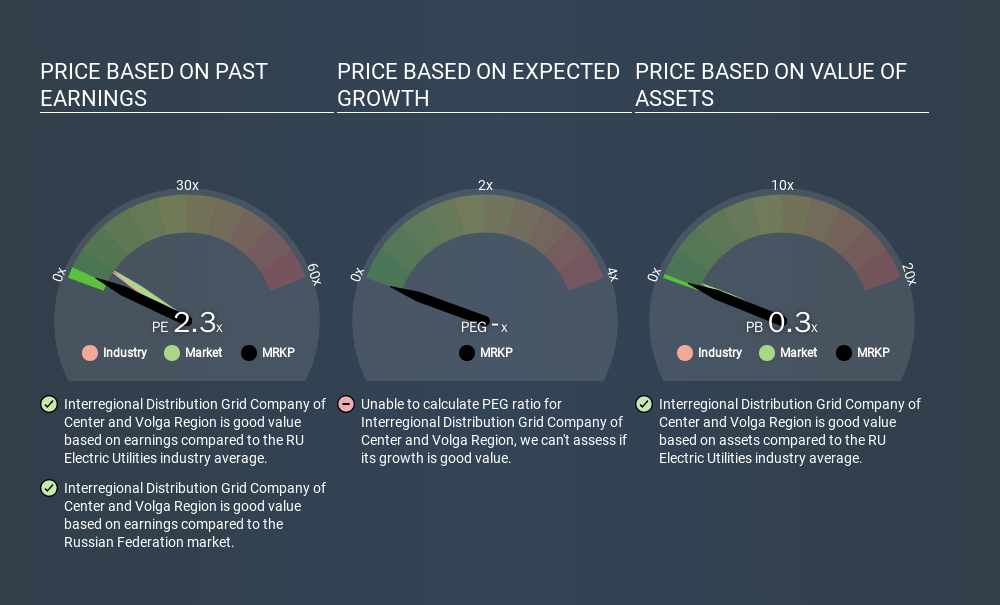

We can tell from its P/E ratio of 2.25 that sentiment around Interregional Distribution Grid Company of Center and Volga Region isn't particularly high. If you look at the image below, you can see Interregional Distribution Grid Company of Center and Volga Region has a lower P/E than the average (6.0) in the electric utilities industry classification.

This suggests that market participants think Interregional Distribution Grid Company of Center and Volga Region will underperform other companies in its industry. Many investors like to buy stocks when the market is pessimistic about their prospects. It is arguably worth checking if insiders are buying shares, because that might imply they believe the stock is undervalued.

How Growth Rates Impact P/E Ratios

Probably the most important factor in determining what P/E a company trades on is the earnings growth. If earnings are growing quickly, then the 'E' in the equation will increase faster than it would otherwise. Therefore, even if you pay a high multiple of earnings now, that multiple will become lower in the future. Then, a lower P/E should attract more buyers, pushing the share price up.

Interregional Distribution Grid Company of Center and Volga Region saw earnings per share decrease by 43% last year. But EPS is up 23% over the last 3 years.

Don't Forget: The P/E Does Not Account For Debt or Bank Deposits

Don't forget that the P/E ratio considers market capitalization. That means it doesn't take debt or cash into account. Hypothetically, a company could reduce its future P/E ratio by spending its cash (or taking on debt) to achieve higher earnings.

Spending on growth might be good or bad a few years later, but the point is that the P/E ratio does not account for the option (or lack thereof).

So What Does Interregional Distribution Grid Company of Center and Volga Region's Balance Sheet Tell Us?

Interregional Distribution Grid Company of Center and Volga Region's net debt is considerable, at 162% of its market cap. If you want to compare its P/E ratio to other companies, you must keep in mind that these debt levels would usually warrant a relatively low P/E.

The Bottom Line On Interregional Distribution Grid Company of Center and Volga Region's P/E Ratio

Interregional Distribution Grid Company of Center and Volga Region trades on a P/E ratio of 2.3, which is below the RU market average of 6.3. Given meaningful debt, and a lack of recent growth, the market looks to be extrapolating this recent performance; reflecting low expectations for the future. Given Interregional Distribution Grid Company of Center and Volga Region's P/E ratio has declined from 3.9 to 2.3 in the last month, we know for sure that the market is more worried about the business today, than it was back then. For those who prefer invest in growth, this stock apparently offers limited promise, but the deep value investors may find the pessimism around this stock enticing.

When the market is wrong about a stock, it gives savvy investors an opportunity. As value investor Benjamin Graham famously said, 'In the short run, the market is a voting machine but in the long run, it is a weighing machine. So this free visualization of the analyst consensus on future earnings could help you make the right decision about whether to buy, sell, or hold.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with modest (or no) debt, trading on a P/E below 20.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About MISX:MRKP

Rosseti Centre and Volga region

Public Joint stock company Rosseti Centre and Volga region, together with its subsidiaries, engages in the transmission and distribution of electricity in Russia.

Good value with adequate balance sheet and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)