- United States

- /

- Diversified Financial

- /

- NYSE:UWMC

UWM Holdings (UWMC) Shares Surge 46% Over Last Quarter

Reviewed by Simply Wall St

UWM Holdings (UWMC) recently declared strong Q2 2025 earnings with revenue rising to $759 million from $622 million and net income jumping to $23 million, amid a broader market upswing. This financial performance, combined with a dividend declaration of $0.10 per share, likely added positive sentiment, contributing to the stock's 46% price increase over the last quarter. While the broader market's upward trend included record highs for the S&P 500 and Nasdaq, UWM's solid earnings and positive guidance for Q3 appear to have reinforced investor confidence, aligning with overall market enthusiasm.

UWM Holdings has 2 weaknesses we think you should know about.

The recent earnings news from UWM Holdings, highlighting a substantial increase in revenue to US$759 million and net income to US$23 million, along with a dividend declaration, is likely to reinforce the company's growth narrative. These developments emphasize UWM's focus on leveraging AI and in-house servicing to drive efficiency and market share, supporting projections of operating margin expansion. However, with the current share price of approximately US$6.40 being slightly above the consensus analyst price target of US$5.78, this suggests potential market caution regarding future growth risks or valuation concerns.

Examining UWM Holdings' longer-term performance, its total shareholder return over the past three years was 116.38%. In contrast, over the past year, UWM underperformed the US Diversified Financial industry, which returned 12.1%. This discrepancy indicates challenges in recent performance compared to peers, potentially due to industry trends or company-specific factors.

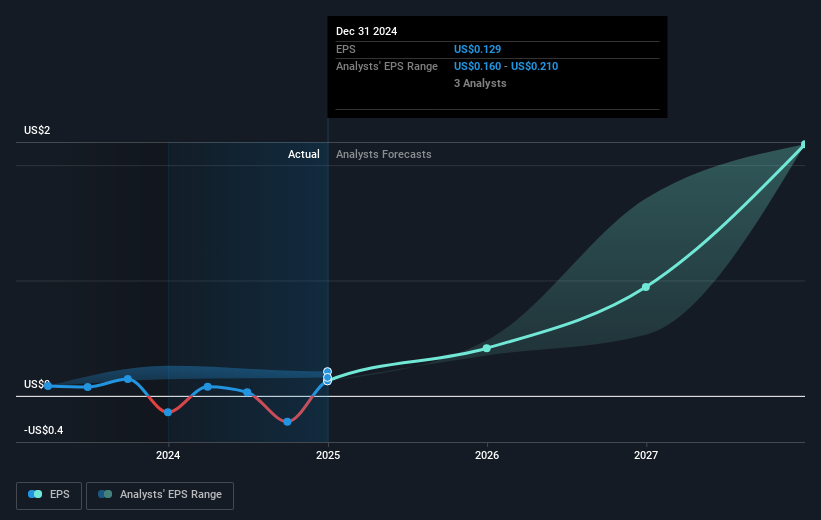

The positive Q2 2025 earnings report could positively influence future revenue and earnings forecasts, aligning with analysts' expectations of annual revenue growth at 13.2% and significant earnings growth. Yet, the price movement relative to the price target suggests investors might be questioning the sustainability of this growth or the risks involved. Overall, current market sentiment appears cautiously optimistic, with the latest financial results reinforcing UWM's strategic initiatives while highlighting the need for continued growth to justify its valuation.

Dive into the specifics of UWM Holdings here with our thorough balance sheet health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UWMC

UWM Holdings

Engages in the origination, sale, and servicing residential mortgage lending in the United States.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives