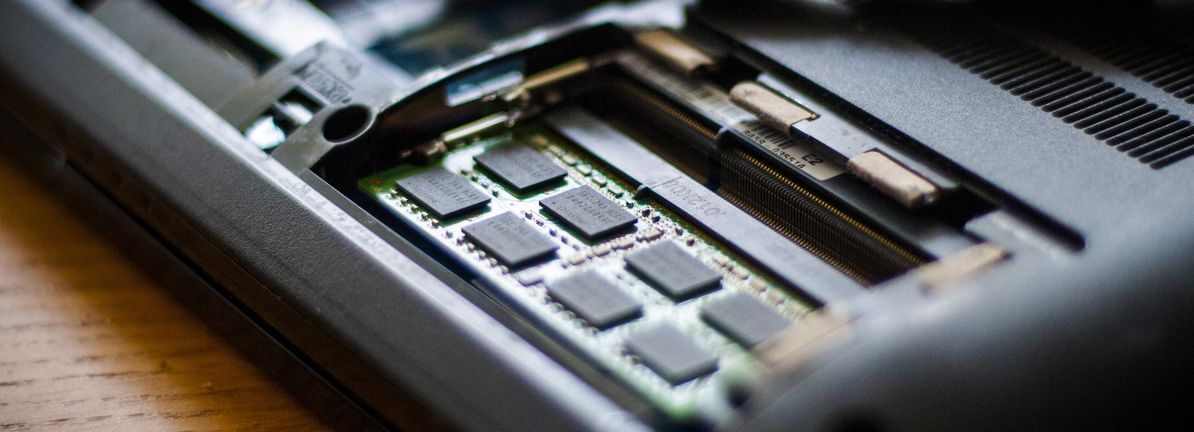

NasdaqGS:SIMOSemiconductor

Why Silicon Motion Technology (SIMO) Is Up 9.6% After Strong Q4 Results And Higher Q1 Guidance

In early February 2026, Silicon Motion Technology Corporation reported that fourth-quarter 2025 sales rose to US$278.46 million with net income of US$47.75 million, and issued first-quarter 2026 revenue guidance of US$292 million to US$306 million alongside an expected operating margin range and confirmation of its regular cash dividend.

These results and projections highlight continued year-over-year growth in both revenue and profitability, while the affirmed dividend policy underlines...