- United States

- /

- Consumer Finance

- /

- NasdaqGS:UPST

Upstart Holdings (NasdaqGS:UPST) Sees 10% Share Price Jump Over Last Week

Reviewed by Simply Wall St

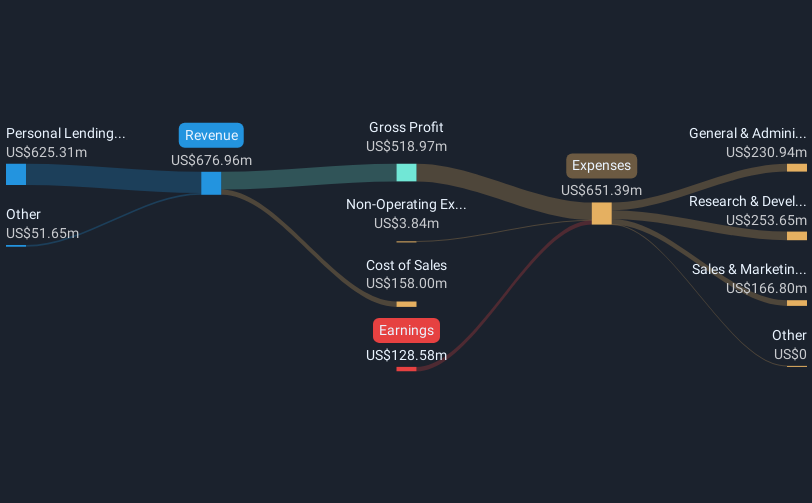

Upstart Holdings (NasdaqGS:UPST) experienced a notable 10% increase in share price over the past week. This rise aligns with the announcement of a partnership with All In Credit Union, aimed at expanding the company's personal loan offerings. The collaboration, which began earlier in the year, leverages technology to reach a broader consumer base. Despite the market remaining flat during the same period, this strategic move may have added positive momentum to Upstart Holdings' stock performance, reflecting investor optimism in its growth potential within a crowded fintech landscape.

Every company has risks, and we've spotted 2 weaknesses for Upstart Holdings you should know about.

The recent partnership between Upstart Holdings and All In Credit Union highlighted in the introduction could potentially enhance the company's personal loan offerings, contributing to improved loan approval rates and reduced default risks. This development may align with Upstart's narrative of boosting revenue through technological advancements in underwriting and reduced default rates, giving a positive outlook for future earnings growth.

Over the past year, Upstart Holdings saw a significant total shareholder return of 91.22%. This longer-term perspective contrasts with the company's performance relative to the broader market, where it exceeded the US Consumer Finance industry's return of 26.7% in the same period. These figures suggest a strong position for Upstart Holdings within its industry.

The impact of this news on Upstart's revenue and earnings forecasts could be substantial, potentially supporting its HELOC expansion and personalization efforts, thus enhancing profitability. As the company advances in these areas, the current share price of US$49.19 remains below the consensus analyst price target of US$73.92, representing a potential upside of 33.5%. However, investors must continuously reassess these projections against their own expectations and the company's performance dynamics.

Our valuation report here indicates Upstart Holdings may be overvalued.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UPST

Upstart Holdings

Operates a cloud-based artificial intelligence (AI) lending platform in the United States.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives