- United States

- /

- Transportation

- /

- NYSE:NSC

Union Pacific To Acquire Norfolk Southern (NSC) For US$71 Billion In Rail Mega-Merger

Reviewed by Simply Wall St

Norfolk Southern (NSC) saw its stock price increase by 28% over the last quarter, driven by significant corporate developments. Key among these was the announcement of its acquisition by Union Pacific at a valuation of $71.4 billion, a landmark move in the rail industry. The company's robust Q2 earnings, with net income rising to $768 million, complemented the merger news, reinforcing investor confidence. In contrast to the broader market's more modest rise of 1.5% over the past seven days, these events likely added significant weight to the broader positive sentiment toward the company's stock performance.

We've identified 1 warning sign for Norfolk Southern that you should be aware of.

The recent acquisition announcement of Norfolk Southern by Union Pacific at a valuation of US$71.4 billion has significantly influenced the company's narrative. This development could potentially accelerate Norfolk Southern's PSR 2.0 transformation, enhancing operational efficiency and cost savings. In terms of market performance, Norfolk Southern's shares have appreciated 66.77% over the past five years, showcasing substantial long-term returns. However, over the past year, it has outperformed the US Transportation industry's return of 11% but underperformed the broader US market return of 17.3%.

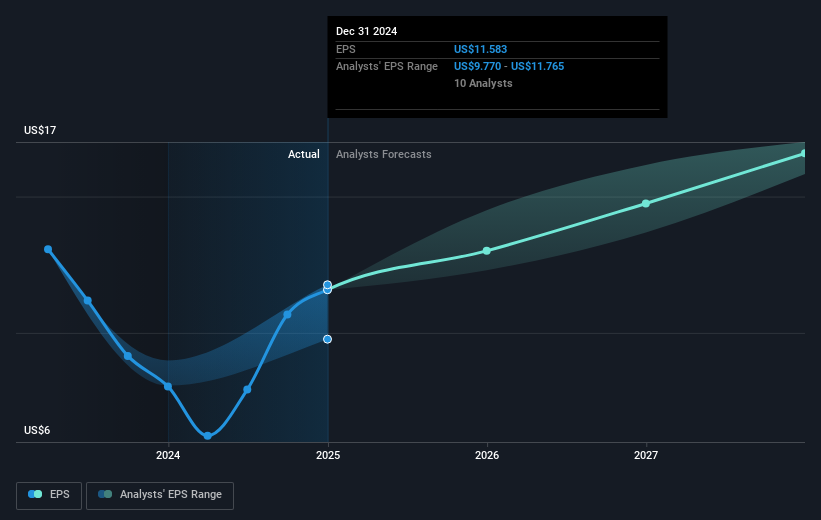

Although short-term fluctuations have been positive, the current share price of US$286.42 is slightly above the consensus price target of approximately US$283.22, suggesting a 1.12% premium, which might imply an overvaluation according to analysts. The merger announcement and robust earnings have bolstered investor sentiment, potentially impacting revenue and earnings forecasts positively. However, analysts remain conservative in their future assumptions, possibly cautioning against overoptimistic projections amidst potential operational challenges and economic uncertainties.

Assess Norfolk Southern's future earnings estimates with our detailed growth reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Norfolk Southern might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NSC

Norfolk Southern

Engages in the rail transportation of raw materials, intermediate products, and finished goods in the United States.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives