- United Kingdom

- /

- Commercial Services

- /

- LSE:MTO

UK's September 2025 Stock Selections Estimated Below Intrinsic Value

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines amid weak trade data from China, highlighting concerns about global economic recovery. In such a fluctuating environment, identifying stocks that are estimated to be undervalued can offer potential opportunities for investors seeking to navigate these uncertain conditions.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Mincon Group (AIM:MCON) | £0.41 | £0.78 | 47.1% |

| Likewise Group (AIM:LIKE) | £0.28 | £0.53 | 47% |

| Kromek Group (AIM:KMK) | £0.049 | £0.091 | 46% |

| Hollywood Bowl Group (LSE:BOWL) | £2.49 | £4.81 | 48.2% |

| Gym Group (LSE:GYM) | £1.484 | £2.75 | 46% |

| Gooch & Housego (AIM:GHH) | £5.44 | £10.77 | 49.5% |

| Gateley (Holdings) (AIM:GTLY) | £1.295 | £2.57 | 49.7% |

| Burberry Group (LSE:BRBY) | £11.395 | £21.34 | 46.6% |

| Begbies Traynor Group (AIM:BEG) | £1.19 | £2.22 | 46.5% |

| AstraZeneca (LSE:AZN) | £119.56 | £223.12 | 46.4% |

Let's dive into some prime choices out of the screener.

Fevertree Drinks (AIM:FEVR)

Overview: Fevertree Drinks PLC, along with its subsidiaries, develops and sells mixer drinks across the United Kingdom, the United States, Europe, and internationally with a market cap of £1.03 billion.

Operations: Fevertree Drinks PLC generates revenue through the development and sale of mixer drinks across various regions, including the United Kingdom, the United States, Europe, and other international markets.

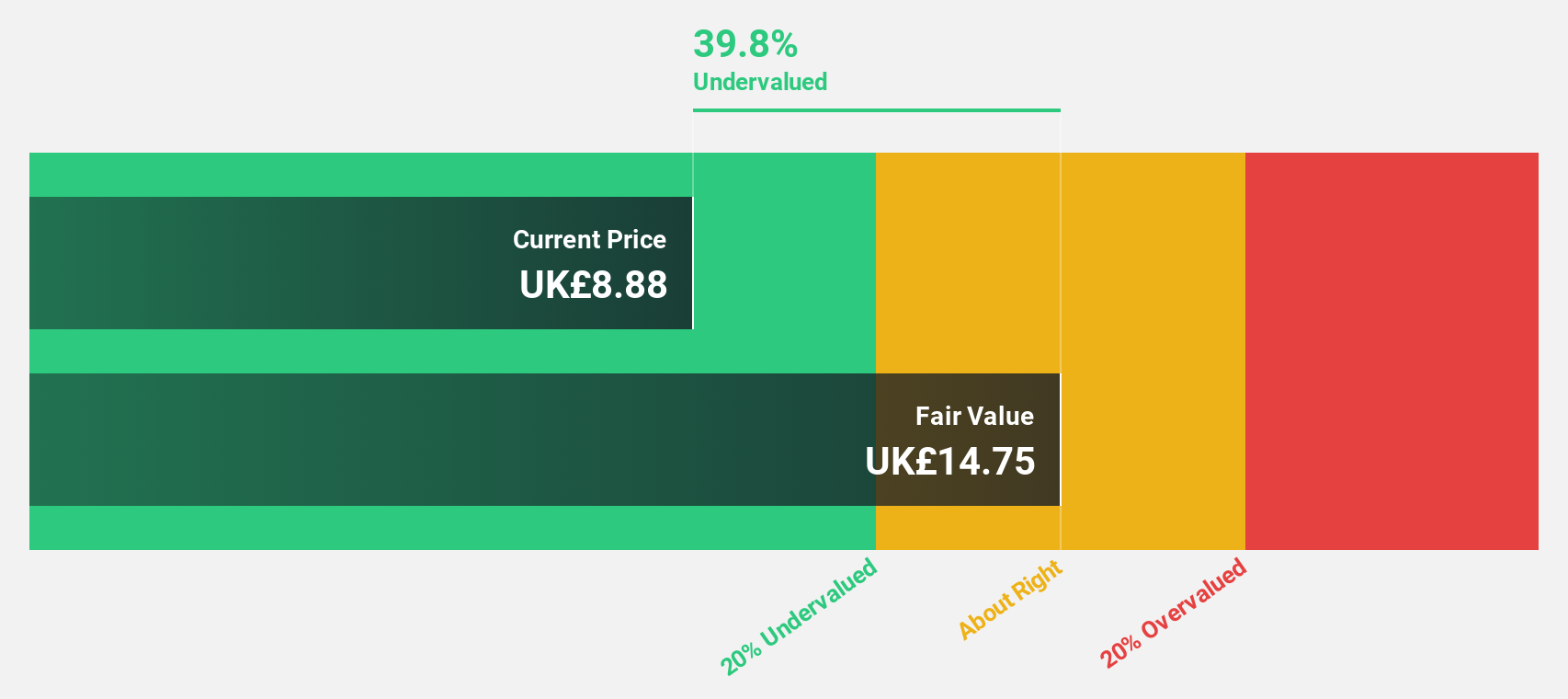

Estimated Discount To Fair Value: 38.8%

Fevertree Drinks is trading at £8.72, significantly below its estimated fair value of £14.25, suggesting it may be undervalued based on cash flows. Despite a drop in sales to £144.3 million for H1 2025 from the previous year's £172.9 million, net income rose to £8.4 million from £7.6 million, reflecting strong earnings growth potential forecasted at 21.7% annually over the next three years, outpacing UK market expectations.

- According our earnings growth report, there's an indication that Fevertree Drinks might be ready to expand.

- Click to explore a detailed breakdown of our findings in Fevertree Drinks' balance sheet health report.

Pan African Resources (AIM:PAF)

Overview: Pan African Resources PLC is involved in the mining, extraction, production, and sale of gold in South Africa and has a market capitalization of approximately £1.55 billion.

Operations: Pan African Resources PLC generates revenue from its activities in gold mining, extraction, production, and sales within South Africa.

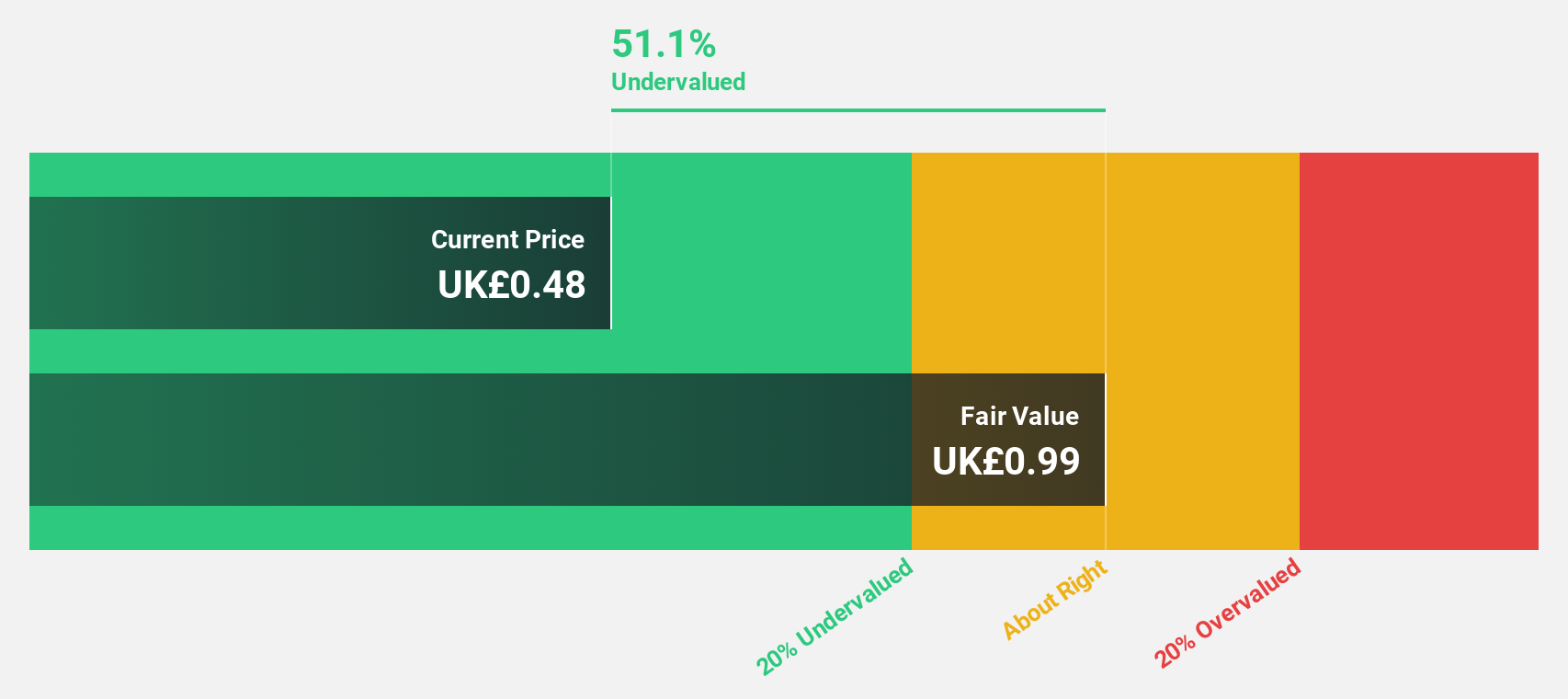

Estimated Discount To Fair Value: 44.6%

Pan African Resources, trading at £0.76, appears undervalued with a fair value estimate of £1.38, reflecting strong cash flow potential. Recent earnings reported a significant rise in net income to US$141.6 million from US$79.38 million last year. The company forecasts robust annual earnings growth of 41.3%, surpassing UK market expectations and supported by a share repurchase program aimed at enhancing shareholder value amidst high non-cash earnings levels and limited insider selling activity recently noted.

- Our comprehensive growth report raises the possibility that Pan African Resources is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of Pan African Resources.

Mitie Group (LSE:MTO)

Overview: Mitie Group plc, along with its subsidiaries, offers facilities management and professional services in the UK and internationally, with a market cap of approximately £1.90 billion.

Operations: Mitie Group's revenue is primarily derived from Business Services (£2.24 billion), Technical Services (£1.98 billion), and Communities (£869.80 million).

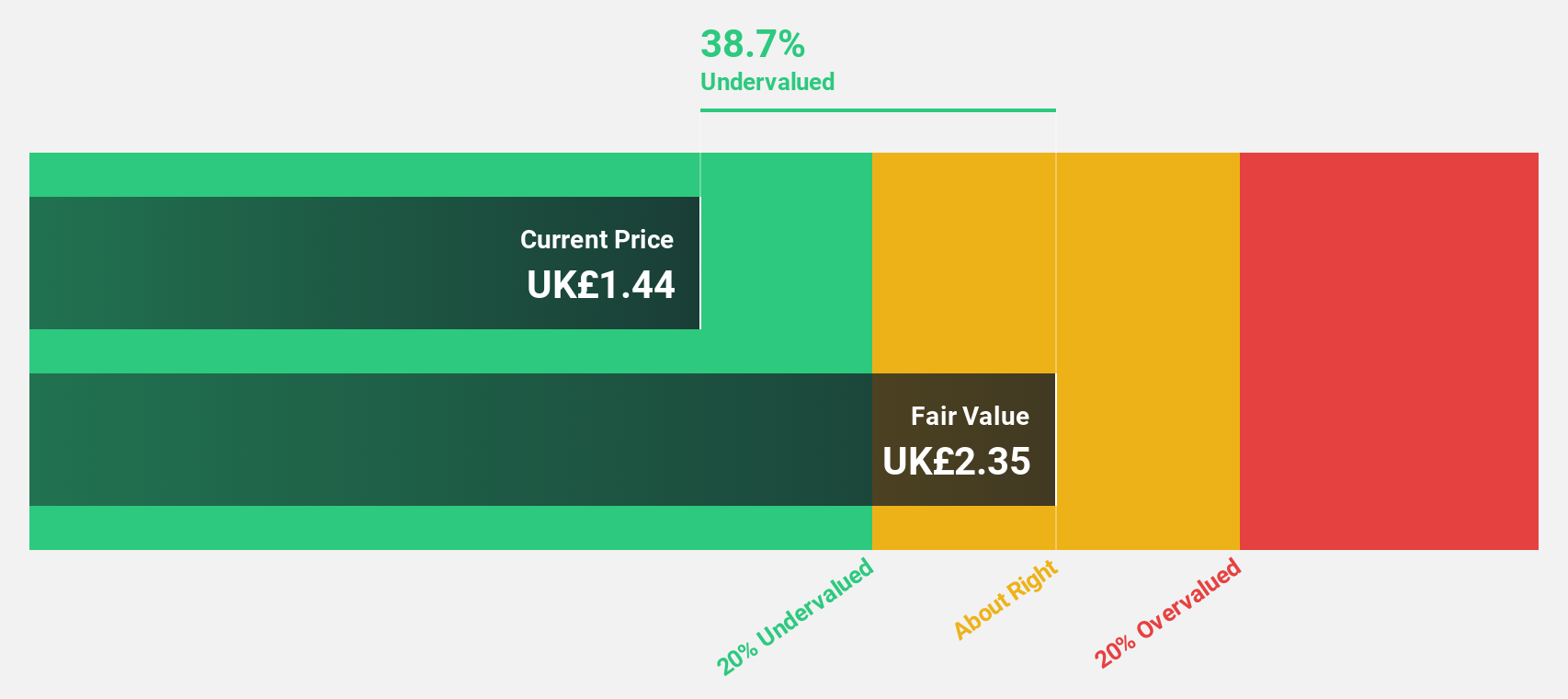

Estimated Discount To Fair Value: 45.3%

Mitie Group, trading at £1.45, is undervalued with a fair value estimate of £2.65, supported by strong cash flow potential and significant expected earnings growth of over 20% annually. Analysts agree on a 20.3% price increase target despite an unstable dividend track record and recent board changes. Revenue is projected to grow faster than the UK market at 6% per year, indicating robust financial health amidst evolving corporate governance dynamics.

- Our expertly prepared growth report on Mitie Group implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Mitie Group.

Make It Happen

- Click here to access our complete index of 49 Undervalued UK Stocks Based On Cash Flows.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:MTO

Mitie Group

Provides facilities management and professional services in the United Kingdom and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives