- United Kingdom

- /

- Pharma

- /

- AIM:FUM

UK Penny Stocks Spotlight: Futura Medical Among 3 Promising Picks

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China, highlighting global economic interdependencies. In such a fluctuating market, identifying stocks with strong fundamentals becomes crucial for investors seeking opportunities. Penny stocks, though an older term, continue to represent potential growth avenues by focusing on smaller or newer companies that are often overlooked but can offer significant value when backed by solid financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| FRP Advisory Group (AIM:FRP) | £1.235 | £306.34M | ✅ 5 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £4.275 | £345.37M | ✅ 4 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.42 | £45.44M | ✅ 5 ⚠️ 2 View Analysis > |

| System1 Group (AIM:SYS1) | £4.05 | £51.39M | ✅ 3 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £3.10 | £319.19M | ✅ 4 ⚠️ 1 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.40 | £122.27M | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.20 | £191.44M | ✅ 4 ⚠️ 1 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.805 | £11.08M | ✅ 3 ⚠️ 4 View Analysis > |

| Braemar (LSE:BMS) | £2.12 | £65.5M | ✅ 3 ⚠️ 4 View Analysis > |

| ME Group International (LSE:MEGP) | £2.21 | £834.33M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 296 stocks from our UK Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Futura Medical (AIM:FUM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Futura Medical plc researches, develops, and sells pharmaceutical and healthcare products focused on sexual health, with a market cap of £34.64 million.

Operations: The company generates revenue of £13.93 million from the development and commercialisation of MED3000, a product within its pharmaceutical and healthcare offerings.

Market Cap: £34.64M

Futura Medical plc, with a market cap of £34.64 million, has shown significant revenue growth, reporting £13.93 million in sales for 2024 and achieving profitability with a net income of £1.29 million. Despite this progress, the company faces challenges as its auditor expressed doubts about its ability to continue as a going concern. The recent appointment of Alex Duggan as Interim CEO introduces seasoned leadership that could influence strategic direction positively. Futura's financial stability is supported by strong asset coverage over liabilities and no debt burden, though share price volatility remains high compared to peers in the UK market.

- Take a closer look at Futura Medical's potential here in our financial health report.

- Examine Futura Medical's earnings growth report to understand how analysts expect it to perform.

Baltic Classifieds Group (LSE:BCG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Baltic Classifieds Group PLC owns and operates online classifieds portals across various sectors such as automotive, real estate, jobs and services, and general merchandise in Estonia, Latvia, and Lithuania with a market cap of £1.71 billion.

Operations: The company's revenue is derived from four primary segments: Auto (€31.39 million), Real Estate (€22.25 million), Jobs & Services (€15.96 million), and Generalist (€13.22 million).

Market Cap: £1.71B

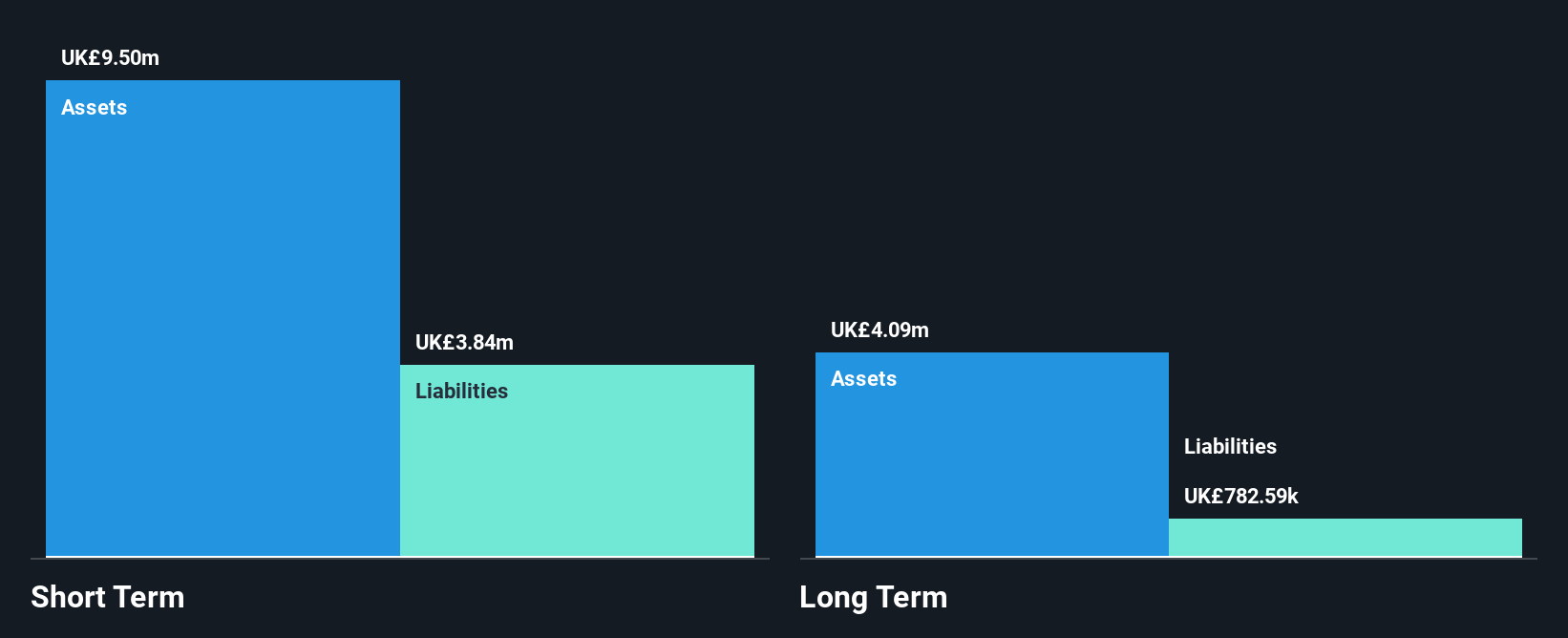

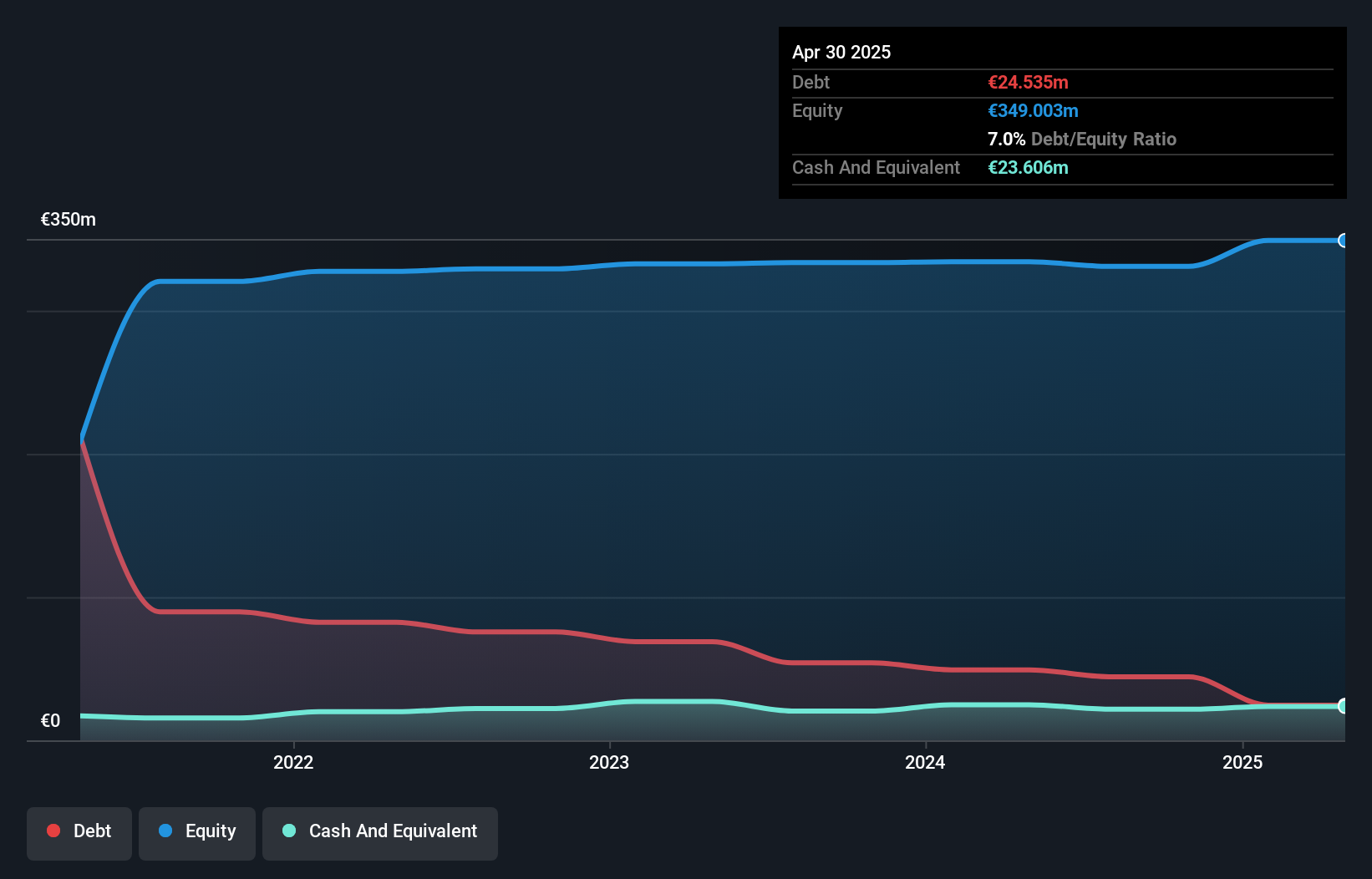

Baltic Classifieds Group PLC, with a market cap of £1.71 billion, demonstrates solid financial health with short-term assets exceeding both its short and long-term liabilities. The company's revenue growth is robust, reaching €82.81 million for the year ending April 30, 2025, driven by strong earnings in sectors like Auto and Real Estate. Its net income rose to €44.76 million from the previous year’s €32.05 million, reflecting high-quality earnings and improved profit margins. Recent strategic moves include a share buyback program and an increased dividend proposal of 2.6 Euro cents per share, indicating shareholder value enhancement efforts amidst stable debt management and seasoned leadership.

- Unlock comprehensive insights into our analysis of Baltic Classifieds Group stock in this financial health report.

- Review our growth performance report to gain insights into Baltic Classifieds Group's future.

Cairn Homes (LSE:CRN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cairn Homes plc is a homebuilder operating in Ireland with a market capitalization of approximately £1.18 billion.

Operations: The company generates its revenue primarily from building and property development, totaling €859.87 million.

Market Cap: £1.18B

Cairn Homes plc, with a market cap of £1.18 billion, shows strong financial fundamentals as its short-term assets (€1.0 billion) surpass both short and long-term liabilities. The company's earnings have grown significantly at 34.1% over the past year, outpacing its five-year average growth rate of 30.6%. Despite an unstable dividend track record, Cairn Homes trades at good value compared to peers and industry standards while maintaining satisfactory debt levels with a net debt to equity ratio of 20.4%. Recent guidance anticipates revenue growth exceeding 10% for fiscal year 2025 alongside operating profit around €160 million.

- Dive into the specifics of Cairn Homes here with our thorough balance sheet health report.

- Understand Cairn Homes' earnings outlook by examining our growth report.

Key Takeaways

- Gain an insight into the universe of 296 UK Penny Stocks by clicking here.

- Looking For Alternative Opportunities? The latest GPUs need a type of rare earth metal called Terbium and there are only 24 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:FUM

Futura Medical

Research, develops, and sells pharmaceutical and healthcare products for sexual health.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives