- United Kingdom

- /

- Capital Markets

- /

- LSE:CLIG

UK Penny Stocks Spotlight: Brickability Group Among 3 Companies To Watch

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines amid weak trade data from China, highlighting global economic uncertainties. Despite these broader market headwinds, certain investment opportunities remain appealing for those willing to explore beyond traditional blue-chip stocks. Penny stocks, although a somewhat outdated term, continue to present potential growth avenues by focusing on smaller or newer companies with strong financial foundations. In this article, we spotlight three such penny stocks that could offer investors both stability and potential upside in today's complex market landscape.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| FRP Advisory Group (AIM:FRP) | £1.21 | £300.14M | ✅ 5 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £4.25 | £343.35M | ✅ 4 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.41 | £44.36M | ✅ 5 ⚠️ 2 View Analysis > |

| System1 Group (AIM:SYS1) | £4.05 | £51.39M | ✅ 3 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £3.06 | £315.07M | ✅ 4 ⚠️ 1 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.56 | £128.03M | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.24 | £197.82M | ✅ 4 ⚠️ 1 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.815 | £11.22M | ✅ 3 ⚠️ 4 View Analysis > |

| Braemar (LSE:BMS) | £2.11 | £65.19M | ✅ 3 ⚠️ 4 View Analysis > |

| ME Group International (LSE:MEGP) | £2.155 | £813.76M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 294 stocks from our UK Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Brickability Group (AIM:BRCK)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Brickability Group Plc, with a market cap of £207.46 million, supplies, distributes, and imports building products in the United Kingdom through its subsidiaries.

Operations: The company has not reported any specific revenue segments.

Market Cap: £207.46M

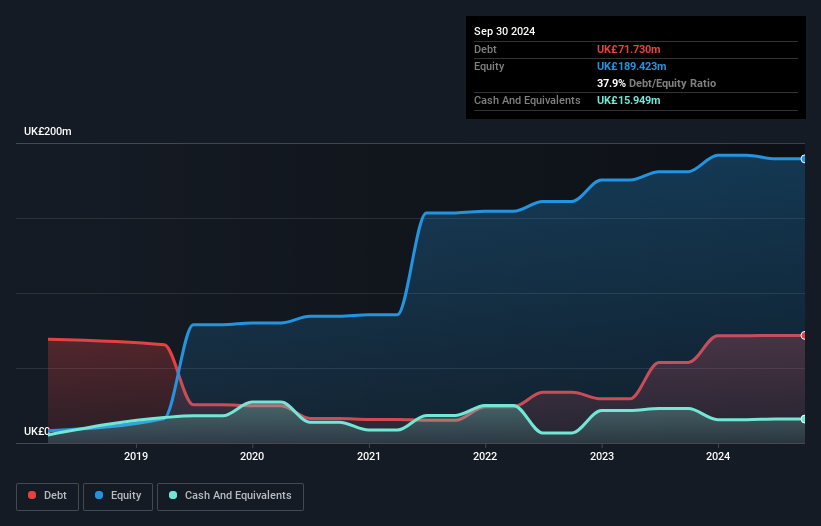

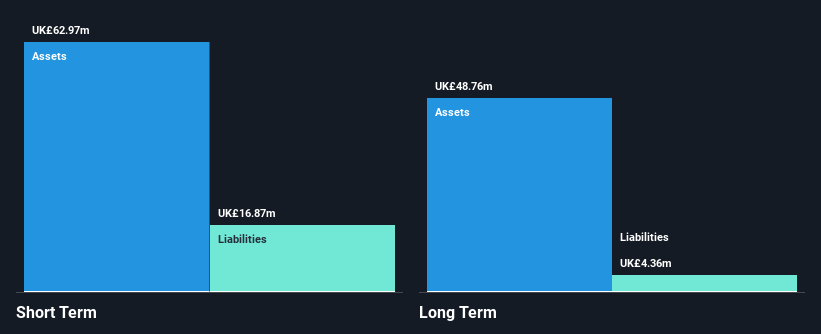

Brickability Group Plc has shown a mixed performance as a penny stock. While its revenue increased to £637.06 million, net income dropped significantly to £6.53 million, reflecting a challenging year with declining profit margins from 4.3% to 1.4%. Despite this, the company maintains strong short-term asset coverage over liabilities and satisfactory debt levels, with operating cash flow well covering its debt obligations at 58.8%. The recent dividend increase indicates confidence in long-term prospects; however, negative earnings growth and significant insider selling raise concerns about future stability amidst an inexperienced management team averaging 1.3 years in tenure.

- Click here to discover the nuances of Brickability Group with our detailed analytical financial health report.

- Review our historical performance report to gain insights into Brickability Group's track record.

ECO Animal Health Group (AIM:EAH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: ECO Animal Health Group plc, with a market cap of £46.75 million, develops, registers, and markets pharmaceutical products for animals globally.

Operations: No specific revenue segments have been reported for this company.

Market Cap: £46.75M

ECO Animal Health Group plc, with a market cap of £46.75 million, presents a mixed picture as an investment opportunity. The company is debt-free and maintains strong asset coverage over both short and long-term liabilities. Despite earnings growth of 60.9% over the past year, it has experienced a decline in earnings by 47.4% annually over five years. Recent results showed sales of £79.6 million, down from the previous year, although net income increased to £1.69 million from £1.05 million due to improved profit margins and stable weekly volatility at 7%. The stock trades significantly below its estimated fair value but faces challenges with past declining profits despite recent improvements.

- Navigate through the intricacies of ECO Animal Health Group with our comprehensive balance sheet health report here.

- Examine ECO Animal Health Group's earnings growth report to understand how analysts expect it to perform.

City of London Investment Group (LSE:CLIG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: City of London Investment Group PLC is a publicly owned investment manager with a market cap of £177.42 million.

Operations: The company generates revenue of $72.64 million from its asset management operations.

Market Cap: £177.42M

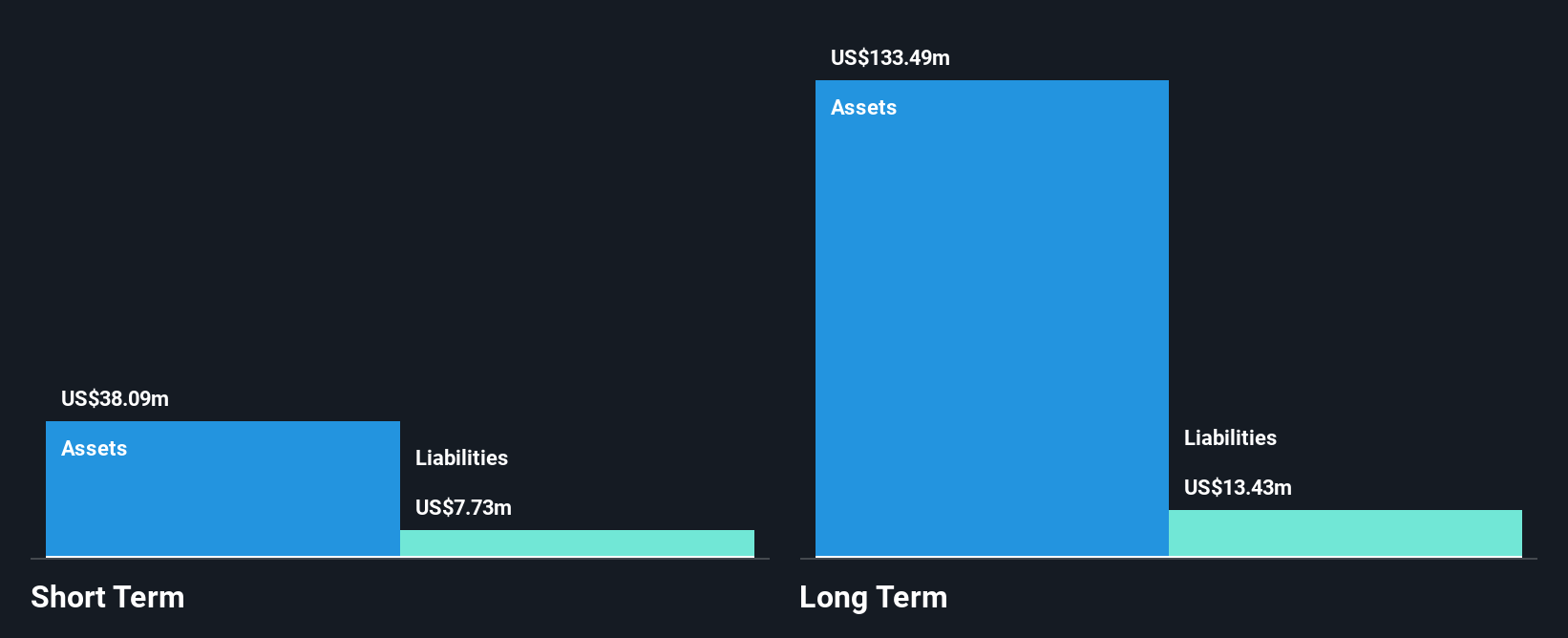

City of London Investment Group PLC, with a market cap of £177.42 million, is an intriguing option in the penny stock space. The company is debt-free and exhibits strong asset coverage over both short and long-term liabilities, with short term assets at $38.1M surpassing its liabilities. Despite earnings growth of 5% annually over five years, recent growth has been modest at 5.2%, trailing the broader Capital Markets industry. Although trading slightly below estimated fair value, significant insider selling raises concerns about future prospects amidst ongoing executive changes as CEO Tom Griffith prepares to depart by July 2025.

- Click here and access our complete financial health analysis report to understand the dynamics of City of London Investment Group.

- Gain insights into City of London Investment Group's outlook and expected performance with our report on the company's earnings estimates.

Turning Ideas Into Actions

- Take a closer look at our UK Penny Stocks list of 294 companies by clicking here.

- Want To Explore Some Alternatives? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:CLIG

City of London Investment Group

City of London Investment Group PLC is a publically owned investment manager.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives