- United Kingdom

- /

- Building

- /

- AIM:EPWN

UK Dividend Stocks: Epwin Group Plus 2 Solid Choices

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting concerns about global economic recovery. In such uncertain times, dividend stocks can offer a measure of stability and income potential, making them an attractive option for investors seeking to navigate volatile markets.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| WPP (LSE:WPP) | 7.12% | ★★★★★★ |

| OSB Group (LSE:OSB) | 6.75% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.68% | ★★★★★☆ |

| Man Group (LSE:EMG) | 7.21% | ★★★★★☆ |

| Keller Group (LSE:KLR) | 3.28% | ★★★★★☆ |

| James Latham (AIM:LTHM) | 7.02% | ★★★★★☆ |

| IG Group Holdings (LSE:IGG) | 4.35% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.63% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.74% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 5.05% | ★★★★★☆ |

Click here to see the full list of 61 stocks from our Top UK Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Epwin Group (AIM:EPWN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Epwin Group Plc manufactures building products for the repair, maintenance and improvement, social housing, and new build markets in the United Kingdom, Europe, and internationally with a market cap of £144.40 million.

Operations: Epwin Group Plc's revenue is primarily derived from its Extrusion and Moulding segment, which accounts for £232.20 million, and its Fabrication and Distribution segment, contributing £131.30 million.

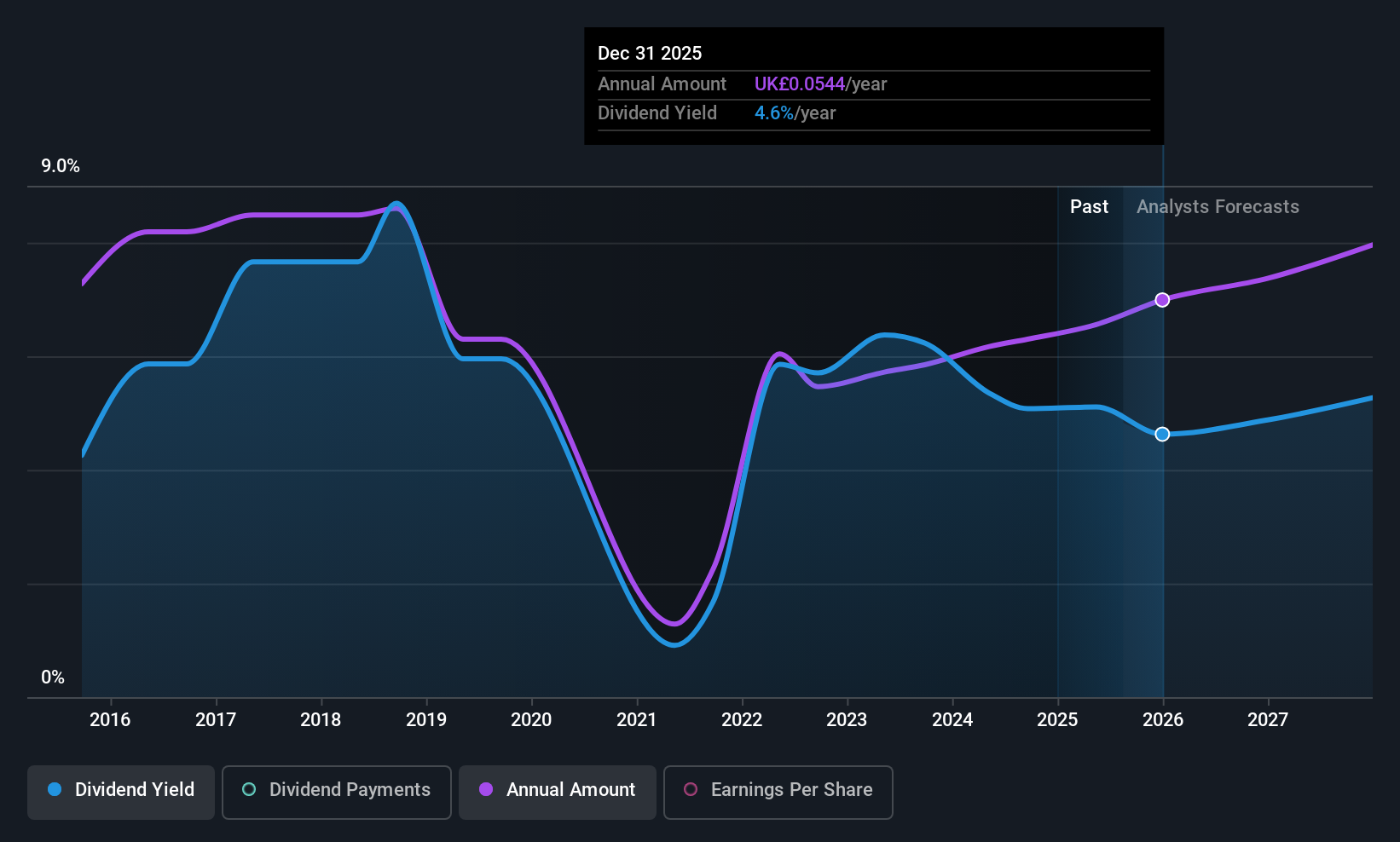

Dividend Yield: 4.8%

Epwin Group's dividend payments have been volatile over the past decade, though recent increases indicate growth. Despite this instability, dividends are well covered by both earnings (payout ratio: 43.4%) and cash flows (cash payout ratio: 21%). The company has maintained a relatively low price-to-earnings ratio of 8.7x compared to the UK market average of 16.5x, suggesting good value. Recent buybacks and a modest dividend yield of 4.79% further characterize its investment profile.

- Unlock comprehensive insights into our analysis of Epwin Group stock in this dividend report.

- Our valuation report here indicates Epwin Group may be undervalued.

NWF Group (AIM:NWF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: NWF Group plc, with a market cap of £85.79 million, primarily operates in the United Kingdom through the sale and distribution of fuel oils.

Operations: NWF Group plc generates its revenue from three main segments: Food (£82.30 million), Feeds (£204.10 million), and Fuels (£653.10 million).

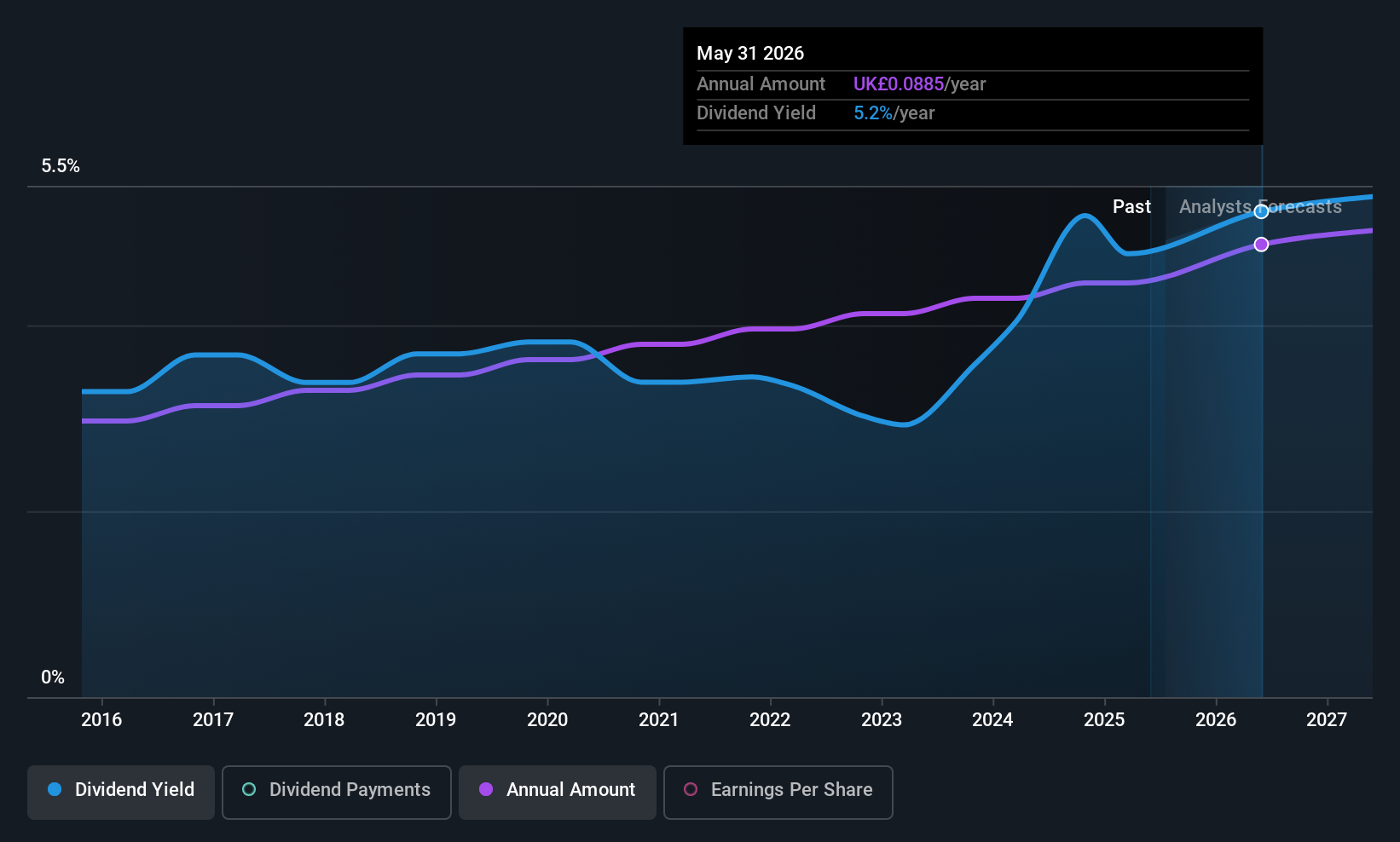

Dividend Yield: 4.7%

NWF Group offers a reliable dividend yield of 4.68%, supported by a reasonable payout ratio of 50.1% and a cash payout ratio of 32.4%, indicating dividends are well covered by earnings and cash flows. Although its profit margins have slightly decreased, the company's dividends have grown consistently over the past decade with little volatility. Trading at 48% below estimated fair value, NWF presents an attractive option for value-conscious investors seeking stable income.

- Navigate through the intricacies of NWF Group with our comprehensive dividend report here.

- Our expertly prepared valuation report NWF Group implies its share price may be too high.

Castings (LSE:CGS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Castings P.L.C. is involved in iron casting and machining operations across various international markets, with a market cap of £118.86 million.

Operations: Castings P.L.C. generates revenue primarily from its Foundry Operations (£225.67 million) and Machining Operations (£35.57 million).

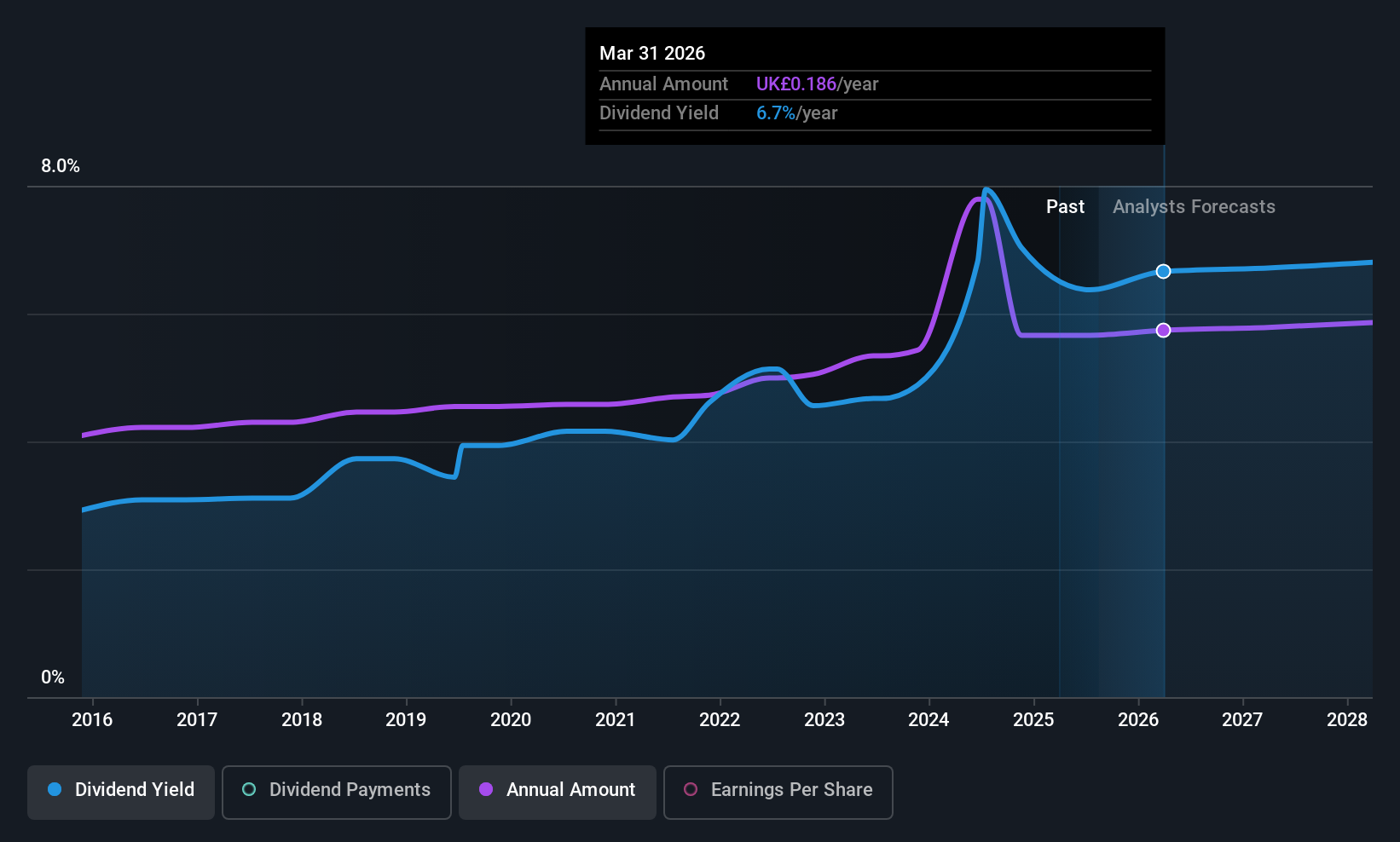

Dividend Yield: 6.7%

Castings P.L.C. offers a high dividend yield of 6.73%, ranking it in the top 25% of UK dividend payers, but its sustainability is questionable due to lack of free cash flow coverage and volatile payouts over the past decade. Despite a reasonable payout ratio of 66.1%, earnings are projected to decline by an average of 0.4% annually over the next three years, raising concerns about future dividend reliability and growth potential for investors focused on stable income streams.

- Click here and access our complete dividend analysis report to understand the dynamics of Castings.

- Our expertly prepared valuation report Castings implies its share price may be lower than expected.

Key Takeaways

- Unlock more gems! Our Top UK Dividend Stocks screener has unearthed 58 more companies for you to explore.Click here to unveil our expertly curated list of 61 Top UK Dividend Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Epwin Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:EPWN

Epwin Group

Manufactures building products for the repair, maintenance and improvement, social housing, and new build markets in the United Kingdom, Europe, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

BABA Analysis: Buying the Fear, Holding the Cloud

Q3 Outlook modestly optimistic

A fully integrated LNG business seems to be ignored by the market.

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale