- Canada

- /

- Diversified Financial

- /

- TSX:TF

TSX Value Stocks Trading Below Estimated Intrinsic Worth In May 2025

Reviewed by Simply Wall St

As Canadian investors navigate a landscape marked by potential changes in U.S. tax policy and rising bond yields, the focus on value investing becomes increasingly pertinent. In this environment, identifying stocks trading below their intrinsic worth can offer opportunities for those seeking to optimize their portfolios amidst evolving economic conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Whitecap Resources (TSX:WCP) | CA$8.73 | CA$14.06 | 37.9% |

| Docebo (TSX:DCBO) | CA$36.04 | CA$58.01 | 37.9% |

| Groupe Dynamite (TSX:GRGD) | CA$15.20 | CA$27.75 | 45.2% |

| Aris Mining (TSX:ARIS) | CA$8.74 | CA$13.08 | 33.2% |

| VersaBank (TSX:VBNK) | CA$16.00 | CA$29.98 | 46.6% |

| Lithium Royalty (TSX:LIRC) | CA$5.50 | CA$8.45 | 34.9% |

| TerraVest Industries (TSX:TVK) | CA$161.99 | CA$297.31 | 45.5% |

| Timbercreek Financial (TSX:TF) | CA$7.28 | CA$10.82 | 32.7% |

| Journey Energy (TSX:JOY) | CA$1.59 | CA$2.84 | 44% |

| Laurentian Bank of Canada (TSX:LB) | CA$28.17 | CA$41.40 | 32% |

Let's dive into some prime choices out of the screener.

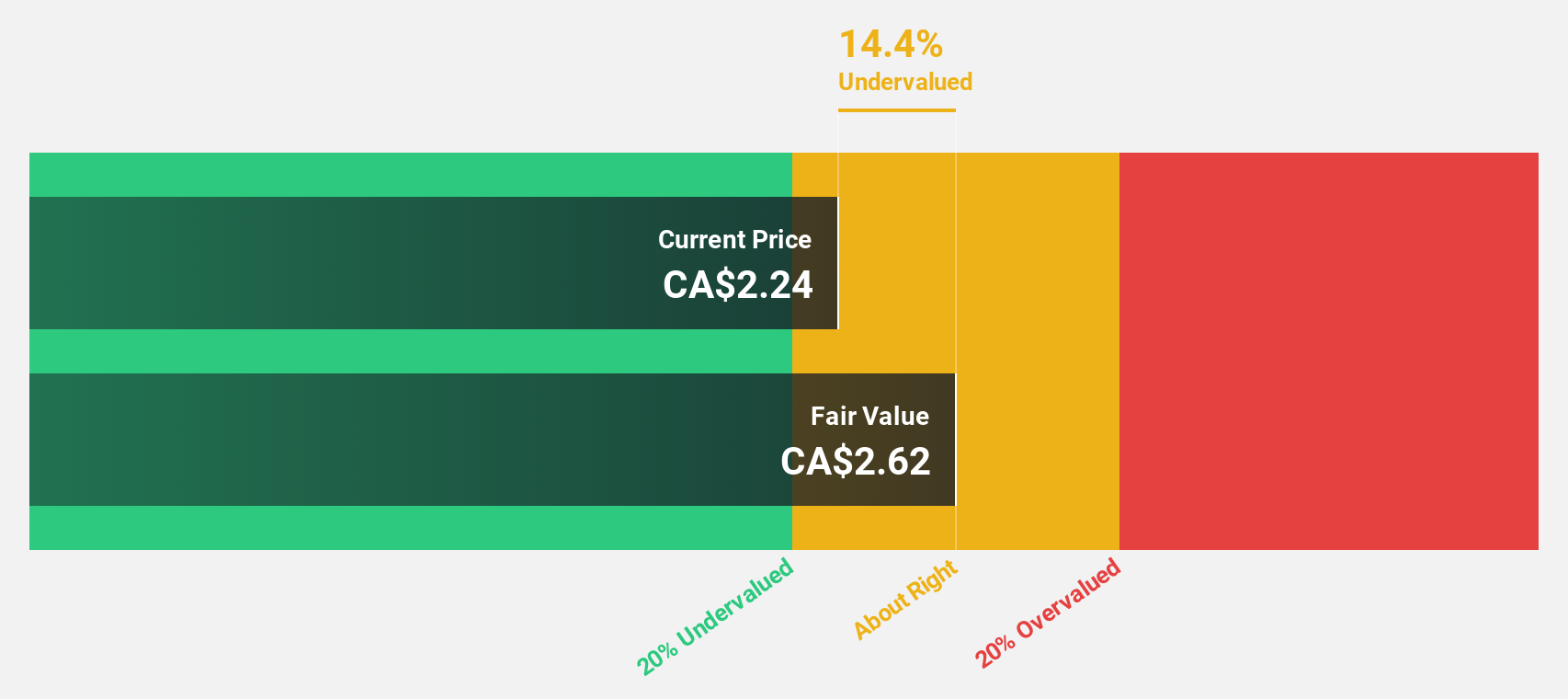

NanoXplore (TSX:GRA)

Overview: NanoXplore Inc. is a graphene company that manufactures and supplies graphene powder for industrial markets in Australia, with a market cap of CA$394.11 million.

Operations: The company's revenue is derived from two main segments: Battery Cells and Materials, contributing CA$0.57 million, and Advanced Materials, Plastics and Composite Products, generating CA$134.79 million.

Estimated Discount To Fair Value: 10.5%

NanoXplore is trading at CA$2.31, below its estimated fair value of CA$2.58, suggesting it may be undervalued based on cash flows. Despite a decline in recent quarterly sales to CA$29.24 million from CA$33.62 million last year, the company has improved its net loss position and forecasts revenue growth of 21.4% annually, outpacing the Canadian market average of 3.4%. A share buyback program further signals management's confidence in future prospects.

- The analysis detailed in our NanoXplore growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of NanoXplore.

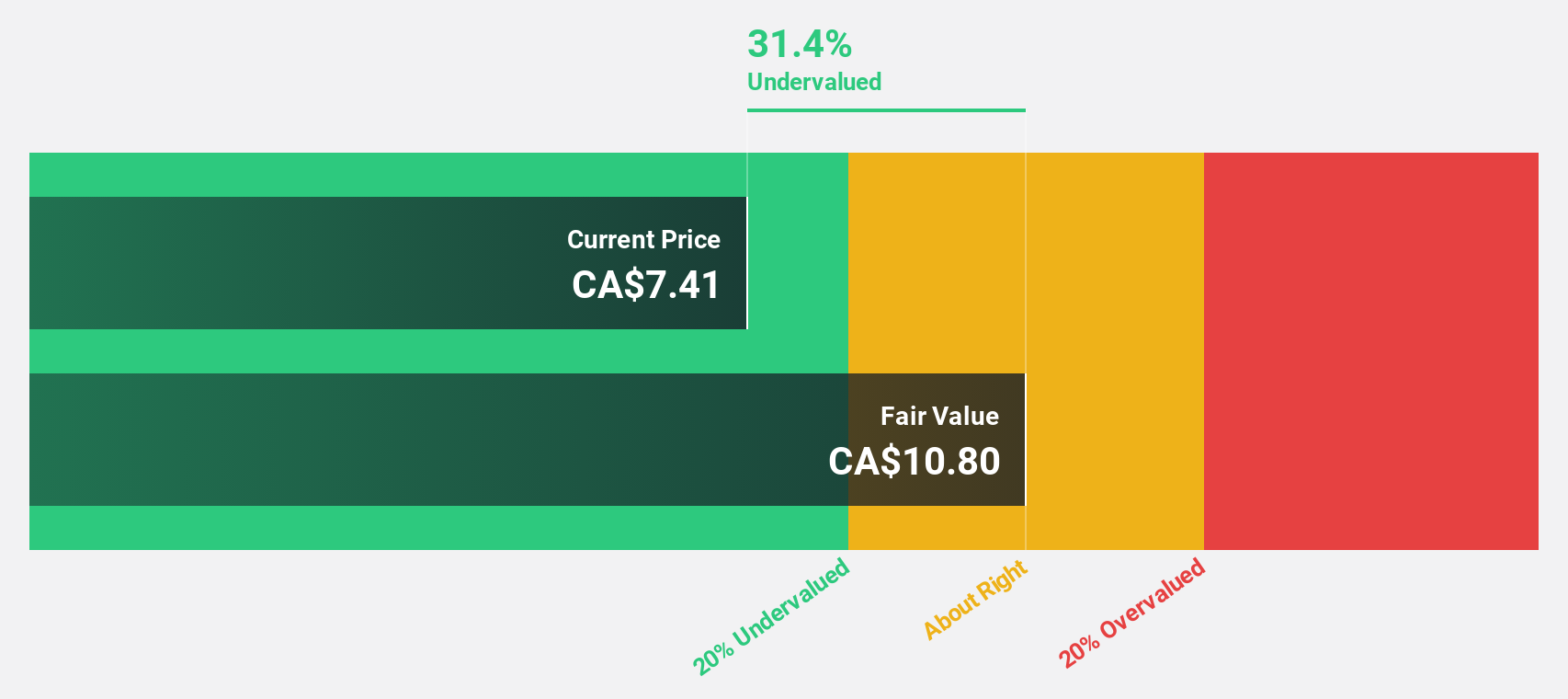

Timbercreek Financial (TSX:TF)

Overview: Timbercreek Financial Corp. offers shorter-duration structured financing solutions to commercial real estate investors in Canada, with a market cap of CA$602.44 million.

Operations: The company's revenue segment primarily consists of financial services through mortgage solutions, generating CA$72.43 million.

Estimated Discount To Fair Value: 32.7%

Timbercreek Financial, trading at CA$7.28, is undervalued with a fair value estimate of CA$10.82. Earnings are projected to grow 12.7% annually, surpassing the Canadian market's 11.6%. However, recent quarterly sales declined to CA$3.16 million from CA$4.35 million last year, though net income slightly rose to CA$14.77 million from CA$14.37 million a year ago, highlighting potential cash flow concerns despite future growth prospects and consistent dividend declarations of CAD 0.0575 per share monthly.

- The growth report we've compiled suggests that Timbercreek Financial's future prospects could be on the up.

- Navigate through the intricacies of Timbercreek Financial with our comprehensive financial health report here.

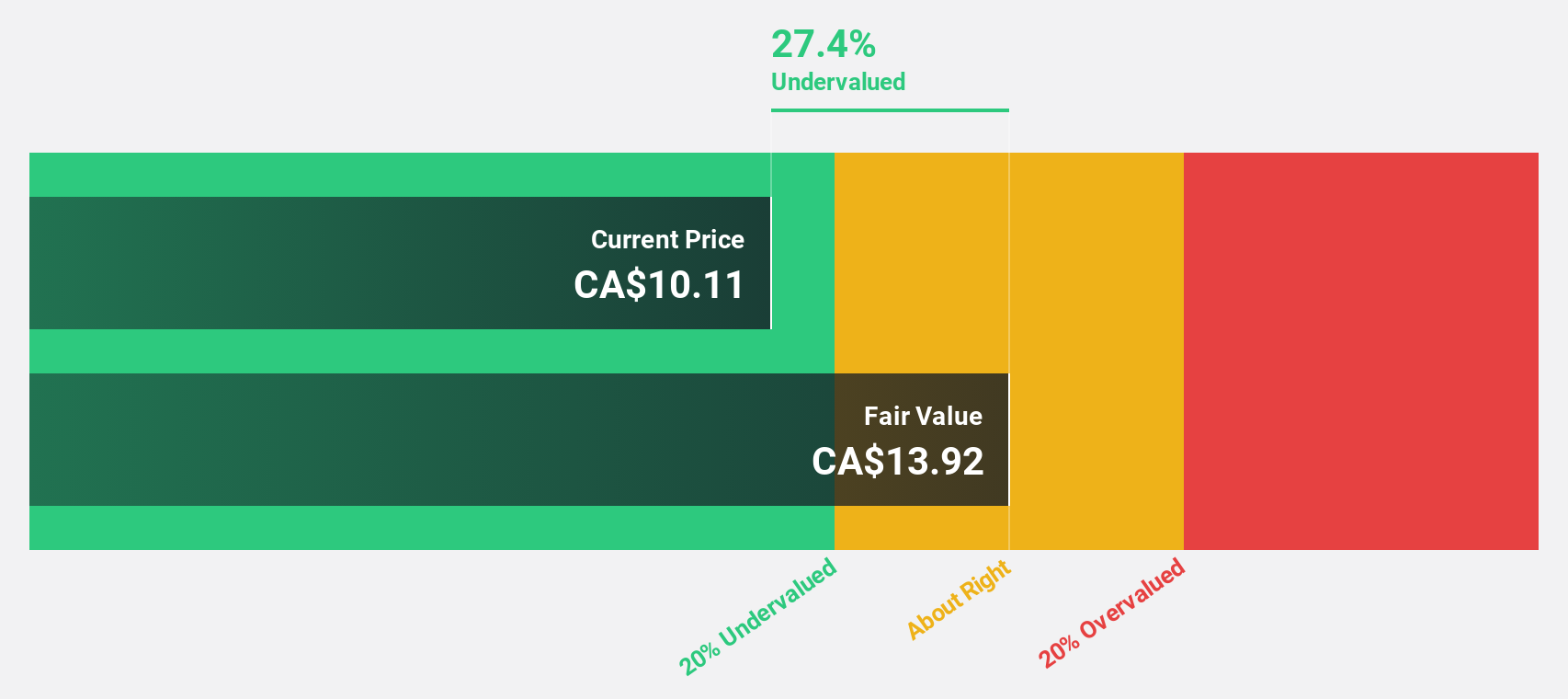

Vitalhub (TSX:VHI)

Overview: Vitalhub Corp. offers technology and software solutions for health and human service providers across various regions including Canada, the United States, the United Kingdom, Australia, and Western Asia, with a market cap of CA$566.78 million.

Operations: The company generates revenue primarily from its Healthcare Software segment, totaling CA$75.01 million.

Estimated Discount To Fair Value: 26.5%

Vitalhub, trading at CA$10.16, is undervalued with a fair value estimate of CA$13.83. Earnings are expected to grow 55.4% annually, outpacing the Canadian market's growth rate of 11.6%. Despite lower profit margins this year (3.8% versus last year's 10.3%), revenue increased to CA$21.67 million from CA$15.26 million in Q1 2025 compared to the previous year, suggesting potential for cash flow improvement amid significant earnings growth projections.

- Our expertly prepared growth report on Vitalhub implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of Vitalhub with our detailed financial health report.

Key Takeaways

- Embark on your investment journey to our 21 Undervalued TSX Stocks Based On Cash Flows selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Timbercreek Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TF

Timbercreek Financial

Provides shorter-duration structured financing solutions to commercial real estate investors in Canada.

Good value with reasonable growth potential.

Market Insights

Community Narratives