- Canada

- /

- Oil and Gas

- /

- TSX:SU

TSX Dividend Stocks To Watch In June 2025

Reviewed by Simply Wall St

As the Canadian market navigates through ongoing tariff uncertainties, investors have shown resilience, with the TSX experiencing a notable rise in May alongside its U.S. counterpart. In this environment of cautious optimism and potential price adjustments, dividend stocks offer a compelling opportunity for those seeking steady income and stability amidst economic fluctuations.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Sun Life Financial (TSX:SLF) | 3.97% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.02% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.54% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 4.70% | ★★★★★☆ |

| Olympia Financial Group (TSX:OLY) | 6.43% | ★★★★★☆ |

| National Bank of Canada (TSX:NA) | 3.51% | ★★★★★☆ |

| IGM Financial (TSX:IGM) | 5.07% | ★★★★★☆ |

| Canadian Imperial Bank of Commerce (TSX:CM) | 4.18% | ★★★★★☆ |

| Atrium Mortgage Investment (TSX:AI) | 9.73% | ★★★★★☆ |

| Acadian Timber (TSX:ADN) | 6.36% | ★★★★★☆ |

Click here to see the full list of 27 stocks from our Top TSX Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

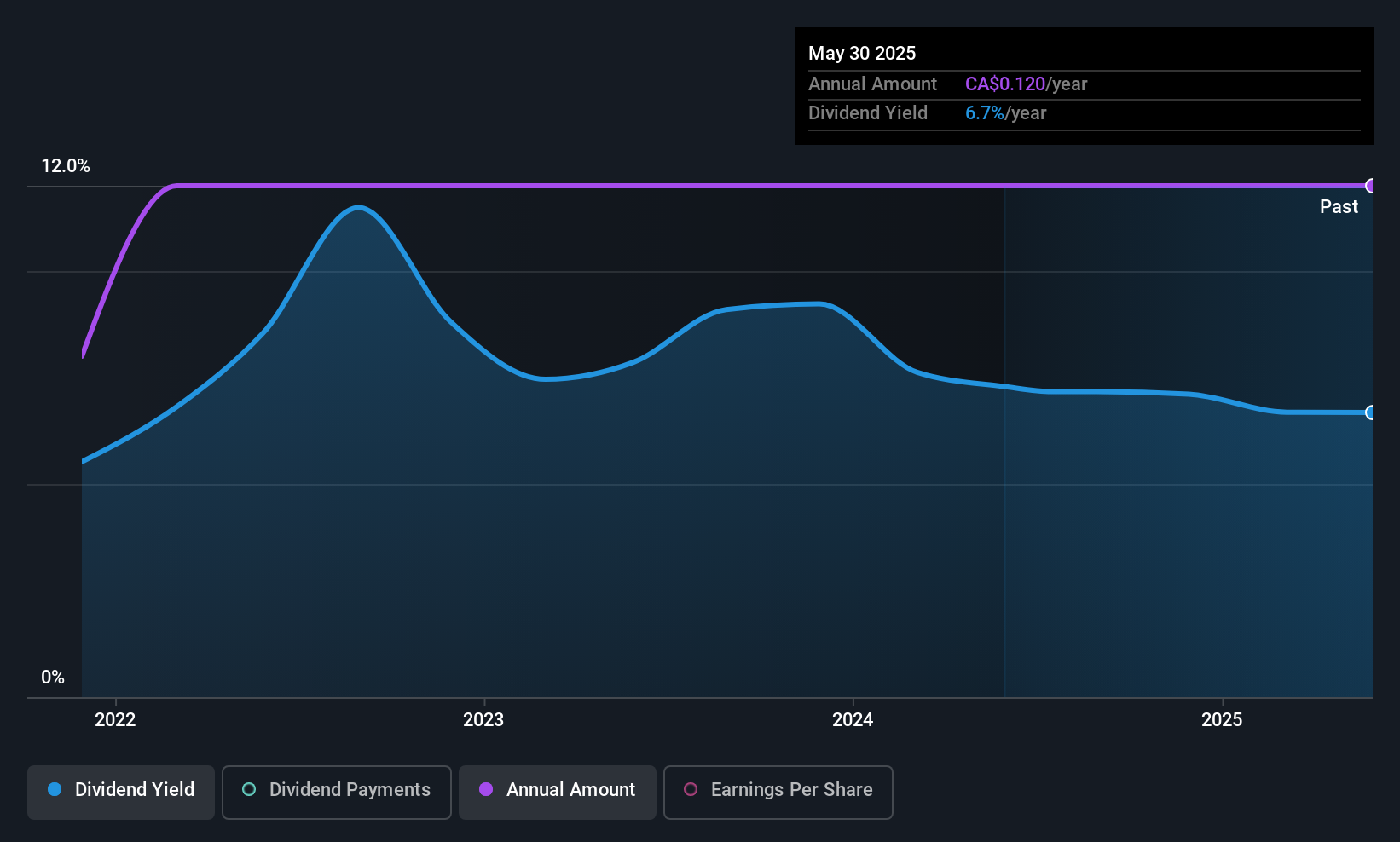

Amerigo Resources (TSX:ARG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Amerigo Resources Ltd., operating through its subsidiary Minera Valle Central S.A., focuses on the production of copper and molybdenum concentrates in Chile, with a market cap of CA$304.85 million.

Operations: Amerigo Resources Ltd. generates revenue primarily from the production of copper concentrates under a tolling agreement with DET, amounting to $192.03 million.

Dividend Yield: 6.2%

Amerigo Resources offers a compelling dividend yield of 6.24%, positioning it among the top 25% of Canadian dividend payers. Despite a history of volatility in its dividend payments, recent affirmations suggest stability with dividends covered by both earnings and cash flows, at payout ratios of 74.4% and 32.6%, respectively. The appointment of Ignacio Cruz to the board may enhance strategic leadership, potentially impacting future financial performance positively for stakeholders.

- Click to explore a detailed breakdown of our findings in Amerigo Resources' dividend report.

- The valuation report we've compiled suggests that Amerigo Resources' current price could be quite moderate.

Magna International (TSX:MG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Magna International Inc. manufactures and supplies vehicle engineering, contract, and automotive solutions with a market cap of CA$14.06 billion.

Operations: Magna International Inc. generates revenue from several key segments, including Power & Vision at $15.20 billion, Body Exteriors & Structures at $16.54 billion, Seating Systems at $5.66 billion, and Complete Vehicles at $5.08 billion.

Dividend Yield: 5.4%

Magna International provides a reliable dividend yield of 5.35%, with payments well covered by earnings (47.8% payout ratio) and cash flows (36.5% cash payout ratio). The dividend has been stable and growing over the past decade, though it remains below the top tier of Canadian payers. Recent financial results show improved net income, supporting its dividend sustainability. Additionally, Magna completed significant fixed-income offerings, potentially enhancing its financial flexibility for future commitments.

- Take a closer look at Magna International's potential here in our dividend report.

- According our valuation report, there's an indication that Magna International's share price might be on the cheaper side.

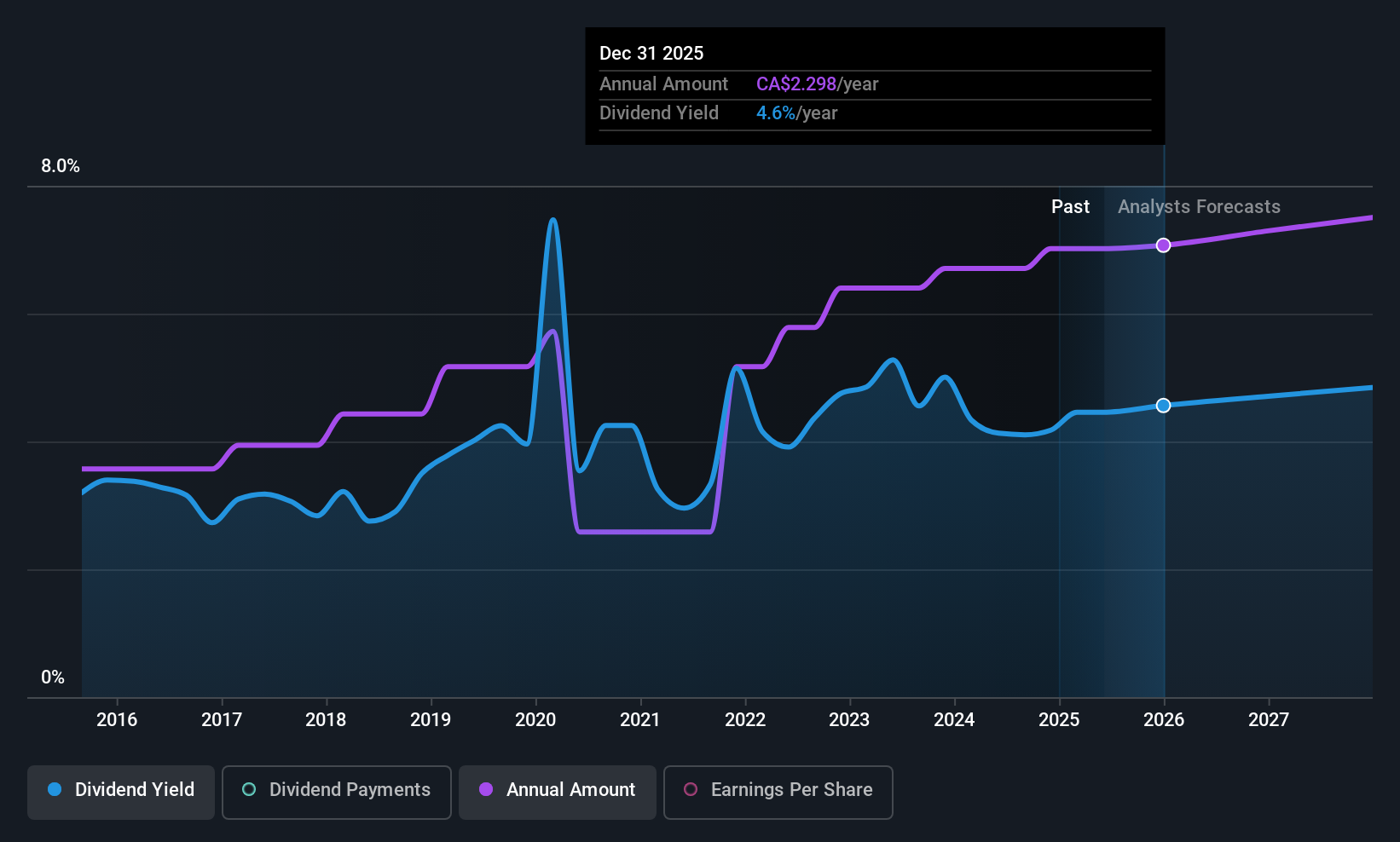

Suncor Energy (TSX:SU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Suncor Energy Inc. is an integrated energy company operating in Canada, the United States, and internationally with a market cap of CA$62.18 billion.

Operations: Suncor Energy Inc.'s revenue segments consist of Oil Sands at CA$25.80 billion, Refining and Marketing at CA$31.36 billion, and Exploration and Production at CA$2.17 billion.

Dividend Yield: 4.6%

Suncor Energy's dividend yield of 4.59% is below the top Canadian payers, yet it maintains strong coverage with a 46.1% earnings payout ratio and a 31.1% cash flow payout ratio. Despite historical volatility and unreliability in dividends, recent affirmations show stability with quarterly payments of C$0.57 per share. First-quarter results revealed record production levels and solid earnings growth, bolstering its capacity to sustain dividends amidst ongoing share buybacks totaling C$3.26 billion since early 2024.

- Click here to discover the nuances of Suncor Energy with our detailed analytical dividend report.

- Our expertly prepared valuation report Suncor Energy implies its share price may be lower than expected.

Seize The Opportunity

- Delve into our full catalog of 27 Top TSX Dividend Stocks here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SU

Suncor Energy

Operates as an integrated energy company in Canada, the United States, and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives