As global markets experience a surge, driven by speculation of potential interest rate cuts and easing trade tensions, investors are keenly observing the economic shifts that have propelled U.S. equities to all-time highs and bolstered sentiment in Europe and Asia. In this dynamic environment, dividend stocks can offer a stable income stream, making them an attractive consideration for those looking to balance growth with consistent returns amidst fluctuating market conditions.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 3.76% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.63% | ★★★★★★ |

| NCD (TSE:4783) | 4.67% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 3.94% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.23% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.03% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.45% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.79% | ★★★★★★ |

| Daicel (TSE:4202) | 4.44% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.65% | ★★★★★★ |

Click here to see the full list of 1372 stocks from our Top Global Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

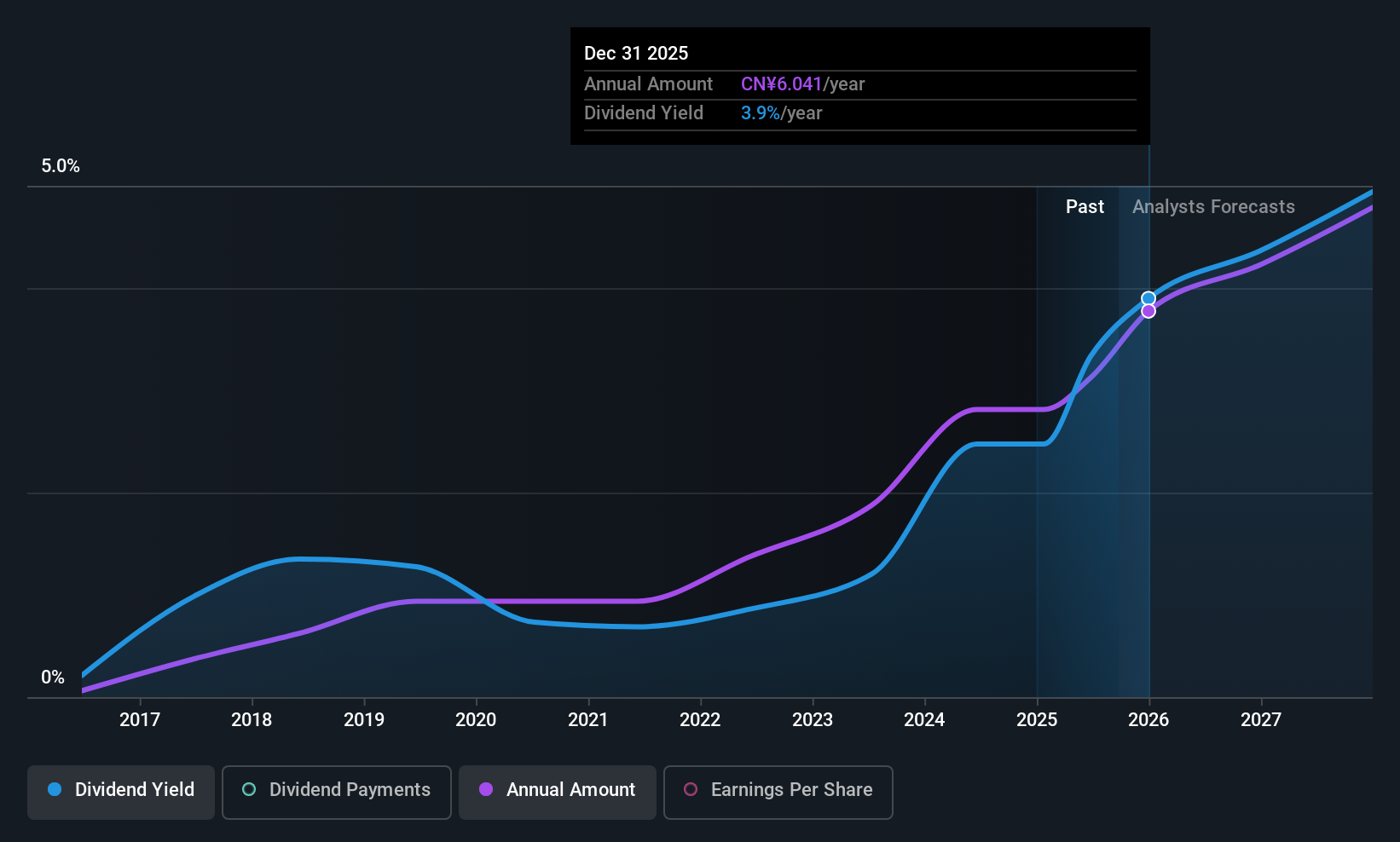

Anhui Gujing Distillery (SZSE:000596)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Anhui Gujing Distillery Co., Ltd. produces and sells distilled wine in China and internationally, with a market cap of CN¥74.78 billion.

Operations: Anhui Gujing Distillery Co., Ltd. derives its revenue primarily from the production and sale of distilled wine both domestically and internationally.

Dividend Yield: 3.1%

Anhui Gujing Distillery's dividend payments have been volatile over the past decade, with a high cash payout ratio of 140.4%, indicating they are not well covered by cash flows. Despite this, dividends have increased over ten years and are in the top 25% of CN market payers. Recent affirmations approved a CNY 50 per 10 shares dividend for 2024, reflecting ongoing commitment despite coverage concerns.

- Dive into the specifics of Anhui Gujing Distillery here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Anhui Gujing Distillery is priced lower than what may be justified by its financials.

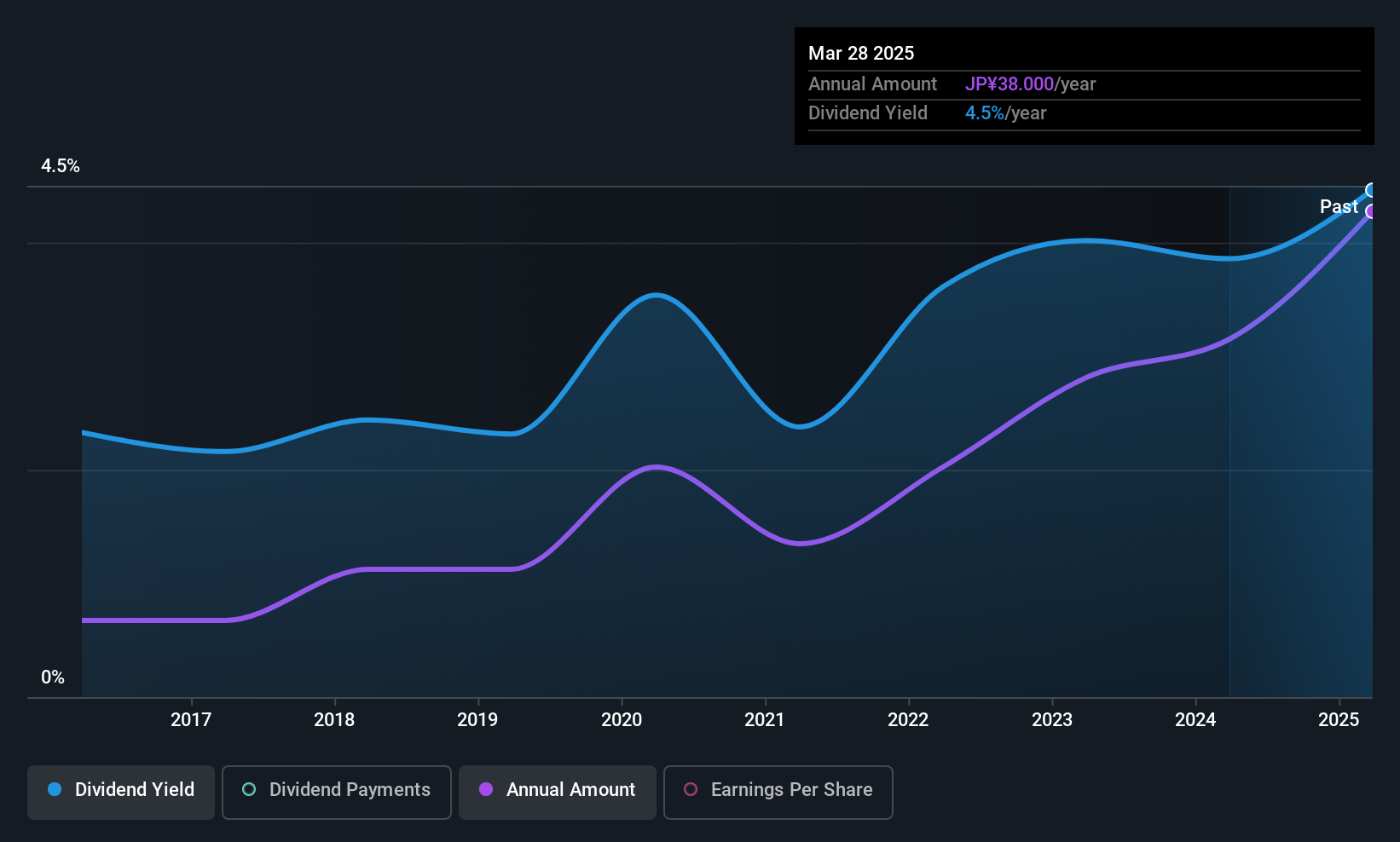

NCS&A (TSE:9709)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: NCS&A Co., Ltd. offers a range of IT services in Japan and has a market cap of ¥18.80 billion.

Operations: NCS&A Co., Ltd. generates revenue through its diverse IT service offerings within Japan.

Dividend Yield: 3.2%

NCS&A's dividend payments have been stable and growing over the past decade, supported by a low payout ratio of 28.9% and a cash payout ratio of 40.3%, indicating strong coverage by earnings and cash flows. Though its yield of 3.17% is below the top tier in Japan, recent share buybacks totaling ¥616.79 million enhance shareholder value and reflect a commitment to returns, with plans to repurchase up to ¥2.1 billion worth through July 2026.

- Take a closer look at NCS&A's potential here in our dividend report.

- Our expertly prepared valuation report NCS&A implies its share price may be lower than expected.

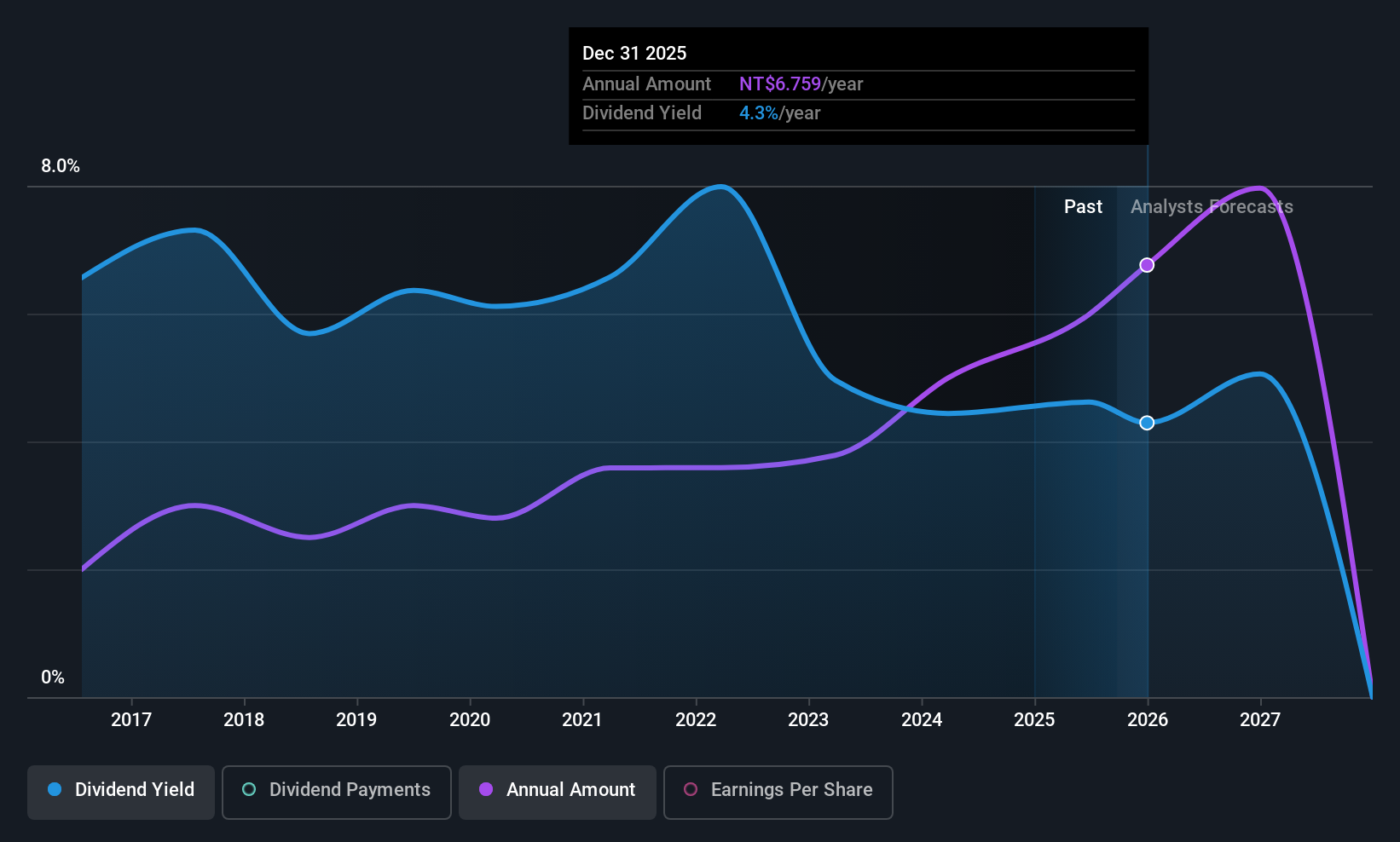

Getac Holdings (TWSE:3005)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Getac Holdings Corporation, along with its subsidiaries, engages in the research, development, manufacturing, and sale of notebook computers and related products across China, the United States, Europe, and other international markets; it has a market cap of approximately NT$77.84 billion.

Operations: Getac Holdings Corporation generates revenue through its research, development, manufacturing, and sales of notebook computers and related products in various global markets.

Dividend Yield: 4.7%

Getac Holdings' dividends have increased over the past decade, though they remain volatile. The payout ratio of 76.9% and cash payout ratio of 78.8% suggest dividends are covered by earnings and cash flows. Despite a dividend yield of 4.67%, which is lower than Taiwan's top tier, recent earnings growth and revenue improvements signal financial strength, as seen in Q2 net income rising to TWD 1.40 billion from TWD 1.15 billion year-on-year.

- Click here to discover the nuances of Getac Holdings with our detailed analytical dividend report.

- Our valuation report unveils the possibility Getac Holdings' shares may be trading at a discount.

Summing It All Up

- Reveal the 1372 hidden gems among our Top Global Dividend Stocks screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000596

Anhui Gujing Distillery

Engages in the production and sale of distilled wine in the People’s Republic of China and internationally.

Very undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives