- Poland

- /

- Oil and Gas

- /

- WSE:PKN

Top European Dividend Stocks To Consider

Reviewed by Simply Wall St

As the pan-European STOXX Europe 600 Index remained relatively stable over recent trading sessions, with mixed returns across major stock indexes, investors are closely watching the eurozone's inflation hitting the European Central Bank's target and a steady labor market. In this environment, dividend stocks can offer an attractive opportunity for income-focused investors seeking stability and potential growth amid fluctuating market conditions.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.47% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.32% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.59% | ★★★★★★ |

| Les Docks des Pétroles d'Ambès -SA (ENXTPA:DPAM) | 5.76% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.87% | ★★★★★★ |

| Holcim (SWX:HOLN) | 5.22% | ★★★★★★ |

| ERG (BIT:ERG) | 5.27% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 3.95% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.70% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.51% | ★★★★★★ |

Click here to see the full list of 235 stocks from our Top European Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Bahnhof (OM:BAHN B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bahnhof AB (publ) operates in the Internet and telecommunications sector across Sweden and Europe, with a market cap of SEK6.49 billion.

Operations: Bahnhof AB (publ) generates revenue primarily from the Retail Market, which accounts for SEK1.42 billion, and the Corporate Market (excluding Typhoon), contributing SEK639.39 million.

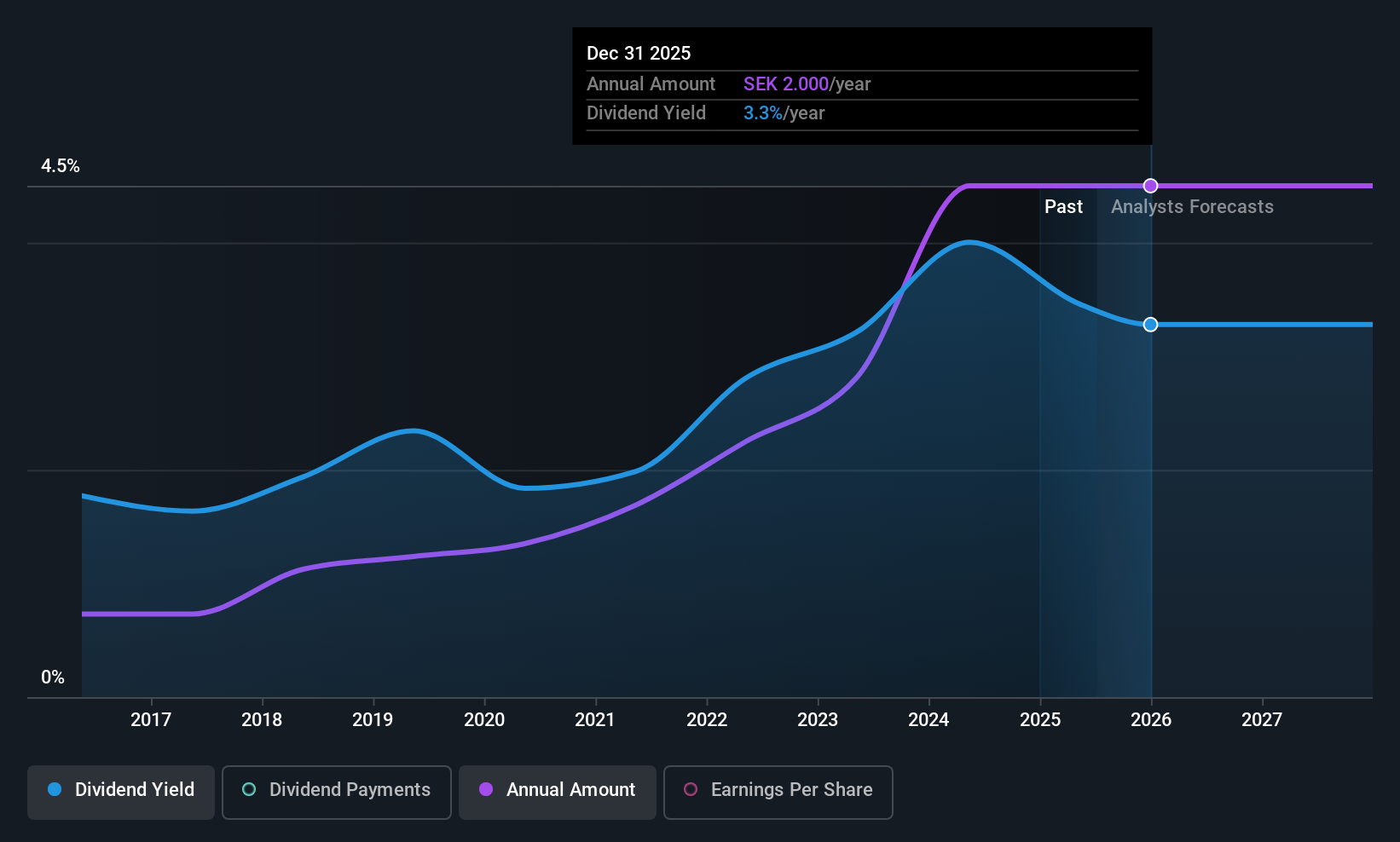

Dividend Yield: 3.3%

Bahnhof's dividend yield of 3.32% lags behind the top quartile in Sweden, yet it has consistently increased over the past decade with stable and reliable payments. Despite its dividends being covered by cash flows, a high payout ratio of 97% indicates limited coverage by earnings, raising sustainability concerns. Recent earnings growth supports potential future stability; however, investors should be cautious given the current payout constraints and evaluate if this aligns with their income-focused strategies.

- Click to explore a detailed breakdown of our findings in Bahnhof's dividend report.

- Upon reviewing our latest valuation report, Bahnhof's share price might be too pessimistic.

Bredband2 i Skandinavien (OM:BRE2)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Bredband2 i Skandinavien AB (publ) offers data communication and security solutions to individuals and companies in Sweden, with a market cap of SEK2.42 billion.

Operations: Bredband2 i Skandinavien AB (publ) generates its revenue primarily from its National Broadband Service, amounting to SEK1.77 billion.

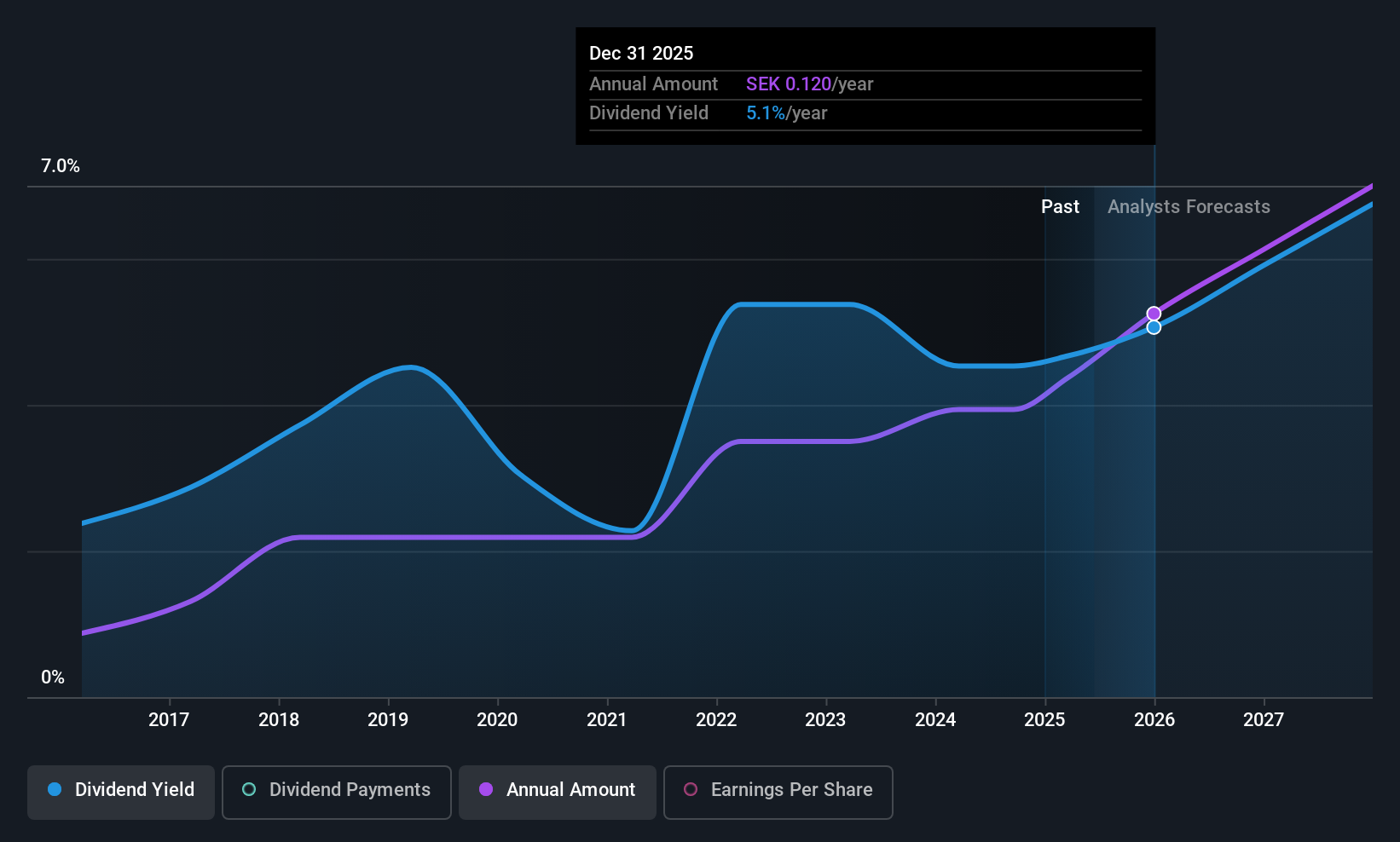

Dividend Yield: 4%

Bredband2 i Skandinavien offers a compelling dividend profile with a yield of 3.95%, ranking in the top quartile of Swedish dividend payers. Its dividends have grown steadily over the past decade, supported by stable earnings and cash flow coverage, with a cash payout ratio at 40.2%. However, an 87.7% earnings payout ratio suggests limited room for growth without affecting sustainability. Recent insider selling may warrant attention despite favorable valuation metrics indicating it trades below estimated fair value.

- Take a closer look at Bredband2 i Skandinavien's potential here in our dividend report.

- According our valuation report, there's an indication that Bredband2 i Skandinavien's share price might be on the cheaper side.

Orlen (WSE:PKN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Orlen S.A. is a diversified company involved in refining, petrochemical, energy, retail, gas, and upstream operations with a market cap of PLN98.09 billion.

Operations: Orlen S.A. generates revenue from its energy segment, which amounts to PLN37.11 billion.

Dividend Yield: 7.1%

Orlen S.A. offers a high dividend yield of 7.1%, placing it among the top 25% of dividend payers in Poland, yet its sustainability is questionable due to a high payout ratio of 234.5%. Despite covering dividends with cash flow, earnings coverage remains weak and volatile over the past decade. Recent Q1 results show net income growth to PLN 4.28 billion, but profit margins have decreased from last year, potentially impacting future dividend reliability and growth prospects.

- Click here and access our complete dividend analysis report to understand the dynamics of Orlen.

- Our valuation report unveils the possibility Orlen's shares may be trading at a premium.

Key Takeaways

- Unlock more gems! Our Top European Dividend Stocks screener has unearthed 232 more companies for you to explore.Click here to unveil our expertly curated list of 235 Top European Dividend Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:PKN

Orlen

Operates in refining, petrochemical, energy, retail, gas, and upstream business.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives