- United States

- /

- Banks

- /

- NasdaqGS:FIBK

Top Dividend Stocks To Consider In September 2025

Reviewed by Simply Wall St

As the U.S. stock market navigates the uncertainty surrounding a potential government shutdown, major indices like the Dow Jones, Nasdaq, and S&P 500 remain relatively stable despite recent volatility. In such fluctuating conditions, dividend stocks can offer a measure of stability and income for investors seeking to balance risk with steady returns.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Rayonier (RYN) | 10.97% | ★★★★★☆ |

| Peoples Bancorp (PEBO) | 5.48% | ★★★★★☆ |

| OceanFirst Financial (OCFC) | 4.55% | ★★★★★★ |

| First Interstate BancSystem (FIBK) | 5.85% | ★★★★★★ |

| Ennis (EBF) | 5.52% | ★★★★★★ |

| Employers Holdings (EIG) | 3.05% | ★★★★★☆ |

| Douglas Dynamics (PLOW) | 3.79% | ★★★★★☆ |

| Columbia Banking System (COLB) | 5.61% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.68% | ★★★★★☆ |

| Banco Latinoamericano de Comercio Exterior S. A (BLX) | 5.40% | ★★★★★☆ |

Click here to see the full list of 126 stocks from our Top US Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

First Interstate BancSystem (FIBK)

Simply Wall St Dividend Rating: ★★★★★★

Overview: First Interstate BancSystem, Inc. is a bank holding company for First Interstate Bank offering various banking products and services in the United States, with a market cap of approximately $3.41 billion.

Operations: First Interstate BancSystem, Inc. generates revenue primarily from its Community Banking segment, which amounts to $935.30 million.

Dividend Yield: 5.9%

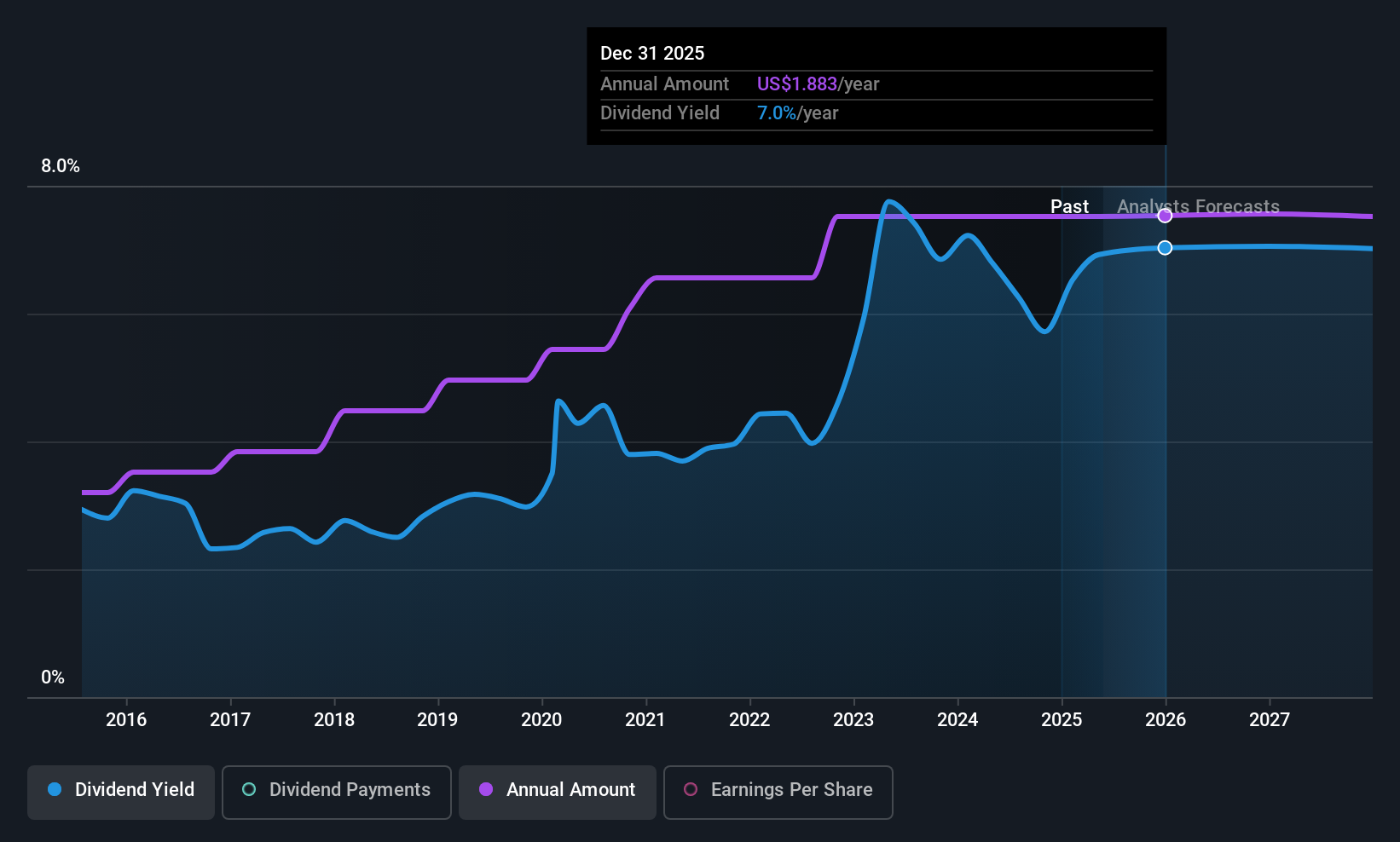

First Interstate BancSystem offers a high dividend yield of 5.85%, placing it in the top 25% of U.S. dividend payers, with dividends consistently increasing over the past decade. The payout ratio is currently 84.5%, indicating dividends are covered by earnings, and future coverage is projected to improve to 69.7%. Recent strategic leadership changes aim to enhance operations, potentially benefiting shareholders, while a US$150 million share repurchase program could further support stock value.

- Unlock comprehensive insights into our analysis of First Interstate BancSystem stock in this dividend report.

- The valuation report we've compiled suggests that First Interstate BancSystem's current price could be quite moderate.

Ituran Location and Control (ITRN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ituran Location and Control Ltd. offers location-based telematics services and machine-to-machine telematics products in Israel, Brazil, and internationally, with a market cap of approximately $697.87 million.

Operations: Ituran Location and Control Ltd. generates revenue from two primary segments: Telematics Products, contributing $92.54 million, and Telematics Services, accounting for $247.08 million.

Dividend Yield: 5.7%

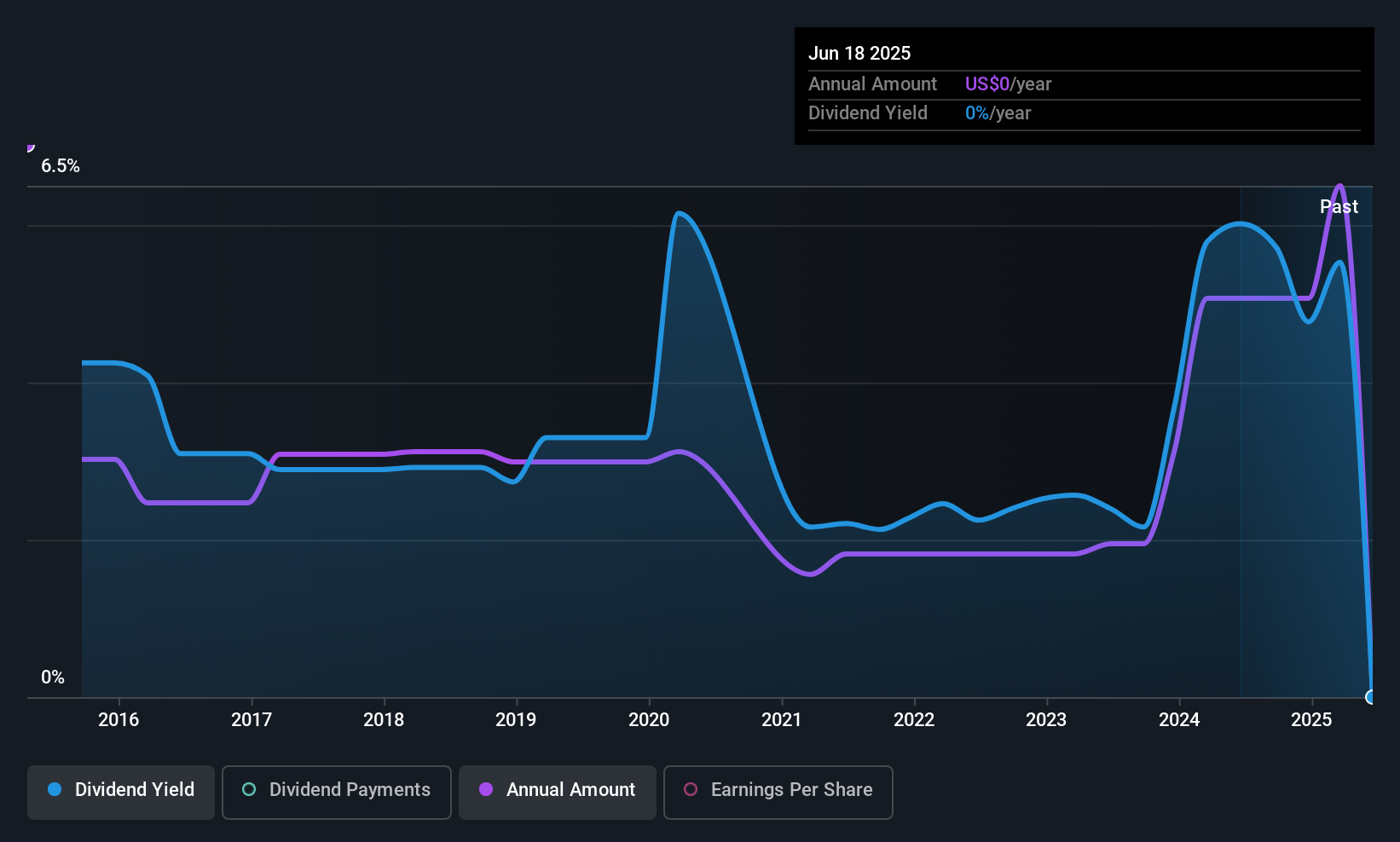

Ituran Location and Control's dividend yield of 5.68% ranks it among the top 25% of U.S. dividend payers, with a payout ratio of 67.7%, indicating dividends are covered by earnings and cash flows. Despite past volatility in payments, dividends have grown over the last decade. Recent affirmations include a US$0.50 per share dividend, totaling approximately US$10 million, payable on October 10, 2025, highlighting ongoing shareholder returns amidst steady earnings growth.

- Click to explore a detailed breakdown of our findings in Ituran Location and Control's dividend report.

- Our comprehensive valuation report raises the possibility that Ituran Location and Control is priced lower than what may be justified by its financials.

CompX International (CIX)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: CompX International Inc. manufactures and sells security products and recreational marine components primarily in North America, with a market cap of $298.71 million.

Operations: CompX International Inc.'s revenue is derived from two main segments: Marine Components, which contributes $34.67 million, and Security Products, which accounts for $118.06 million.

Dividend Yield: 5%

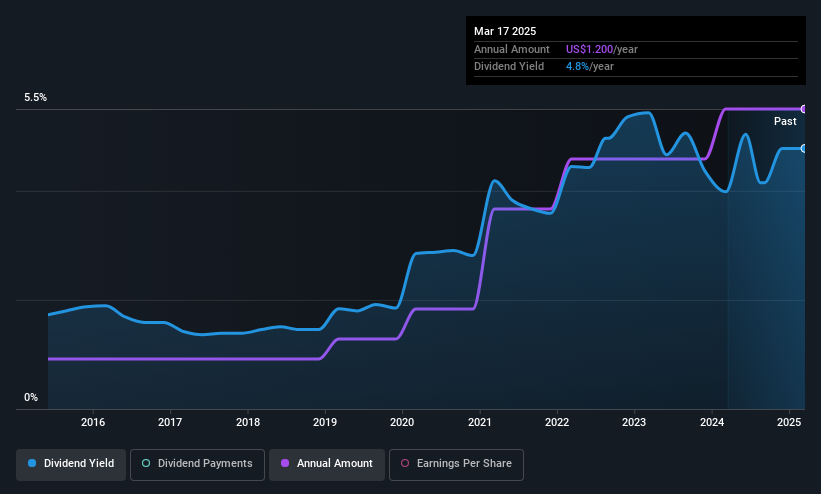

CompX International's dividend yield of 4.99% places it in the top 25% of U.S. dividend payers, though its high cash payout ratio of 112.3% indicates dividends are not well covered by free cash flows. Despite this, dividends have been stable and growing over the past decade. Recent announcements include a regular US$0.30 per share quarterly dividend and a special US$1.00 per share dividend, reflecting continued shareholder returns alongside improved earnings performance.

- Click here to discover the nuances of CompX International with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that CompX International is trading beyond its estimated value.

Next Steps

- Get an in-depth perspective on all 126 Top US Dividend Stocks by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FIBK

First Interstate BancSystem

Operates as the bank holding company for First Interstate Bank that provides a range of banking products and services in the United States.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives