- United States

- /

- Pharma

- /

- NYSE:JNJ

Top Dividend Stocks To Consider In July 2025

Reviewed by Simply Wall St

The United States market has been flat over the last week but is up 14% over the past year, with earnings forecast to grow by 15% annually. In this environment, dividend stocks can offer a reliable income stream and potential for capital appreciation, making them an attractive consideration for investors seeking stability and growth.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Universal (UVV) | 5.91% | ★★★★★★ |

| Peoples Bancorp (PEBO) | 5.17% | ★★★★★☆ |

| Huntington Bancshares (HBAN) | 3.65% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 6.11% | ★★★★★★ |

| Ennis (EBF) | 5.61% | ★★★★★★ |

| Douglas Dynamics (PLOW) | 4.06% | ★★★★★☆ |

| Dillard's (DDS) | 5.63% | ★★★★★★ |

| Credicorp (BAP) | 4.86% | ★★★★★☆ |

| CompX International (CIX) | 4.71% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.91% | ★★★★★★ |

Click here to see the full list of 138 stocks from our Top US Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

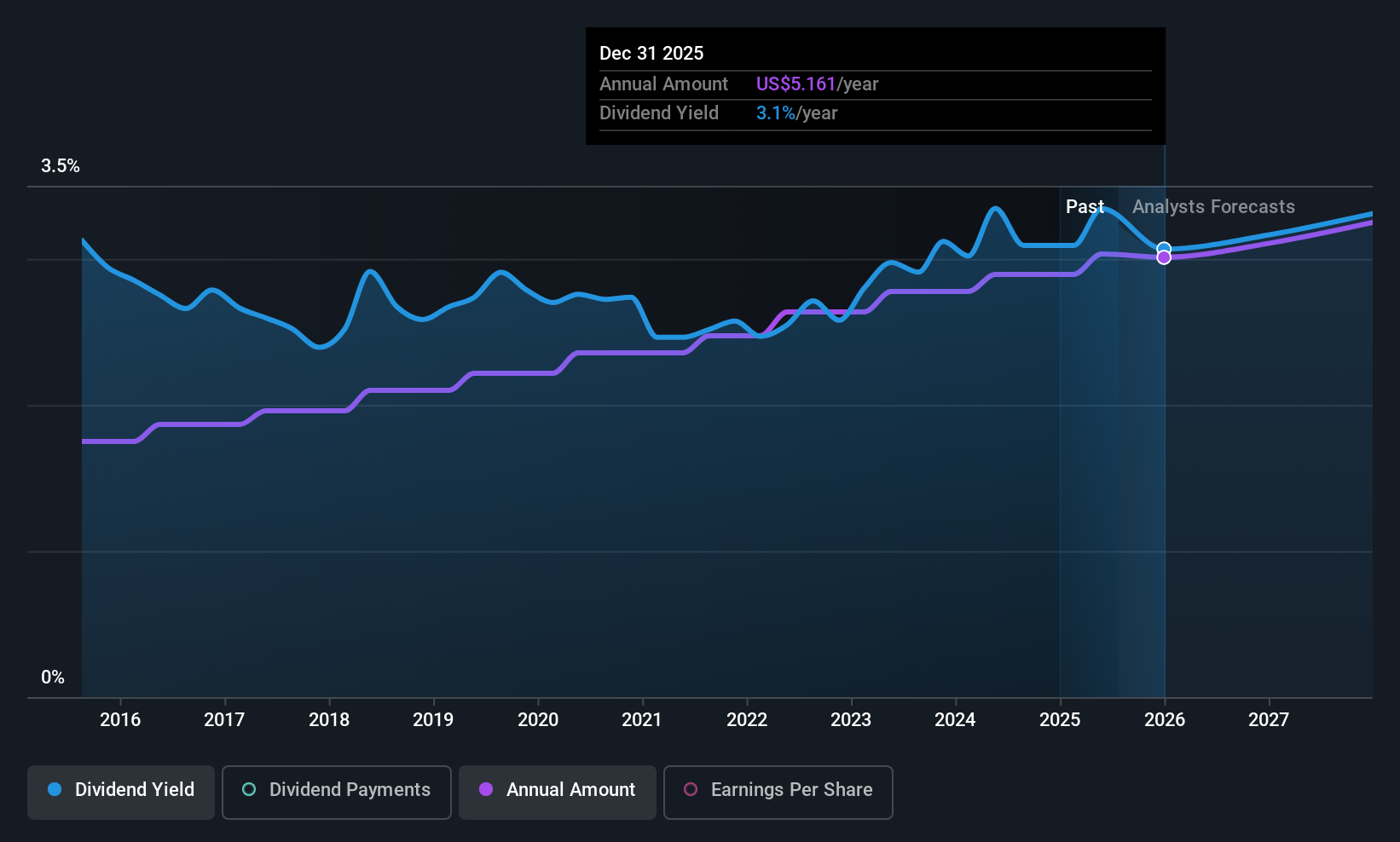

Johnson & Johnson (JNJ)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Johnson & Johnson, with a market cap of approximately $396.47 billion, operates globally in the healthcare sector through research and development, manufacturing, and sales of diverse healthcare products.

Operations: Johnson & Johnson's revenue is primarily derived from its Medtech segment, which generated $32.64 billion, and its Innovative Medicine segment, contributing $57.99 billion.

Dividend Yield: 3.2%

Johnson & Johnson's recent dividend affirmation of US$1.30 per share highlights its commitment to returning value to shareholders, supported by a stable payout ratio of 53.3%. Despite a lower yield compared to top-tier dividend payers, JNJ's dividends have shown consistent growth and stability over the past decade. The company's earnings have grown significantly, bolstering confidence in its ability to sustain dividends covered by both earnings and cash flows, despite facing legal challenges and product-related advancements.

- Navigate through the intricacies of Johnson & Johnson with our comprehensive dividend report here.

- According our valuation report, there's an indication that Johnson & Johnson's share price might be on the cheaper side.

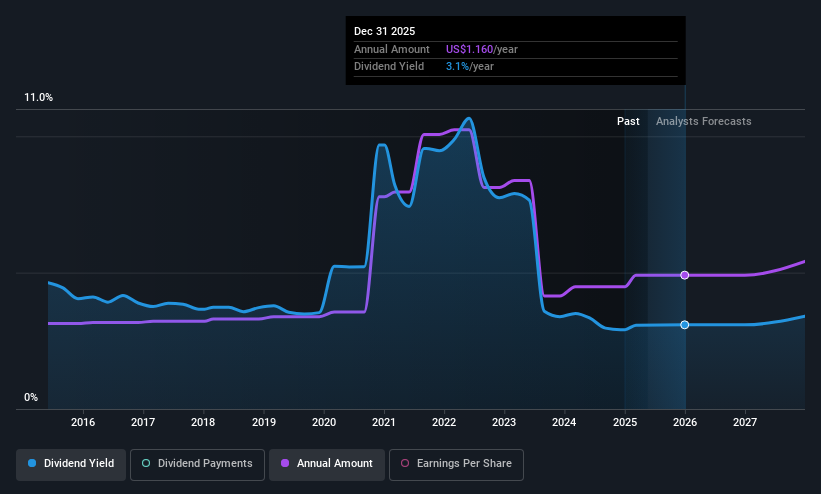

Old Republic International (ORI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Old Republic International Corporation, with a market cap of $8.95 billion, operates through its subsidiaries to provide insurance underwriting and related services primarily in the United States and Canada.

Operations: Old Republic International Corporation generates revenue primarily from its Specialty Insurance segment with $5.57 billion and Title Insurance segment with $2.74 billion, focusing on insurance underwriting and related services in the United States and Canada.

Dividend Yield: 3.2%

Old Republic International's dividend payments, though historically volatile, are currently well-covered by earnings (34.9% payout ratio) and cash flows (21.7% cash payout ratio). Recent affirmations show a 9.4% increase in dividends to US$1.16 per share annually, despite a yield lower than top-tier payers. The company's strategic partnership with Endurance Vehicle Services aims to enhance underwriting resources, while executive changes may influence future stability and growth prospects in its specialty insurance operations.

- Click here to discover the nuances of Old Republic International with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Old Republic International is priced lower than what may be justified by its financials.

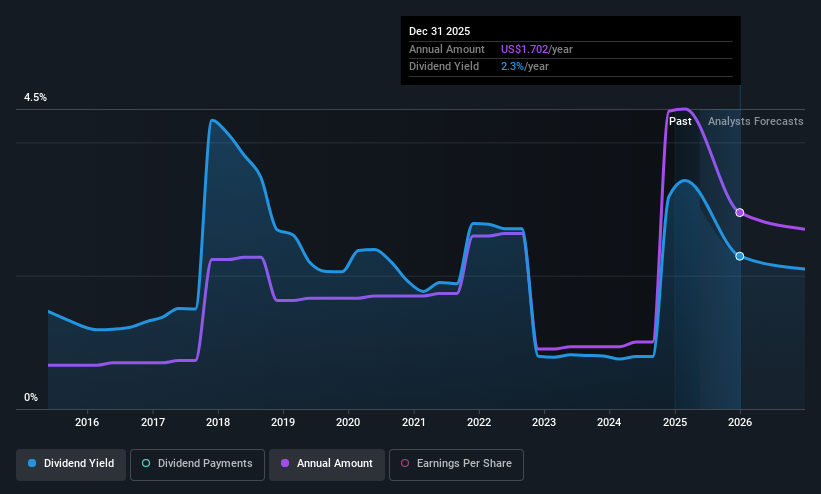

RLI (RLI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: RLI Corp. is an insurance holding company that underwrites property, casualty, and surety insurance products, with a market cap of $6.47 billion.

Operations: RLI Corp.'s revenue segments include $145.95 million from surety, $883.61 million from casualty, and $534.52 million from property insurance products.

Dividend Yield: 3.7%

RLI's dividend payments have grown over the past decade, supported by a low payout ratio of 18.9% and a cash payout ratio of 40.6%, ensuring sustainability despite volatility in its dividend history. The recent 6.7% increase to US$0.16 per share highlights ongoing commitment to shareholders, although the yield remains below top-tier levels at 3.7%. A new partnership with Simply Business expands RLI's product offerings, potentially enhancing future revenue streams in specialty insurance markets.

- Unlock comprehensive insights into our analysis of RLI stock in this dividend report.

- Upon reviewing our latest valuation report, RLI's share price might be too optimistic.

Summing It All Up

- Take a closer look at our Top US Dividend Stocks list of 138 companies by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JNJ

Johnson & Johnson

Engages in the research and development, manufacture, and sale of various products in the healthcare field worldwide.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives