As of early September 2025, the Australian stock market has seen mixed performances, with the ASX200 retreating intraday and sectors such as energy lagging while IT remains on top. In this environment of fluctuating sentiment and potential interest rate cuts in the US, dividend stocks can offer stability and income, making them an appealing choice for investors looking to navigate uncertain market conditions.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Sugar Terminals (NSX:SUG) | 7.92% | ★★★★★☆ |

| Steadfast Group (ASX:SDF) | 3.20% | ★★★★★☆ |

| Smartgroup (ASX:SIQ) | 5.82% | ★★★★★☆ |

| New Hope (ASX:NHC) | 9.21% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.75% | ★★★★★☆ |

| Lindsay Australia (ASX:LAU) | 5.63% | ★★★★★☆ |

| Kina Securities (ASX:KSL) | 7.38% | ★★★★★☆ |

| Joyce (ASX:JYC) | 5.19% | ★★★★☆☆ |

| Fiducian Group (ASX:FID) | 3.96% | ★★★★★☆ |

| EQT Holdings (ASX:EQT) | 4.28% | ★★★★★☆ |

Click here to see the full list of 30 stocks from our Top ASX Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

CTI Logistics (ASX:CLX)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CTI Logistics Limited, with a market cap of A$151.42 million, operates in Australia providing transport and logistics services through its subsidiaries.

Operations: CTI Logistics Limited generates revenue primarily from its Transport segment at A$232.21 million and its Logistics segment at A$126.96 million, with additional income from Property amounting to A$9.69 million.

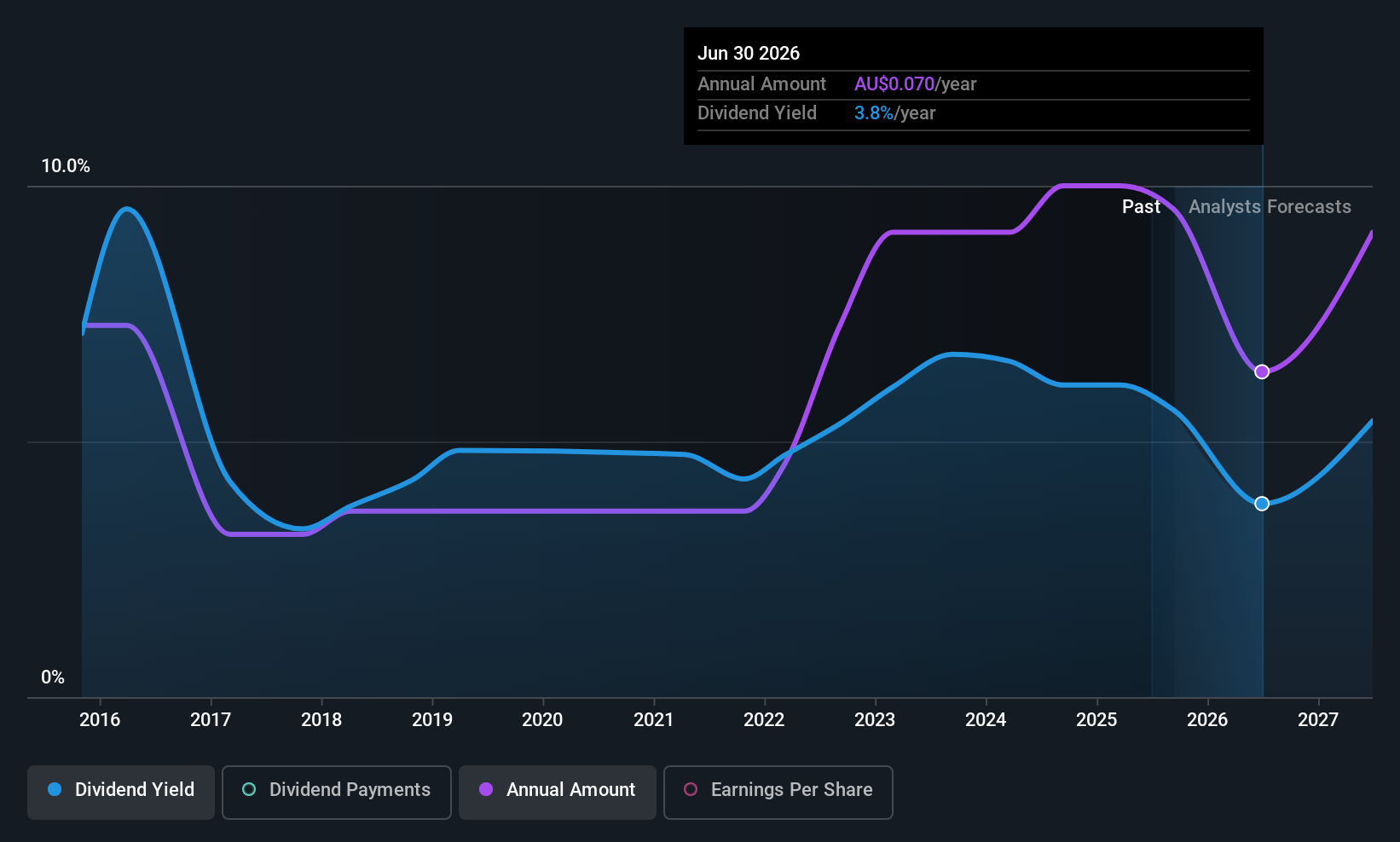

Dividend Yield: 5.6%

CTI Logistics recently affirmed a dividend of A$0.055 per share, with payments set for October 2, 2025. Despite a payout ratio of 57.6%, indicating coverage by earnings, the dividend is not well-supported by free cash flows due to a high cash payout ratio of 114%. Historically volatile and unreliable over the past decade, CTI's dividends have nonetheless grown during this period. The stock trades at good value relative to peers and industry standards in Australia.

- Delve into the full analysis dividend report here for a deeper understanding of CTI Logistics.

- The analysis detailed in our CTI Logistics valuation report hints at an deflated share price compared to its estimated value.

Service Stream (ASX:SSM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Service Stream Limited is an Australian company involved in the design, construction, operation, and maintenance of infrastructure networks across telecommunications, utilities, and transport sectors with a market cap of A$1.22 billion.

Operations: Service Stream Limited generates revenue from three primary segments: Telecommunications (A$1.17 billion), Utilities (A$1.01 billion), and Transport (A$154.23 million).

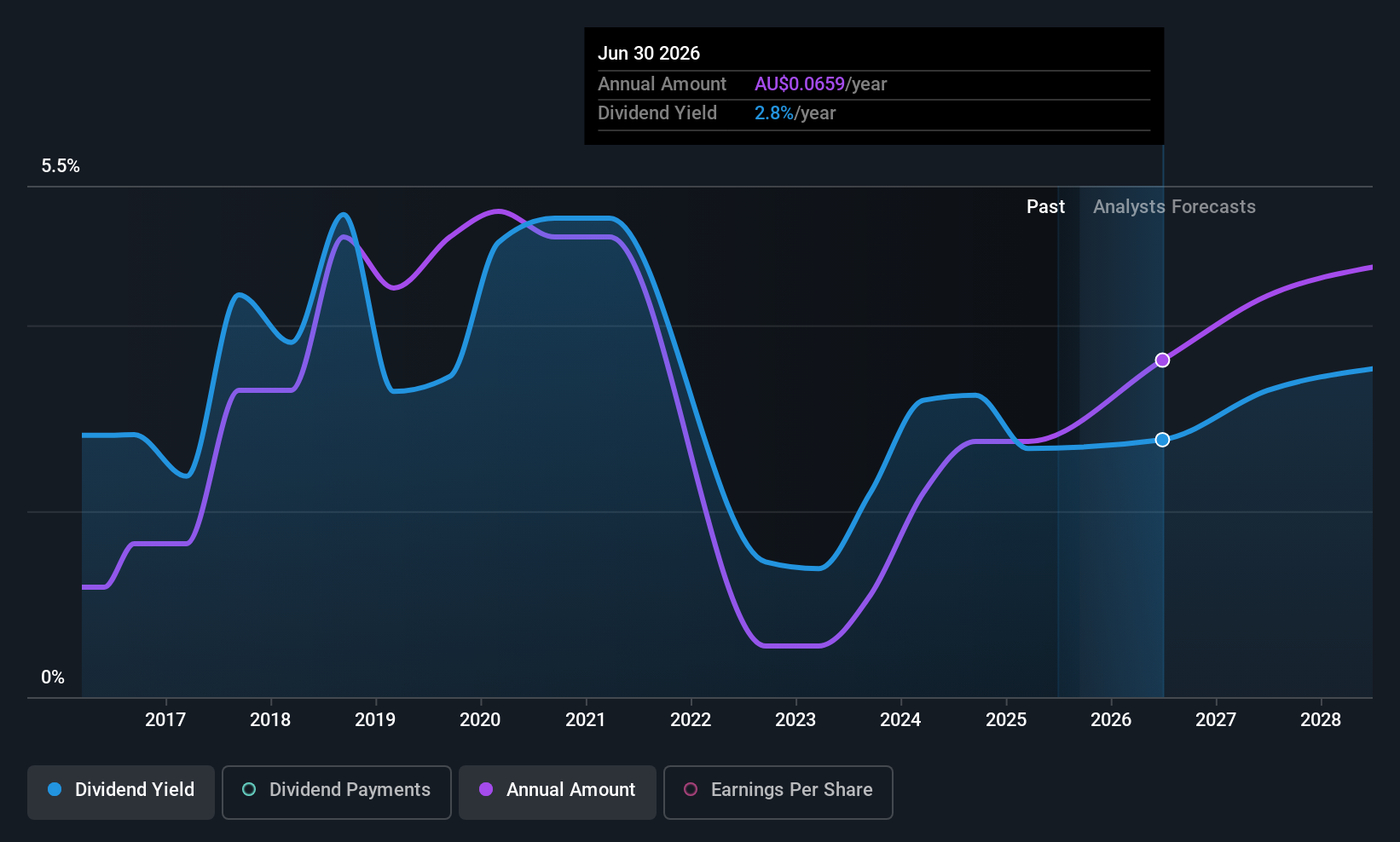

Dividend Yield: 3%

Service Stream announced a fully franked dividend of A$0.03 per share, payable on October 3, 2025. With a payout ratio of 56.9%, dividends are well-covered by both earnings and cash flows, though the yield is modest compared to top Australian payers. Earnings rose significantly last year, and potential M&A activity could impact future dividends. Despite past volatility in payments, the company has increased its dividend over the last decade and trades below estimated fair value.

- Get an in-depth perspective on Service Stream's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Service Stream's share price might be too pessimistic.

Super Retail Group (ASX:SUL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Super Retail Group Limited operates in the retail sector, offering auto, sports, and outdoor leisure products across Australia and New Zealand, with a market cap of A$4.12 billion.

Operations: Super Retail Group Limited generates revenue through its distinct segments: Rebel at A$1.36 billion, Macpac at A$231.40 million, Super Cheap Auto (SCA) at A$1.53 billion, and Boating, Camping and Fishing (BCF) at A$950.70 million.

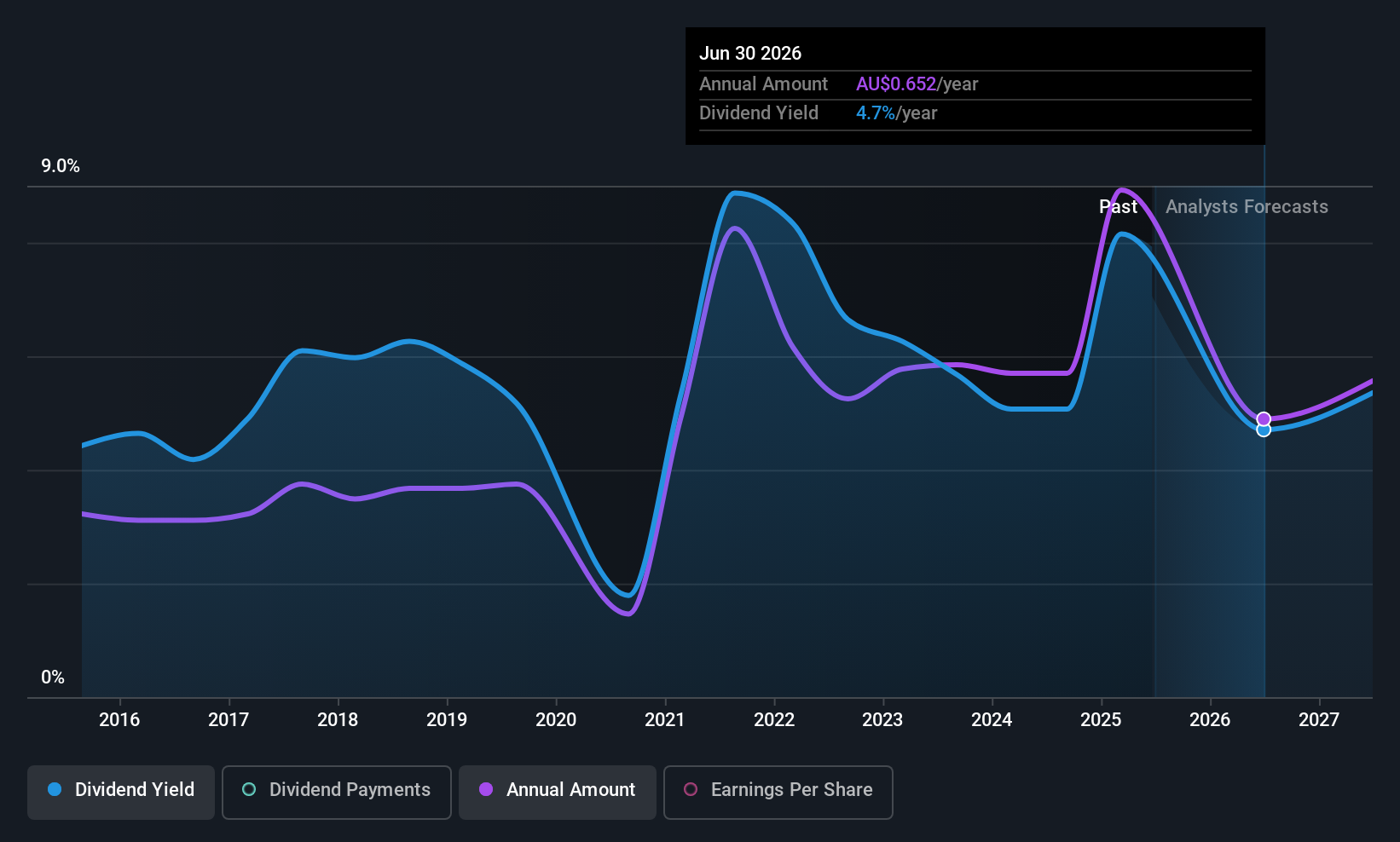

Dividend Yield: 5.3%

Super Retail Group declared a regular dividend of A$0.34 and a special dividend of A$0.30, payable on October 16, 2025. Despite trading at 52% below estimated fair value, its dividend yield is slightly lower than top Australian payers. While dividends are well-covered by earnings and cash flows with payout ratios of 67.2% and 52.7%, respectively, the company has an unstable track record due to past volatility in payments over the last decade.

- Click to explore a detailed breakdown of our findings in Super Retail Group's dividend report.

- Our valuation report unveils the possibility Super Retail Group's shares may be trading at a discount.

Seize The Opportunity

- Unlock our comprehensive list of 30 Top ASX Dividend Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CLX

CTI Logistics

Engages in the provision of transport and logistics services in Australia.

Undervalued with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives