As global markets experience a wave of optimism fueled by easing trade tensions and positive economic signals, Asian indices have seen notable gains, particularly with the recent developments between the U.S. and China. Amidst this backdrop, investors are increasingly drawn to dividend stocks in Asia as a way to capitalize on stable income streams while navigating the current market dynamics.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Nissan Chemical (TSE:4021) | 4.04% | ★★★★★★ |

| NCD (TSE:4783) | 4.25% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.34% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.48% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.46% | ★★★★★★ |

| ENEOS Holdings (TSE:5020) | 4.23% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.36% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 4.05% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.00% | ★★★★★★ |

| Asian Terminals (PSE:ATI) | 6.32% | ★★★★★★ |

Click here to see the full list of 1234 stocks from our Top Asian Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Zhejiang Chinastars New Materials Group (SZSE:301077)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Zhejiang Chinastars New Materials Group Co., Ltd. (SZSE:301077) operates in the materials industry with a market cap of CN¥3.43 billion.

Operations: Zhejiang Chinastars New Materials Group Co., Ltd. generates its revenue from various segments within the materials industry.

Dividend Yield: 3.7%

Zhejiang Chinastars New Materials Group's dividend yield of 3.73% ranks in the top 25% of Chinese dividend payers, supported by an earnings payout ratio of 86.6%. However, its dividends have been unstable over its short three-year history. Recent earnings growth and a proposed CNY 8 cash dividend per 10 shares for 2024 highlight potential, though past volatility and a highly volatile share price suggest caution for income-focused investors.

- Click here and access our complete dividend analysis report to understand the dynamics of Zhejiang Chinastars New Materials Group.

- The valuation report we've compiled suggests that Zhejiang Chinastars New Materials Group's current price could be quite moderate.

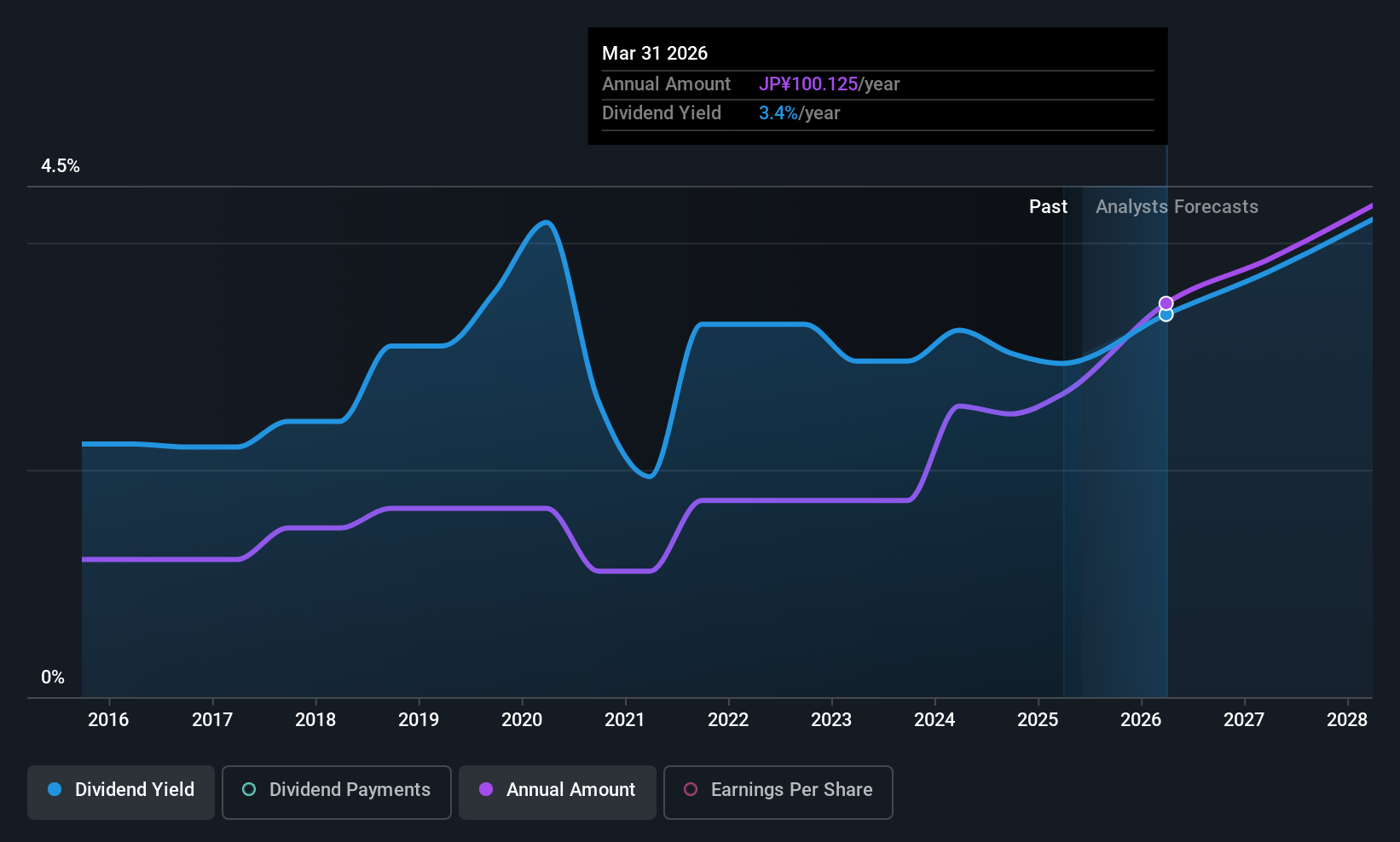

Sumitomo Electric Industries (TSE:5802)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sumitomo Electric Industries, Ltd. is a global manufacturer and seller of electric wires and cables with a market capitalization of ¥2.43 trillion.

Operations: Sumitomo Electric Industries, Ltd. generates revenue from several segments including Automotive (¥2.73 billion), Electronics (¥377.25 million), Infocommunications (¥223.28 million), Environment & Energy (¥1.08 billion), and Industrial Materials & Others (¥372.67 million).

Dividend Yield: 3.2%

Sumitomo Electric Industries offers dividend potential with a low payout ratio of 39%, ensuring dividends are well-covered by earnings and cash flows. Recent increases in dividend payments, such as JPY 61 per share for the fiscal year ended March 2025, contrast with historical volatility and an expected decrease to JPY 50 per share by March 2026. Despite trading below fair value, its unstable dividend history and volatile stock price may concern income-focused investors.

- Click here to discover the nuances of Sumitomo Electric Industries with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Sumitomo Electric Industries is trading behind its estimated value.

CKD (TSE:6407)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CKD Corporation specializes in the development, manufacturing, sale, and export of automation machinery and various control components globally, with a market cap of ¥177.09 billion.

Operations: CKD Corporation's revenue is primarily derived from its automation machinery, drive components, pneumatic control components, pneumatic auxiliary components, and fluid control components.

Dividend Yield: 3%

CKD Corporation's dividend profile is mixed, with recent increases such as a year-end dividend of ¥42 per share for fiscal 2025, up from ¥26 the previous year. Despite this growth, dividends have been volatile over the past decade. The payout ratio remains sustainable at 37.4%, supported by cash flows (40.5%). However, its yield of 3.02% lags behind top-tier Japanese payers (3.99%). Recent announcements confirm stable guidance for future dividends and earnings growth forecasts remain positive.

- Get an in-depth perspective on CKD's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that CKD is priced lower than what may be justified by its financials.

Make It Happen

- Click through to start exploring the rest of the 1231 Top Asian Dividend Stocks now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Zhejiang Chinastars New Materials Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301077

Zhejiang Chinastars New Materials Group

Zhejiang Chinastars New Materials Group Co., Ltd.

Solid track record with excellent balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)