- United States

- /

- Media

- /

- NYSE:IPG

Top 3 Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As the Dow Jones Industrial Average tumbles and oil prices surge due to escalating geopolitical tensions, investors are closely monitoring market volatility and its impact on their portfolios. In such uncertain times, dividend stocks can offer a measure of stability and income generation, making them an attractive option for those looking to navigate the current economic landscape.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Valley National Bancorp (VLY) | 4.93% | ★★★★★☆ |

| Universal (UVV) | 5.37% | ★★★★★★ |

| Southside Bancshares (SBSI) | 5.03% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 6.85% | ★★★★★★ |

| Ennis (EBF) | 5.30% | ★★★★★★ |

| Dillard's (DDS) | 6.46% | ★★★★★★ |

| CompX International (CIX) | 4.92% | ★★★★★★ |

| Columbia Banking System (COLB) | 6.16% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.94% | ★★★★★☆ |

| Chevron (CVX) | 4.72% | ★★★★★★ |

Click here to see the full list of 145 stocks from our Top US Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Sierra Bancorp (BSRR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sierra Bancorp is the bank holding company for Bank of the Sierra, offering retail and commercial banking products and services to individuals and businesses in California, with a market cap of $381.63 million.

Operations: Sierra Bancorp generates revenue primarily through its banking segment, which accounted for $144.26 million.

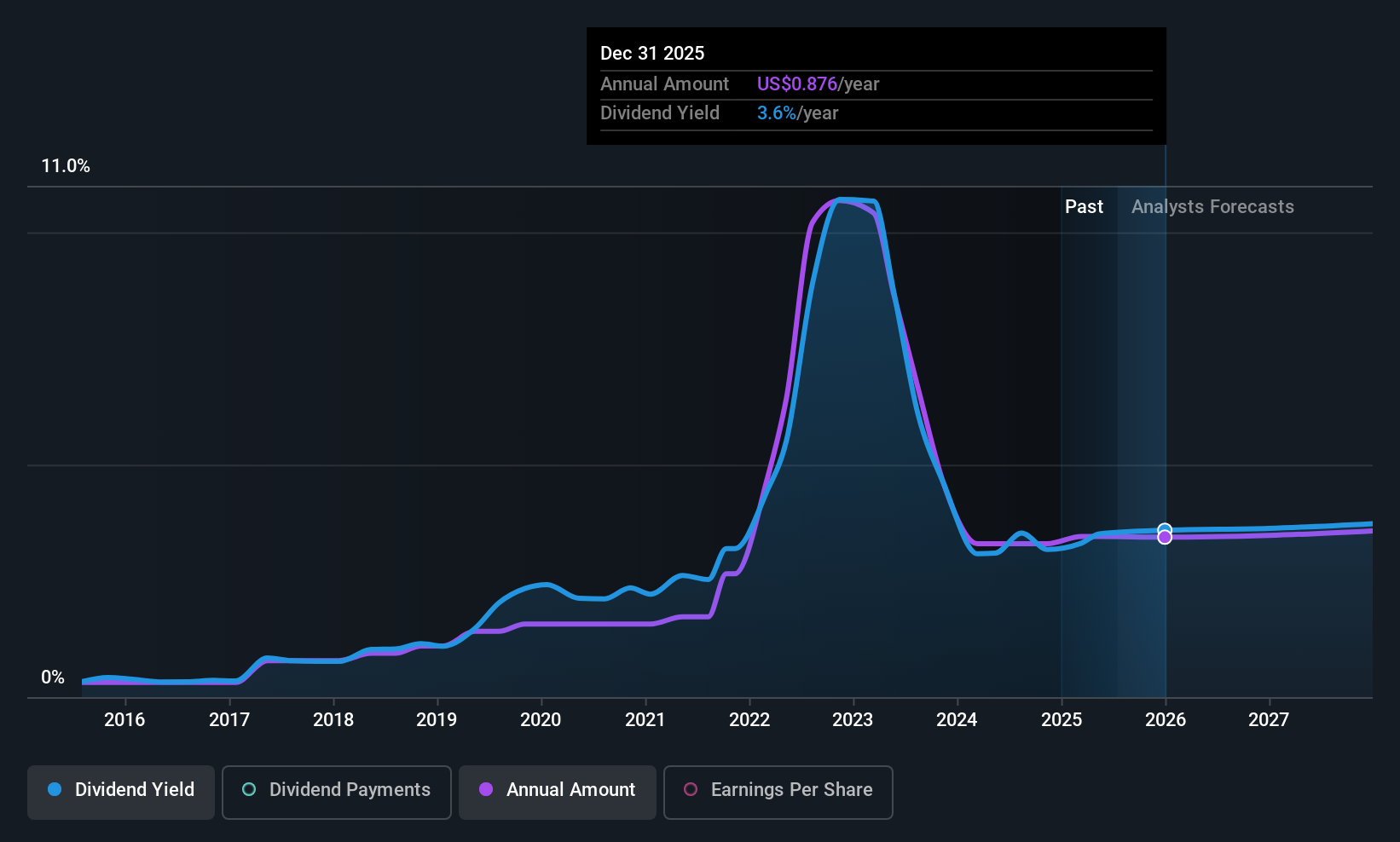

Dividend Yield: 3.6%

Sierra Bancorp offers a reliable dividend, growing steadily over the past decade with a current yield of 3.56%, though it lags behind the top US dividend payers. Its dividends are well-covered by earnings due to a low payout ratio of 34.3%. Recent financials show stable net interest income and slight growth in earnings per share. The company has completed significant share buybacks, enhancing shareholder value while maintaining consistent quarterly dividends.

- Unlock comprehensive insights into our analysis of Sierra Bancorp stock in this dividend report.

- The analysis detailed in our Sierra Bancorp valuation report hints at an deflated share price compared to its estimated value.

Coterra Energy (CTRA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Coterra Energy Inc. is an independent oil and gas company focused on the exploration, development, and production of oil, natural gas, and natural gas liquids in the United States with a market cap of $19.68 billion.

Operations: Coterra Energy Inc. generates its revenue primarily from the development, exploitation, exploration, and production of natural gas and oil, amounting to $5.80 billion.

Dividend Yield: 3.4%

Coterra Energy's dividend payments, covered by earnings (49.2% payout ratio) and cash flows (53.3% cash payout ratio), have been volatile over the past decade despite recent increases. The dividend yield of 3.37% is below top US payers, and significant insider selling raises concerns. Recent Q1 2025 results showed strong revenue growth to US$1.90 billion and net income of US$516 million, while ongoing share buybacks enhance shareholder value with a completed repurchase worth US$888.28 million.

- Click here and access our complete dividend analysis report to understand the dynamics of Coterra Energy.

- Our valuation report here indicates Coterra Energy may be undervalued.

Interpublic Group of Companies (IPG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: The Interpublic Group of Companies, Inc. is a global provider of advertising and marketing services with a market capitalization of approximately $8.78 billion.

Operations: Interpublic Group of Companies generates its revenue from three main segments: Media, Data & Engagement Solutions ($4.14 billion), Integrated Advertising & Creativity Led ($3.44 billion), and Specialized Communications & Experiential Solutions ($1.42 billion).

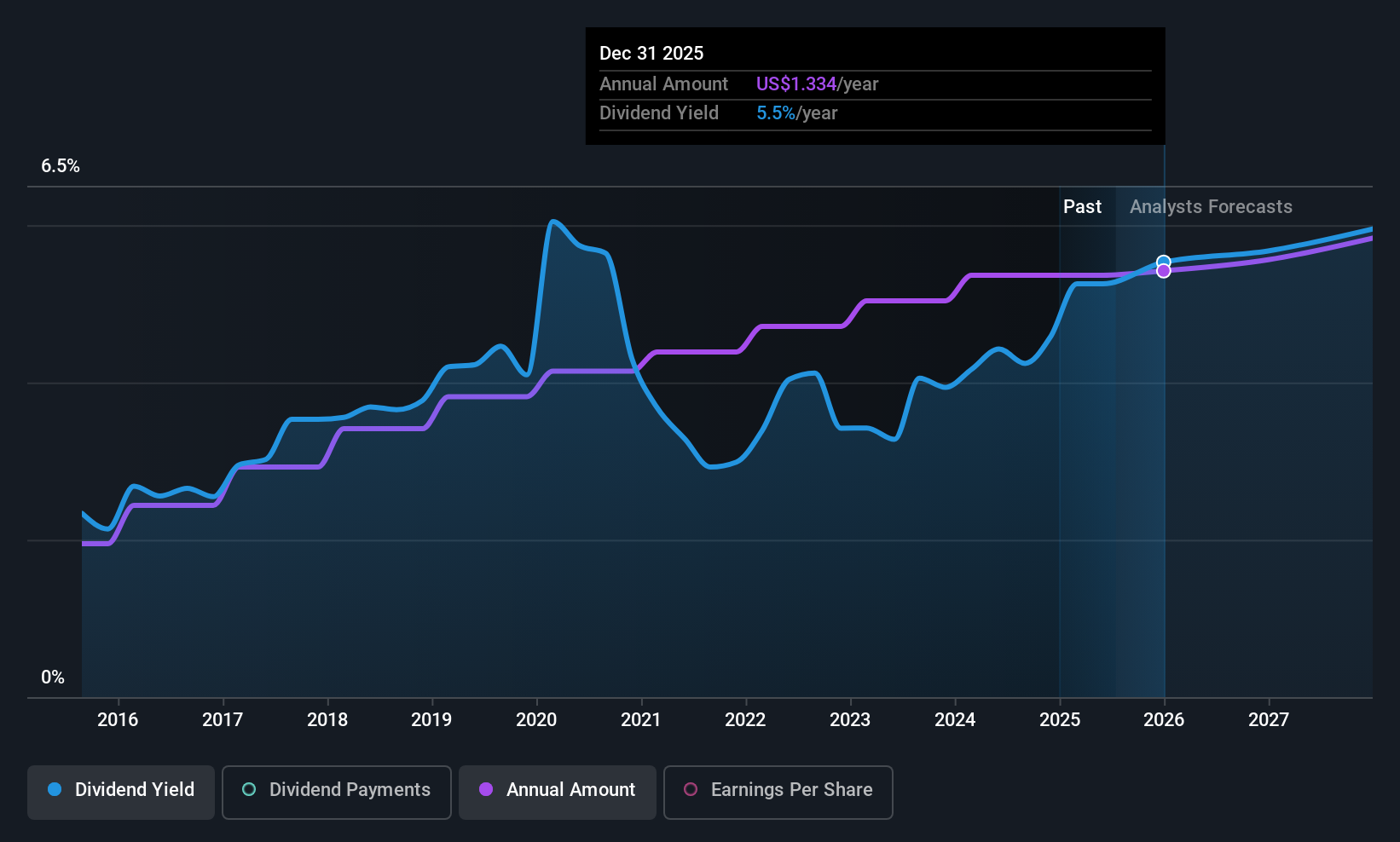

Dividend Yield: 5.6%

Interpublic Group's dividend yield of 5.58% ranks in the top 25% of US payers, yet its sustainability is questionable due to a high payout ratio of 99.9%, not covered by earnings despite being well-covered by cash flows (46.6%). Dividends have been stable and growing over the past decade, but recent financials show challenges with a Q1 net loss of US$85.4 million and declining revenues to US$2.32 billion from last year’s US$2.50 billion.

- Click here to discover the nuances of Interpublic Group of Companies with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Interpublic Group of Companies' share price might be too pessimistic.

Make It Happen

- Click this link to deep-dive into the 145 companies within our Top US Dividend Stocks screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IPG

Interpublic Group of Companies

Provides advertising and marketing services worldwide.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion