- United States

- /

- Consumer Durables

- /

- NYSE:SN

Three Stocks Estimated To Be Undervalued In July 2025

Reviewed by Simply Wall St

Over the past year, the United States market has experienced a 13% increase despite remaining flat over the past week, with earnings expected to grow by 15% annually. In this environment, identifying undervalued stocks can be crucial for investors seeking opportunities that may offer potential value relative to their current price levels.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Roku (ROKU) | $90.25 | $174.09 | 48.2% |

| Robert Half (RHI) | $42.92 | $83.09 | 48.3% |

| Ligand Pharmaceuticals (LGND) | $124.98 | $240.64 | 48.1% |

| Insteel Industries (IIIN) | $39.67 | $77.33 | 48.7% |

| e.l.f. Beauty (ELF) | $115.37 | $228.96 | 49.6% |

| Carter Bankshares (CARE) | $18.22 | $35.50 | 48.7% |

| Camden National (CAC) | $43.50 | $83.56 | 47.9% |

| Atlantic Union Bankshares (AUB) | $33.67 | $65.54 | 48.6% |

| ACNB (ACNB) | $44.16 | $84.62 | 47.8% |

| Acadia Realty Trust (AKR) | $18.43 | $36.55 | 49.6% |

Here we highlight a subset of our preferred stocks from the screener.

Roku (ROKU)

Overview: Roku, Inc., along with its subsidiaries, operates a TV streaming platform both in the United States and internationally, with a market cap of approximately $13.24 billion.

Operations: The company's revenue is derived from two main segments: Devices, contributing $603.44 million, and Platform, generating $3.65 billion.

Estimated Discount To Fair Value: 48.2%

Roku is trading at US$90.25, significantly below its estimated fair value of US$174.09, indicating potential undervaluation based on cash flows. The company's revenue is projected to grow faster than the overall U.S. market, with a forecasted annual growth rate of 10%. Recent partnerships, such as with Amazon Ads for CTV integration, enhance Roku's market reach and could drive future performance improvements despite current low return on equity forecasts.

- Insights from our recent growth report point to a promising forecast for Roku's business outlook.

- Delve into the full analysis health report here for a deeper understanding of Roku.

Bloom Energy (BE)

Overview: Bloom Energy Corporation designs, manufactures, sells, and installs solid-oxide fuel cell systems for on-site power generation in the United States and internationally, with a market cap of approximately $6.67 billion.

Operations: The company's revenue is primarily derived from its electric equipment segment, which generated $1.56 billion.

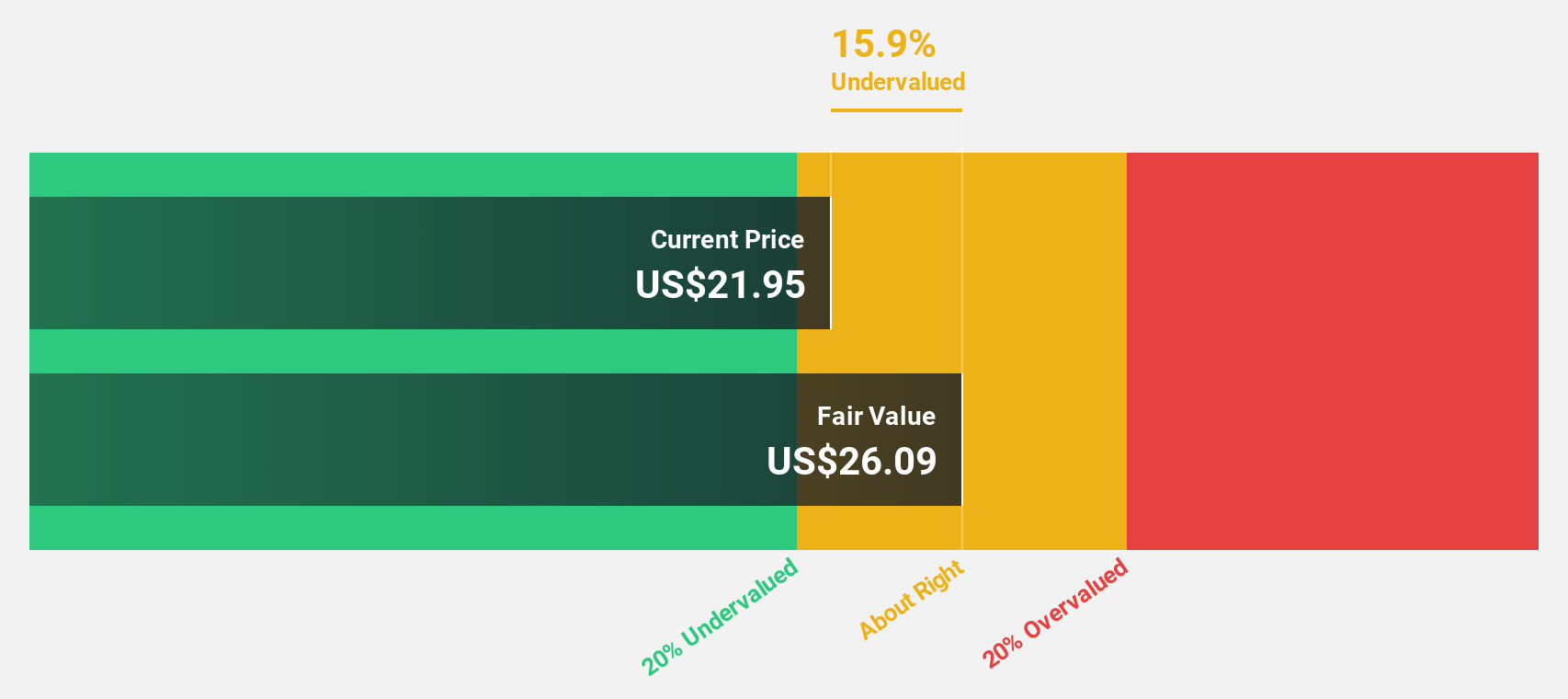

Estimated Discount To Fair Value: 11%

Bloom Energy, trading at US$25.85, is slightly undervalued compared to its fair value of US$29.03. Revenue growth is expected to outpace the broader U.S. market at 14.5% annually, though it remains below the 20% threshold for high growth. Earnings are projected to grow significantly at 48.1% per year, surpassing market averages despite recent index exclusions and interest coverage concerns from earnings not fully covering interest payments on debt obligations.

- Our earnings growth report unveils the potential for significant increases in Bloom Energy's future results.

- Click here to discover the nuances of Bloom Energy with our detailed financial health report.

SharkNinja (SN)

Overview: SharkNinja, Inc. is a product design and technology company that offers consumer solutions in the United States, China, and internationally with a market cap of $15.34 billion.

Operations: SharkNinja's revenue primarily comes from its Appliance & Tool segment, which generated $5.69 billion.

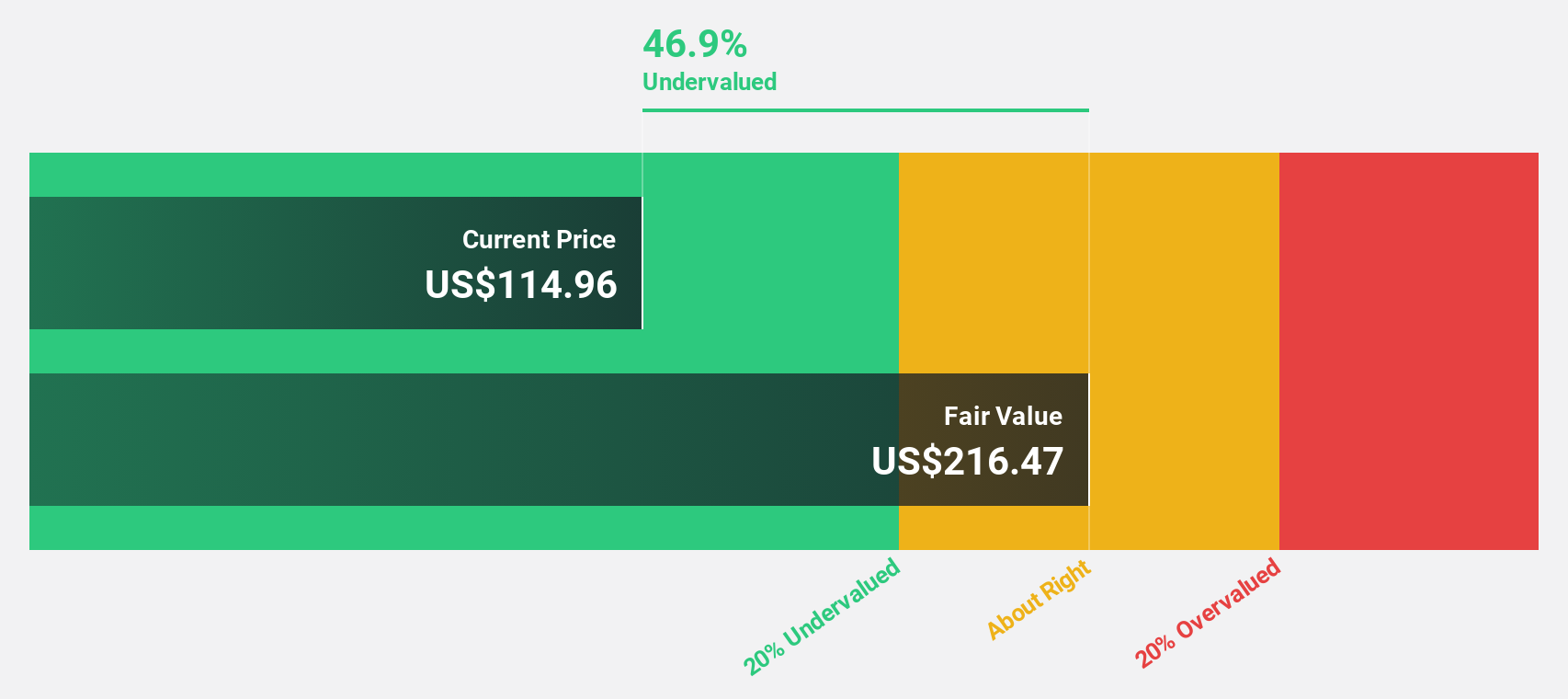

Estimated Discount To Fair Value: 47%

SharkNinja, trading at US$111.19, is significantly undervalued relative to its fair value of US$209.79. The company's earnings are projected to grow annually at 19.3%, outpacing the U.S. market average of 14.8%. Despite a slower revenue growth forecast of 9.4% per year, SharkNinja's recent strategic initiatives, including new product launches and executive appointments like Mike Harris as Chief Innovation & Technology Officer, may bolster future cash flows and operational efficiency.

- According our earnings growth report, there's an indication that SharkNinja might be ready to expand.

- Dive into the specifics of SharkNinja here with our thorough financial health report.

Summing It All Up

- Investigate our full lineup of 181 Undervalued US Stocks Based On Cash Flows right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SN

SharkNinja

A product design and technology company, engages in the provision of various solutions for consumers in the United States, China, and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives