- India

- /

- Paper and Forestry Products

- /

- NSEI:RUCHIRA

There's No Escaping Ruchira Papers Limited's (NSE:RUCHIRA) Muted Earnings

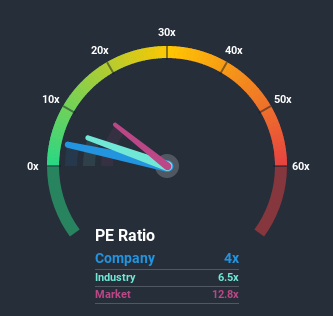

Ruchira Papers Limited's (NSE:RUCHIRA) price-to-earnings (or "P/E") ratio of 4x might make it look like a strong buy right now compared to the market in India, where around half of the companies have P/E ratios above 13x and even P/E's above 31x are quite common. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

As an illustration, earnings have deteriorated at Ruchira Papers over the last year, which is not ideal at all. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Ruchira Papers

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Ruchira Papers would need to produce anemic growth that's substantially trailing the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 35%. As a result, earnings from three years ago have also fallen 22% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

This is in contrast to the rest of the market, which is expected to decline by 3.2% over the next year, or less than the company's recent medium-term annualised earnings decline.

With this information, it's not too hard to see why Ruchira Papers is trading at a lower P/E in comparison. Nonetheless, with earnings going quickly in reverse, it's not guaranteed that the P/E has found a floor yet. Even just maintaining these prices will be difficult to achieve as recent earnings trends are already weighing down the shares heavily.

The Key Takeaway

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Ruchira Papers maintains its low P/E on the weakness of its recentthree-year earnings being even worse than the forecasts for a struggling market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. However, we're still cautious about the company's ability to prevent an acceleration of its recent medium-term course and resist even greater pain to its business from the broader market turmoil. In the meantime, unless the company's relative performance improves, the share price will hit a barrier around these levels.

Before you settle on your opinion, we've discovered 3 warning signs for Ruchira Papers that you should be aware of.

Of course, you might also be able to find a better stock than Ruchira Papers. So you may wish to see this free collection of other companies that sit on P/E's below 20x and have grown earnings strongly.

When trading Ruchira Papers or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:RUCHIRA

Ruchira Papers

Manufactures and markets kraft paper, and writing and printing paper products in India and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives