- United States

- /

- Transportation

- /

- NYSE:XPO

The XPO Logistics (NYSE:XPO) Share Price Is Up 133% And Shareholders Are Boasting About It

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

When you buy a stock there is always a possibility that it could drop 100%. But on a lighter note, a good company can see its share price rise well over 100%. Long term XPO Logistics, Inc. (NYSE:XPO) shareholders would be well aware of this, since the stock is up 133% in five years. We note the stock price is up 6.2% in the last seven days.

View our latest analysis for XPO Logistics

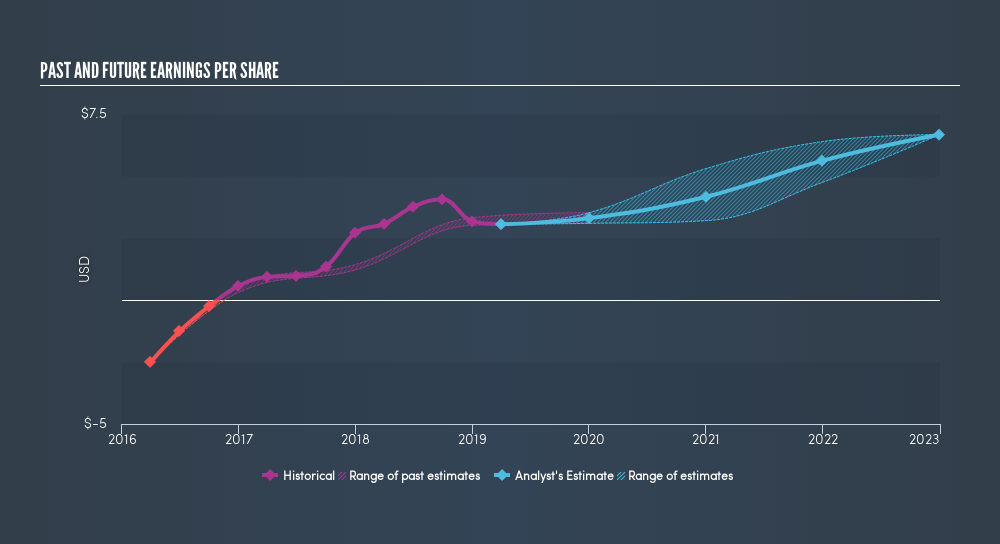

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the five years of share price growth, XPO Logistics moved from a loss to profitability. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

We know that XPO Logistics has improved its bottom line over the last three years, but what does the future have in store? It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Investors in XPO Logistics had a tough year, with a total loss of 39%, against a market gain of about 5.7%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 18% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. Is XPO Logistics cheap compared to other companies? These 3 valuation measures might help you decide.

We will like XPO Logistics better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:XPO

XPO

Provides freight transportation services in the United States, North America, France, the United Kingdom, and rest of Europe.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives