- United States

- /

- Auto

- /

- NasdaqGS:TSLA

Tesla (NasdaqGS:TSLA) Appoints Jack Hartung To Board To Enhance Financial Oversight

Reviewed by Simply Wall St

Tesla (NasdaqGS:TSLA) recently announced the appointment of Jack Hartung to its board, a move that signals a focus on strengthening its financial oversight. Alongside amendments to its company bylaws, such as introducing a jury trial waiver, these governance efforts aim to bolster shareholder confidence. Despite an 8% quarterly rise in Tesla's stock price, external events like the legal wrangle involving its self-driving technology allegations and a partnership with Kia EV owners to access its Supercharger network might have provided mixed influences. Market trends, particularly the tech sector's recent rallies, also likely influenced the stock's upward momentum.

You should learn about the 2 possible red flags we've spotted with Tesla.

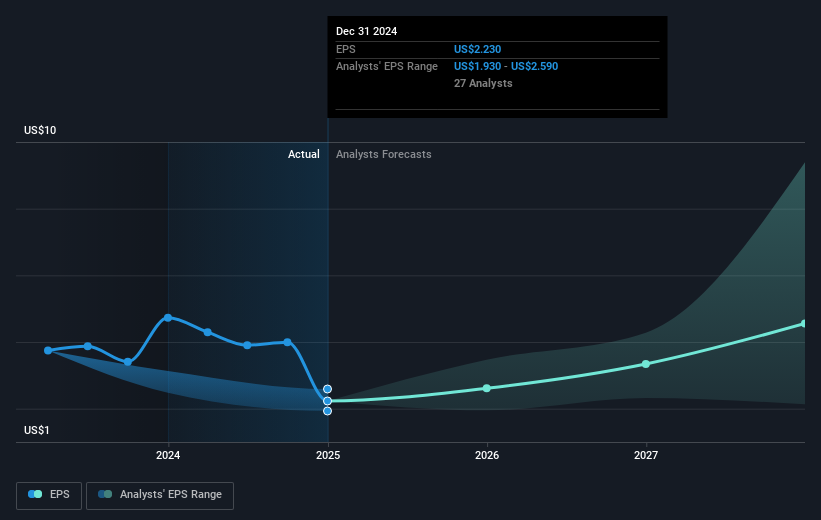

Tesla's recent governance changes, including the appointment of Jack Hartung to its board, could have several implications on its future trajectory. Enhancing financial oversight and modifying bylaws such as the jury trial waiver may foster investor confidence, thereby potentially impacting Tesla's revenue and earnings forecasts. While these governance efforts aim to stabilize operations, the influence of external factors, like the legal challenges surrounding self-driving technology and partnerships with other EV manufacturers, also remains significant.

Over a five-year span, Tesla's total shareholder returns, including dividends, have been very large at 356.60%. This impressive performance showcases robust growth, particularly when compared to the previous year's performance within the US market. Over the last year, Tesla outperformed the broader US market, which returned 11%, closely aligning with the tech sector rallies that have partly propelled Tesla's stock price gains.

Despite recent share price increases, the current trading level of approximately US$275.35 still reflects a slight discount to the consensus analyst price target of US$299.38, indicating expectations for upside potential. Tesla's future revenue and earnings forecasts remain subject to both internal initiatives, like the launch of autonomous vehicles and new energy projects, and external risks, including geopolitical uncertainties and market competition. Nevertheless, the market's moderate optimism is evident in the relatively narrow difference between current price levels and projected targets, suggesting a belief in Tesla's growth story that hinges on effective execution and sustained market demand.

The valuation report we've compiled suggests that Tesla's current price could be inflated.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tesla might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TSLA

Tesla

Designs, develops, manufactures, leases, and sells electric vehicles, and energy generation and storage systems in the United States, China, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives