- United States

- /

- Consumer Finance

- /

- NasdaqGS:SOFI

SoFi Technologies (NasdaqGS:SOFI) Surges 94% In Last Quarter

Reviewed by Simply Wall St

SoFi Technologies (NasdaqGS:SOFI) has been actively enhancing its digital financial services platform by introducing new crypto-powered capabilities and entering a partnership with Benzinga to deliver enhanced market insights. These recent initiatives, along with key product releases, like the SmartStart refinancing option and expansion of private market fund access, may have contributed to the company's 94% share price increase over the last quarter. Although these developments could add weight to broader market trends, the market rose a modest 2% over the last 7 days and 14% over the past year, suggesting SoFi's performance aligned with these overall movements.

Be aware that SoFi Technologies is showing 1 possible red flag in our investment analysis.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent initiatives by SoFi Technologies, including its partnership with Benzinga and the introduction of new crypto-powered capabilities, alongside its SmartStart refinancing option, may align with the company's efforts to expand its financial services and enhance user engagement. These developments could potentially influence increased revenue and earnings in the future by expanding the toolset available to consumers, thereby potentially attracting more customers to its platform.

Over a longer-term period, SoFi's total shareholder return, combining share price growth and dividends, was 196.65% over the past three years, indicating significant growth compared to the past year's industry return of 40.9% and the broader market return of 14.3%. This performance underscores the company's advancement and investor confidence beyond short-term fluctuations.

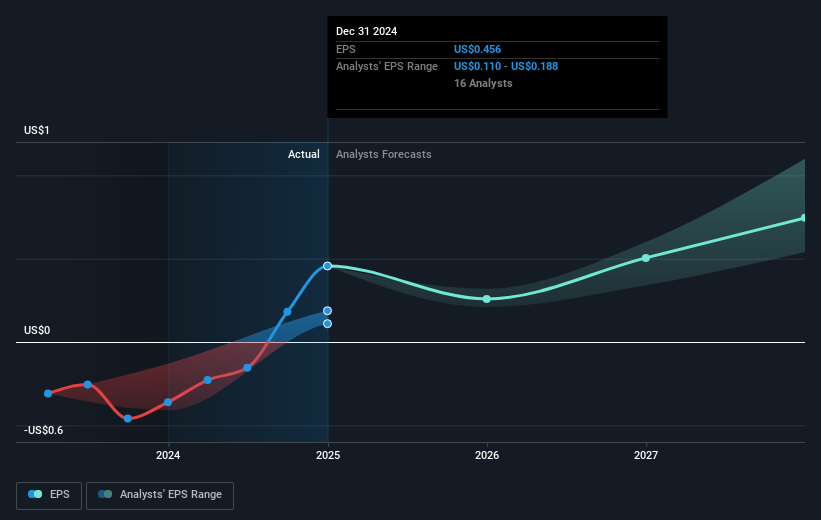

The current share price movement, with an increase of 94% over the last quarter, remains noteworthy when evaluated against the consensus analyst price target of US$13.83. Presently, the stock trades slightly below this target, reflecting that analysts see modest potential upside or alignment with current valuation metrics. Analysts anticipate revenue growth of 14.6% annually, which is projected to outpace the broader US market's expected growth of 8.7%. If the new initiatives succeed in boosting engagement, they could enhance financial metrics, supporting a fair value closer to the price target.

Explore SoFi Technologies' analyst forecasts in our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SOFI

SoFi Technologies

Provides various financial services in the United States, Latin America, Canada, and Hong Kong.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives