- United States

- /

- IT

- /

- NYSE:SNOW

Snowflake (SNOW) Expands AI Data Cloud in South Africa via AWS Partnership

Reviewed by Simply Wall St

Snowflake (SNOW) announced the expansion of its AI Data Cloud to the Africa region, specifically on AWS in Cape Town, aligning with local regulations, which led to positive client engagement. This move, alongside its growing local partnerships, may have added momentum to its share price, which increased by 22.6% last week. This was despite a broader tech sector slump, where companies like Nvidia and Broadcom faced declines. Snowflake's strategic initiatives in Africa and recent raised earnings guidance may have provided sufficient appeal to investors, contrasting the general tech downturn due to a market retreat from record highs.

Snowflake has 2 warning signs we think you should know about.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Snowflake's recent expansion of its AI Data Cloud into Africa has the potential to enhance its position in the market by increasing its global footprint and strategic partnerships. This may positively contribute to the company's revenue growth, as increased client engagement can lead to higher product adoption and improved ecosystem influence. As a result, analysts might reassess revenue and earnings forecasts to reflect these new opportunities. The move aligns with Snowflake's narrative of pushing AI initiatives and partnerships, which bolster its long-term market position but pose challenges such as heavy reliance on new product adoption.

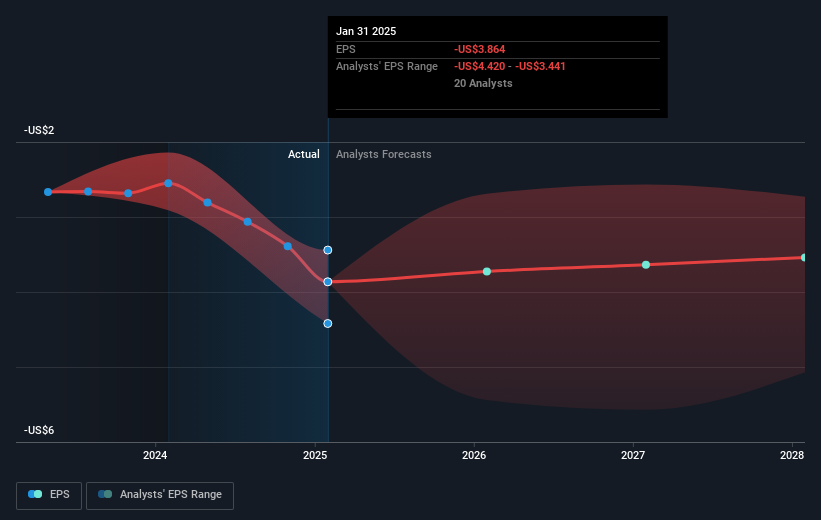

Over the last year, Snowflake's total shareholder return was 108.93%, setting a context of strong performance despite being currently unprofitable. In comparison, Snowflake's one-year return outpaced both the US Market and US IT industry returns of 15.7% and 18.3%, respectively. This suggests a robust market sentiment towards Snowflake's potential for growth and its strategic initiatives.

Currently, Snowflake's share price is US$238.66, which represents a 9.2% discount to the analysts' consensus price target of US$260.62. This current valuation reflects investor optimism towards Snowflake's future prospects amid its innovative ventures and expanding partnerships. However, with the price being higher than the estimated fair value of US$177.52, it indicates investor belief in the company's potential for revenue growth and strategic execution. Investors are encouraged to consider whether these initiatives and anticipated market expansions sufficiently justify the current price in relation to the price target.

Our valuation report here indicates Snowflake may be overvalued.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SNOW

Snowflake

Provides a cloud-based data platform for various organizations in the United States and internationally.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)