- Germany

- /

- Electrical

- /

- XTRA:ENR

Siemens Energy (XTRA:ENR) Plans Orlando Move to Innovative Lake Nona Hub

Reviewed by Simply Wall St

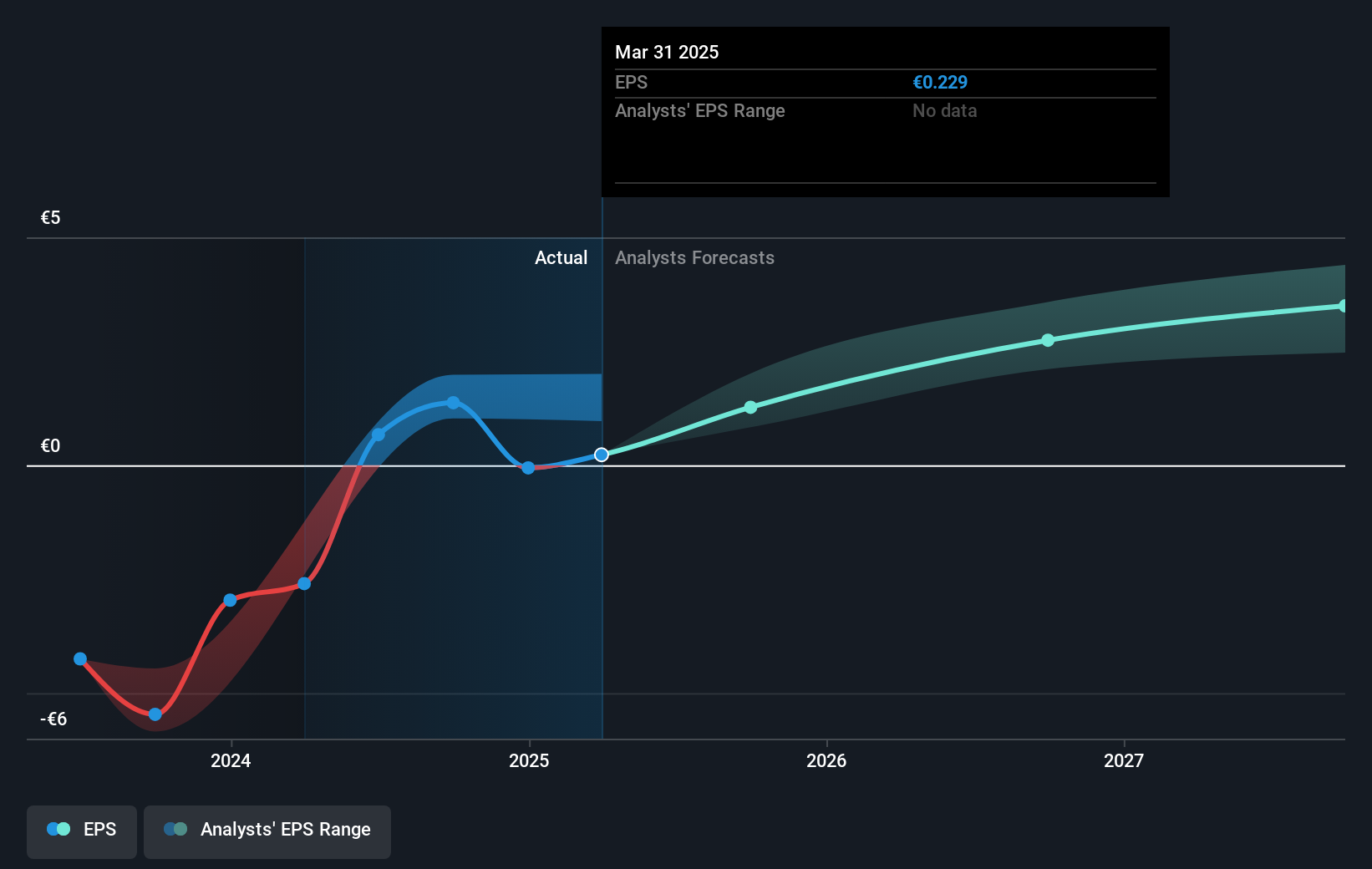

Siemens Energy (XTRA:ENR) announced its plans to relocate its Orlando office to Lake Nona, a move set to enhance its operational capabilities with a focus on energy efficiency and modern workplace experiences. Over the last quarter, the company's stock price moved up by 14%, reflecting a positive performance amidst a fluctuating market that saw a 1.5% drop in recent weeks. Siemens Energy's robust Q3 earnings, marked by increased sales and a return to profitability, provided additional buoyancy. Despite market volatility, the company's strategic initiatives and solid financial results supported its positive share price momentum.

Buy, Hold or Sell Siemens Energy? View our complete analysis and fair value estimate and you decide.

Find companies with promising cash flow potential yet trading below their fair value.

Siemens Energy's plan to relocate its Orlando office to Lake Nona is expected to bolster operational efficiency and energy-focused innovation. This move aligns with ongoing efforts like grid modernization and energy transition, which are central to the company's growth narrative. However, potential risks such as execution challenges and market affordability concerns could impact the financial outcomes projected from these initiatives. The relocation could positively influence revenue and earnings forecasts by enhancing operational effectiveness, supporting Siemens Energy's efforts to capitalize on strong order intake and energy transition trends.

Over the past three years, Siemens Energy's total shareholder return was very large at 503.31%, indicating significant gains for investors. In contrast, over the last year, the company outperformed the German market with a return exceeding 16%. This reflects strong operational execution amid a challenging market, yet underscores the volatility inherent in its business model and industry.

Despite the current share price of €93.00, above the consensus price target of €90.88, some analysts anticipate further growth driven by energy transition demands and operational improvements. However, the share price could come under pressure if these anticipated improvements do not materialize as expected. Analysts have differing views on Siemens Energy's fair value, highlighting the uncertainties involved and the importance of cautious investor assessments.

Gain insights into Siemens Energy's historical outcomes by reviewing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:ENR

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives