Should You Worry About China All Access (Holdings) Limited's (HKG:633) CEO Salary Level?

Kwok Keung Shao is the CEO of China All Access (Holdings) Limited (HKG:633). First, this article will compare CEO compensation with compensation at similar sized companies. After that, we will consider the growth in the business. Third, we'll reflect on the total return to shareholders over three years, as a second measure of business performance. The aim of all this is to consider the appropriateness of CEO pay levels.

See our latest analysis for China All Access (Holdings)

How Does Kwok Keung Shao's Compensation Compare With Similar Sized Companies?

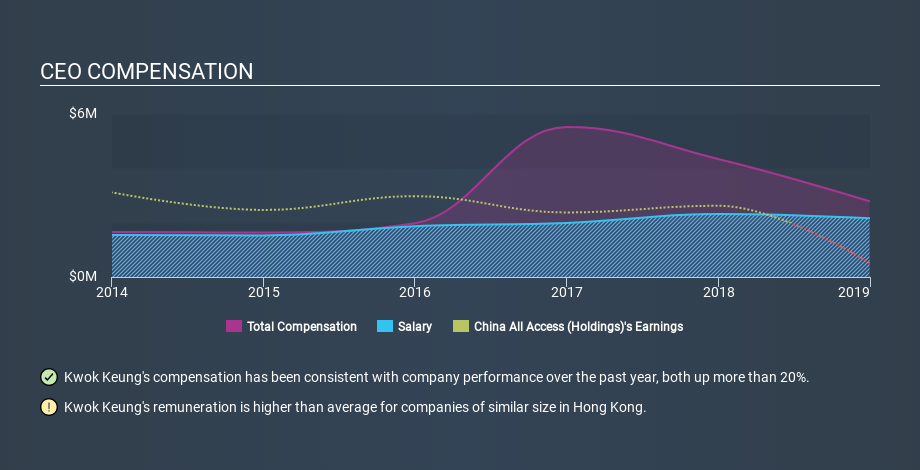

According to our data, China All Access (Holdings) Limited has a market capitalization of HK$344m, and paid its CEO total annual compensation worth CN¥2.8m over the year to December 2018. While this analysis focuses on total compensation, it's worth noting the salary is lower, valued at CN¥2.2m. We examined a group of similar sized companies, with market capitalizations of below CN¥1.4b. The median CEO total compensation in that group is CN¥1.6m.

Pay mix tells us a lot about how a company functions versus the wider industry, and it's no different in the case of China All Access (Holdings). Talking in terms of the sector, salary represented approximately 73% of total compensation out of all the companies we analysed, while other remuneration made up 27% of the pie. So it seems like there isn't a significant difference between China All Access (Holdings) and the broader market, in terms of salary allocation in the overall compensation package.

Thus we can conclude that Kwok Keung Shao receives more in total compensation than the median of a group of companies in the same market, and of similar size to China All Access (Holdings) Limited. However, this doesn't necessarily mean the pay is too high. We can get a better idea of how generous the pay is by looking at the performance of the underlying business. You can see, below, how CEO compensation at China All Access (Holdings) has changed over time.

Is China All Access (Holdings) Limited Growing?

On average over the last three years, China All Access (Holdings) Limited has shrunk earnings per share by 121% each year (measured with a line of best fit). In the last year, its revenue is up 197%.

The reduction in earnings per share, over three years, is arguably concerning. But in contrast the revenue growth is strong, suggesting future potential for earnings growth. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. Although we don't have analyst forecasts shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has China All Access (Holdings) Limited Been A Good Investment?

Given the total loss of 93% over three years, many shareholders in China All Access (Holdings) Limited are probably rather dissatisfied, to say the least. So shareholders would probably think the company shouldn't be too generous with CEO compensation.

In Summary...

We compared total CEO remuneration at China All Access (Holdings) Limited with the amount paid at companies with a similar market capitalization. Our data suggests that it pays above the median CEO pay within that group.

The growth in the business has been uninspiring, but the shareholder returns have arguably been worse, over the last three years. Although we'd stop short of calling it inappropriate, we think the CEO compensation is probably more on the generous side of things. CEO compensation is an important area to keep your eyes on, but we've also identified 5 warning signs for China All Access (Holdings) (2 are concerning!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)